-

Over the last 20 years, at least 145,000 Detroit properties have been put up for sale in the annual Wayne County Tax Auction, and, of that number, an estimated 50,000 properties were occupied at the time of foreclosure.

November 20 -

The mortgage delinquency rate dipped to a 12-year low, but overvalued housing markets and eventual reversal in the unemployment rate present risk for future delinquencies, according to CoreLogic.

November 13 -

The city of Savannah, Ga., more than doubled the number of properties targeted with a blight tax this year in a continued attempt to reduce the amount of unsafe and unsightly structures throughout its neighborhoods.

November 12 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Excellent credit quality and strong performance of post-housing-crisis originations resulted in a steep decline in foreclosure starts in September, according to Black Knight.

November 5 -

A low-rated segment of an index that most closely tracks the performance of U.S. mall mortgage loans saw its biggest decline in more than a year in October.

November 5 -

Goldman Sachs is getting closer to hitting its $1.8 billion consumer relief obligation as outlined in mortgage settlement agreements between the U.S. Department of Justice and three states.

November 2 -

Lennar Corp. is selling a portion of its Rialto business to Stone Point Capital for $340 million, adding to Stone Point's holdings in the real estate and financial industries.

October 30 -

Housing policies are helping the number of vacant foreclosure homes drop, which could also mean homebuyers have been taking advantage of these properties as inventory continues to be constrained, according to Attom Data Solutions.

October 30 -

A Queens, N.Y., man who helped defraud mortgage lending units at Bank of America, Chase Bank and AmTrust is now facing 21 months in prison and three years of supervised release.

October 29 -

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Natural disasters are now the leading driver of lenders' foreclosure risk, with last year's hurricanes causing a rise in third-quarter filings in affected markets, according to Attom Data Solutions.

October 11 -

One in five new homes permitted in Houston in the year after Hurricane Harvey is in a flood plain — some on prairie developed for the first time after the storm — even as new rainfall data showed existing flood maps understate the risk posed by strengthening storms.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

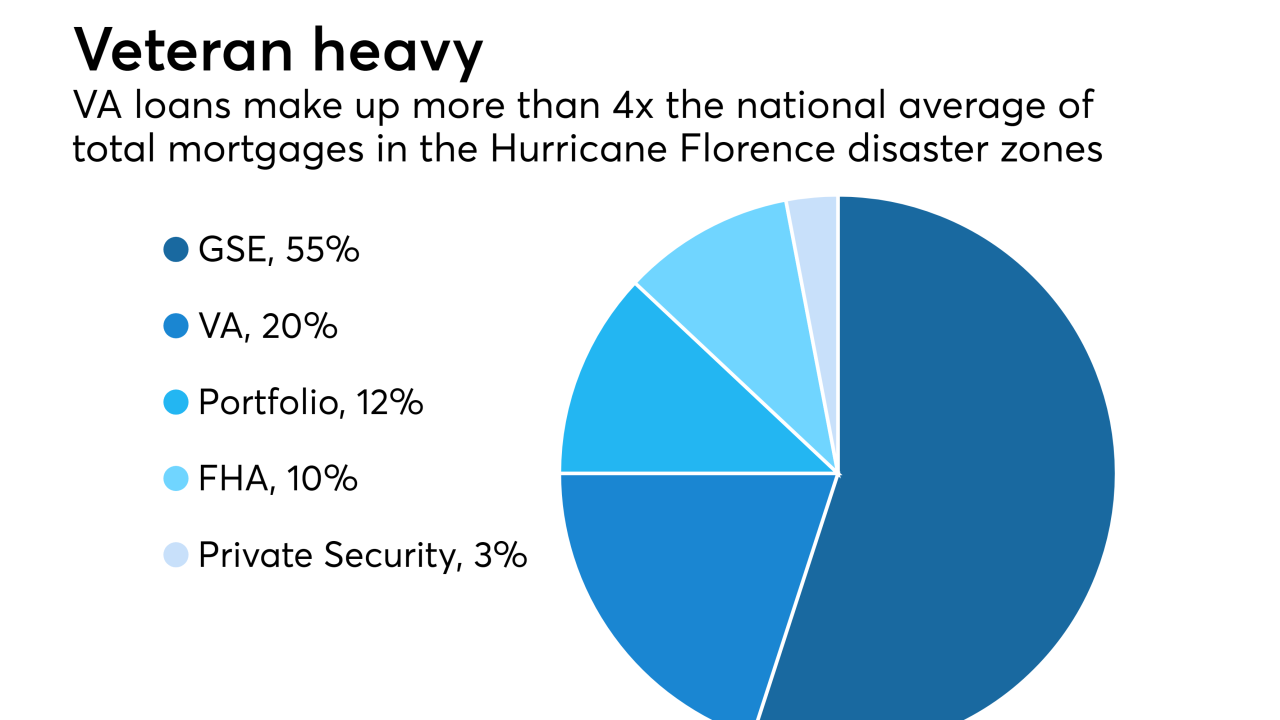

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

During the foreclosure crisis, thousands of Floridians turned to Mark Stopa for help in saving their homes.

October 1 -

Foreclosure starts increased 9% in August compared with July, slightly higher than the historic norm between the two months, according to Attom Data Solutions.

September 27 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

Real estate crowdfund lender Sharestates introduced a new program to provide financing to investors to purchase nonperforming mortgage loans.

September 24