-

Numbers decreased across all loan types, with the largest decline among GSE-backed mortgages.

October 29 -

Numbers have fallen on a consecutive quarter and 12-month basis in half of all states but are likely to increase following the gradual end to the federal foreclosure ban, according to Attom Data Solutions.

October 28 -

The firm, dubbed Polpo Capital, is looking to produce a 15% net return to investors with modest leverage by capitalizing on the coming distress in commercial mortgage debt as forbearance agreements expire

October 22 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

The current volume of distressed mortgages is now down by more than 70% from its peak pandemic level.

October 8 -

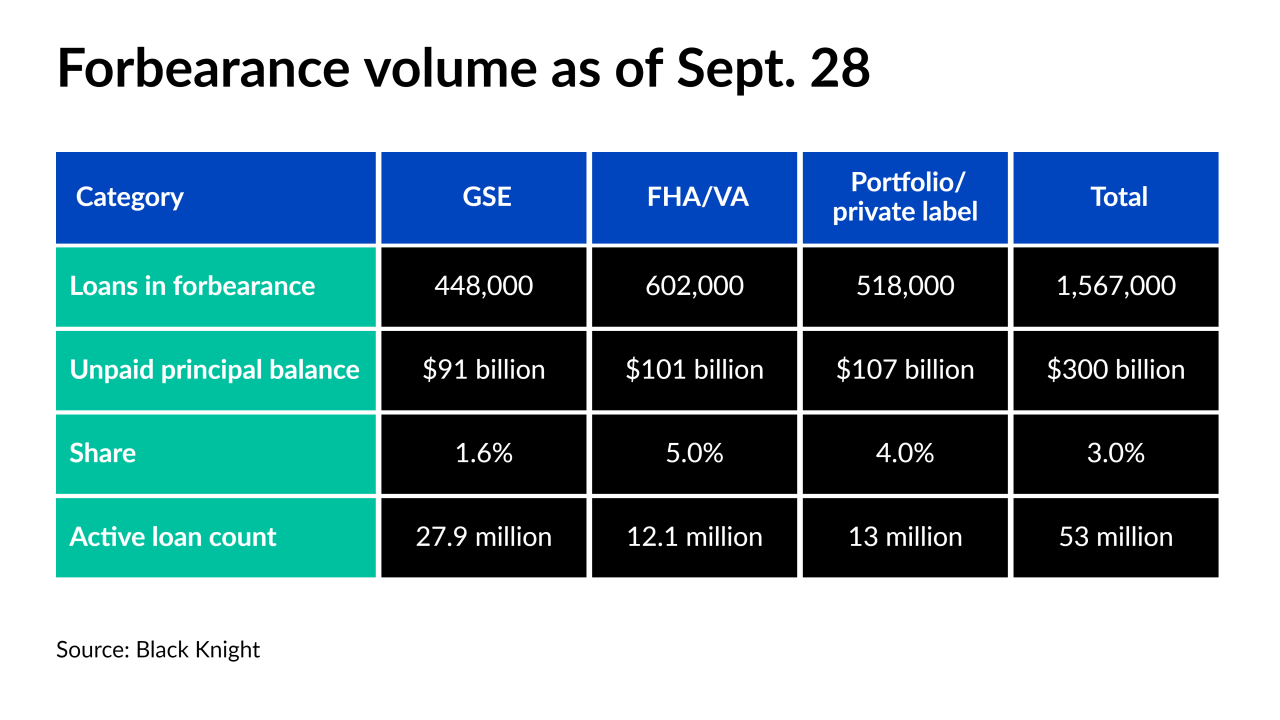

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

While nearly 1.6 million forborne borrowers remain, about 460,000 are up for review at the end of September.

September 24 -

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

August 27 -

The overall pace of both entries and exits slowed, even as the private-label securities and portfolio loan segment saw a spike in its numbers.

August 23 -

The most vulnerable areas all have the same things in common: relatively moderate price appreciation and affordability hurdles — either due to high home values or employment issues.

August 17 -

Forborne mortgages stemming from the coronavirus outbreak reached their lowest level since late March 2020, according to the Mortgage Bankers Association.

August 16 -

Nearly half the country saw foreclosure starts rise year-over-year during the final month of the moratorium, according to Attom Data Solutions.

August 10 -

Delinquency concerns continue to wane as the end of forbearances is not expected to lead to a massive wave of foreclosure activity.

August 6 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The numbers in a new Research Institute for Housing America report reinforce other signs that recovery isn’t moving quite as quickly as originally anticipated.

August 4 -

The number of people exiting pandemic-related payment suspensions starting in September will be daunting to process, according to a Black Knight report published Monday.

August 2 -

However, 8% fewer borrowers are still in a plan compared with a month ago, Black Knight said.

July 30 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

The company’s results included some transitory revenue sources, including early buyouts of loans in forbearance from securitized pools, but executives plan to maintain growth over time through economies of scale.

July 29 -

Borrowers reacted positively to the increased interaction and engagement resulting forbearances and payoff requests, J.D. Power found.

July 29