-

Mortgage servicers are getting better at helping borrowers avoid foreclosure, as evidenced by a declining auction rate, which was also supported by healthy home equity levels, according to Auction.com.

July 30 -

Not a single state posted annual gains in overall or serious mortgage delinquency rate in April as the national rate plummeted to a low not reached in over 20 years, according to CoreLogic.

July 9 -

The mortgage industry is calling for better alignment between the federal government and state of New York regarding proposed regulatory revisions that would affect local servicers.

July 1 -

Completed foreclosures shot down 50% in May from the year before, with overall activity also declining by 22% during the same period, according to Attom Data Solutions.

June 14 -

Foreclosure rates in March hit their lowest reading for the month in at least 20 years, while overall and serious delinquency rates also achieved 13-year lows for the same period, according to CoreLogic.

June 11 -

Covius Holdings plans to buy several businesses from Chronos Solutions that support mortgage servicing and origination processes, including three delivery platforms that will increase the breadth of its technology offerings.

June 4 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

As the government shutdown enters its third week, mortgage servicers are activating the response plans they normally use during hurricanes and wildfires to assist federal workers who may have trouble paying their mortgages.

January 4 -

CoreLogic is exiting its loan origination software and default management operations over the next 24 months and instead accelerated plans to transform its appraisal management company unit.

December 21 -

Other than in areas hit by natural disasters, delinquency rates are falling with help from a healthier labor market, but a rise in riskier lending habits could signal trouble for borrowers should housing conditions change, according to CoreLogic.

December 11 -

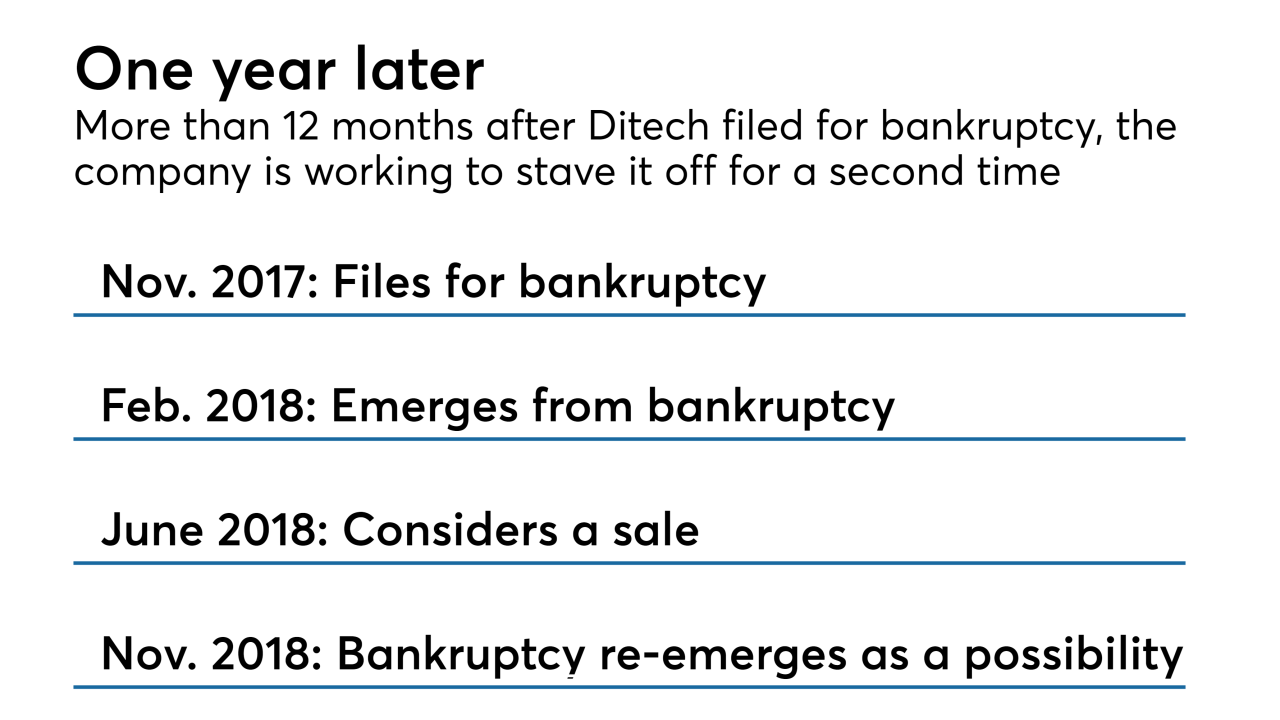

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

The government-sponsored enterprises are suspending eviction lockouts for the holiday season.

