-

While mobile applications have become increasingly present in the originations segment of the mortgage industry, they're now making their mark in the servicing space.

April 5 -

From mixed messages about enforcement to complexities about which loans have to be reported, here's a look at five pitfalls to avoid when adjusting to the new HMDA compliance requirements.

March 20 -

Home Captain, a fintech company that looks to increase mortgage-lead conversion rates, completed a Series A financing round led by Spring Mountain Capital.

March 20 -

CoreLogic will have to provide property data to Attom Data Solution's RealtyTrac unit for three additional years to resolve allegations it did not adhere to a 2014 agreement with the Federal Trade Commission.

March 16 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2 -

Equifax, the credit-reporting firm that suffered a massive data breach last year, said it will notify an additional 2.4 million U.S. consumers that they were affected by the hack.

March 1 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Servicers continue to face data management challenges, particularly during loan onboarding and transfers. Blockchain technology may hold the key to resolving those issues.

February 16 -

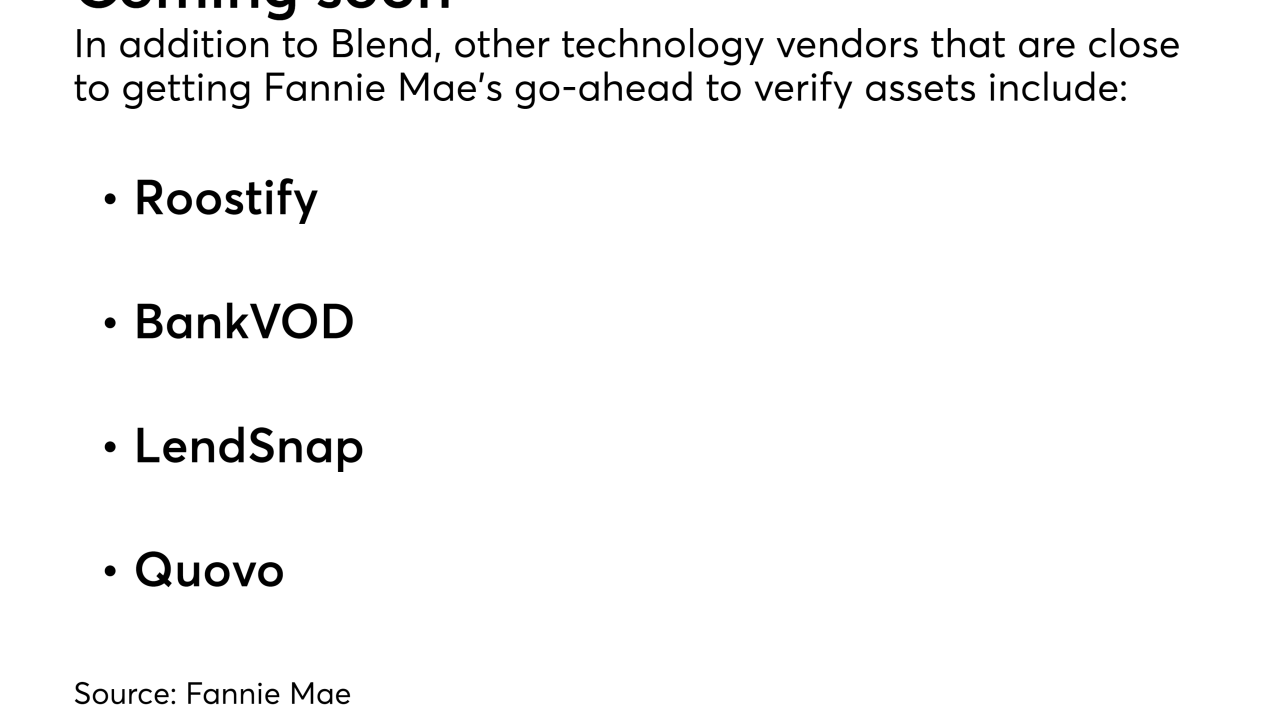

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

Ellie Mae's fourth-quarter and full-year revenue increased over the corresponding prior periods following its acquisition of Velocify.

February 9 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

From government grants to automating branch management tasks, lenders are using their knowledge of real estate, finance, and government incentives to maximize the resources they invest in facilities.

January 29 -

Credit score damage is a chief regret among consumers, but among financial goals it impedes, buying a home lies further down the food chain than other priorities.

January 29 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26 -

While the majority of lenders feel mortgage industry data initiatives have been valuable, their cost is clouding some originators' viewpoint, a Fannie Mae survey found.

January 24 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney has cited hundreds of confirmed and suspected data breaches as justification for his halting the bureau's data collection activities last month.

January 19