Digital banking

Digital banking

-

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

Prosper hopes to do for lines of credit what it did for unsecured personal loans, while BBVA hopes to provide a better experience for customers.

November 4 -

Startups are increasingly expanding into new areas with their bank partners in an effort to broaden their customer base and bring products to market faster.

October 29 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

Credible Labs, which lets consumers shop for the best rates on student loans, mortgages and other credits, would be part of an evolving digital strategy at Fox after the multibillion-dollar sale of many of its traditional media assets to Disney.

August 5 -

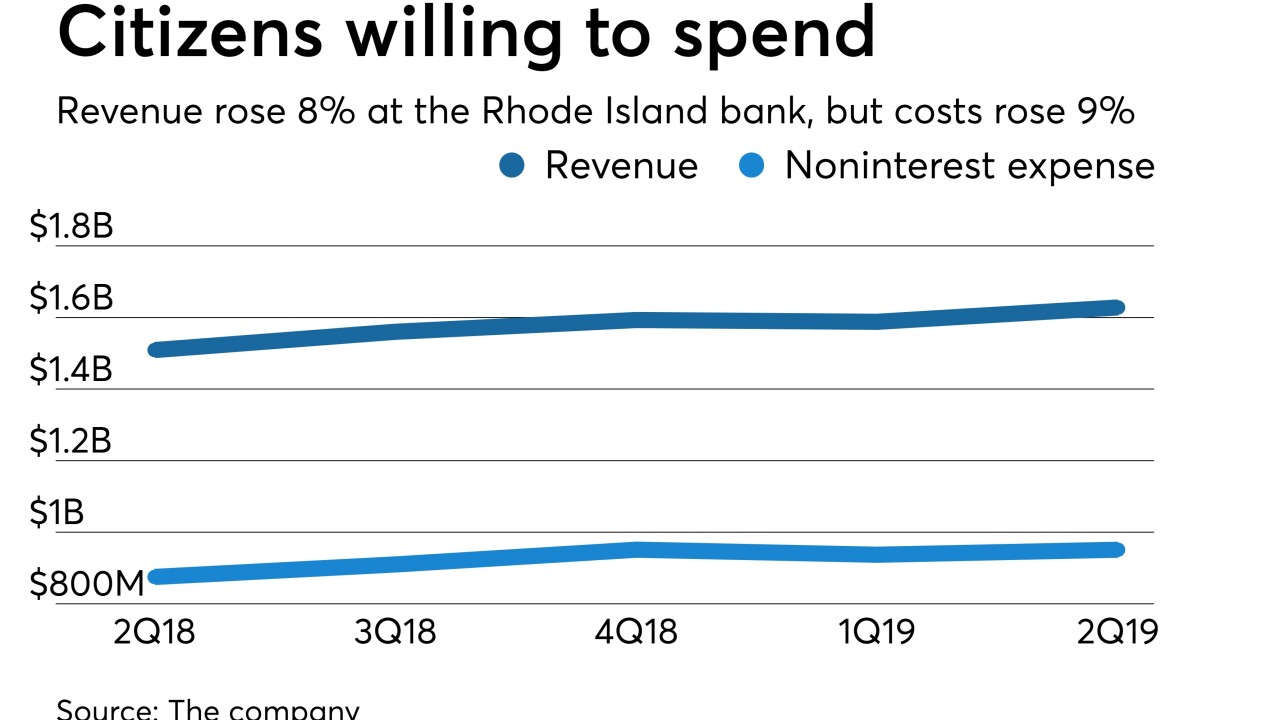

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Nearly half the nation's state regulators have agreed to a new multistate licensing business for money servicers, including fintechs.

June 24 -

House Financial Services Committee Chairwoman Maxine Waters and Rep. Patrick McHenry, the top GOP panel member, said Facebook must testify about Project Libra.

June 18 -

Sens. Elizabeth Warren, D-Mass., and Doug Jones, D-Ala., cited research that found algorithmic lending can lead to higher interest rates for minority borrowers.

June 12 -

JPMorgan Chase's banner quarter didn't stop executives from warning that the pause in rate hikes could crimp profits, or from hinting that the bank might downsize its mammoth mortgage operation.

April 12 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

Gateway Mortgage Group says its launch of a digital-only bank is scheduled for this summer.

March 14 -

The bank says it has restored access, but it hasn’t explained how a fire-suppression system at one facility could cause a nationwide outage across all of its channels, or how its system as a whole could have been left so vulnerable to the incident.

February 8 -

The merged bank would set up an innovation and technology center in Charlotte as part of its bid to compete better against the largest institutions and fintech startups.

February 7 -

Customers reported being unable to access online banking, mobile banking or their debit cards.

February 7 -

Community banks generally make digital a consumer play, but TransPecos Bank, with its BankMD brand, is focusing on doctor practices, which tend to weather economic downturns well.

February 1 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26