December 10 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

While consumer debt is growing overall, borrowers are exhibiting more caution when it comes to mortgage loans, according to LendingTree.

May 11 -

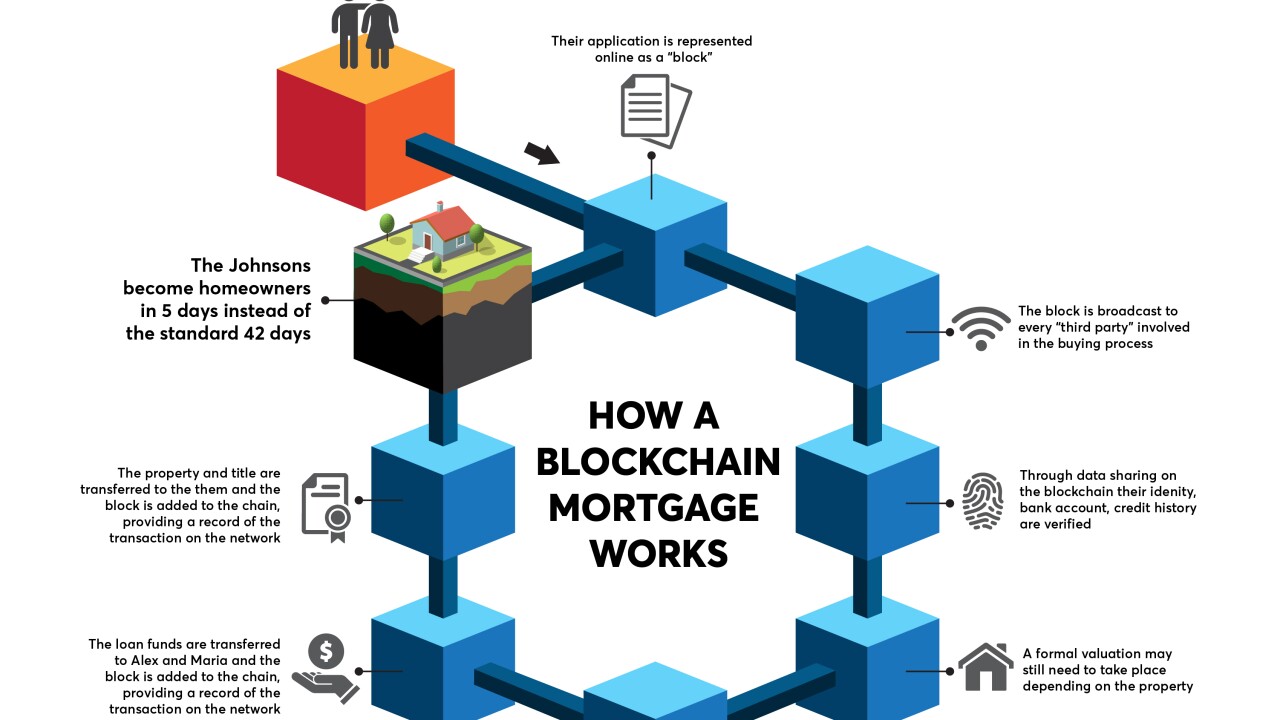

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

Serious delinquency rates were up sharply in November in both Texas and Florida compared to a year ago, while lower in all other states but Alaska, according to CoreLogic.

February 13 -

Default rates in second mortgages and bank cards rose notably in December, suggesting consumers are having trouble managing increased spending.

January 17 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3