-

After falling to its lowest level in over 12 years, servicers expected September's surge in delinquencies following the damage of Hurricane Florence, according to Black Knight.

October 24 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

Natural disasters are now the leading driver of lenders' foreclosure risk, with last year's hurricanes causing a rise in third-quarter filings in affected markets, according to Attom Data Solutions.

October 11 -

One in five new homes permitted in Houston in the year after Hurricane Harvey is in a flood plain — some on prairie developed for the first time after the storm — even as new rainfall data showed existing flood maps understate the risk posed by strengthening storms.

October 9 -

Destruction from Michael's storm surge and flooding has potential to affect 57,000 homes, with a worst-case total of $13.4 billion in reconstruction cost value, according to CoreLogic's latest estimates.

October 9 -

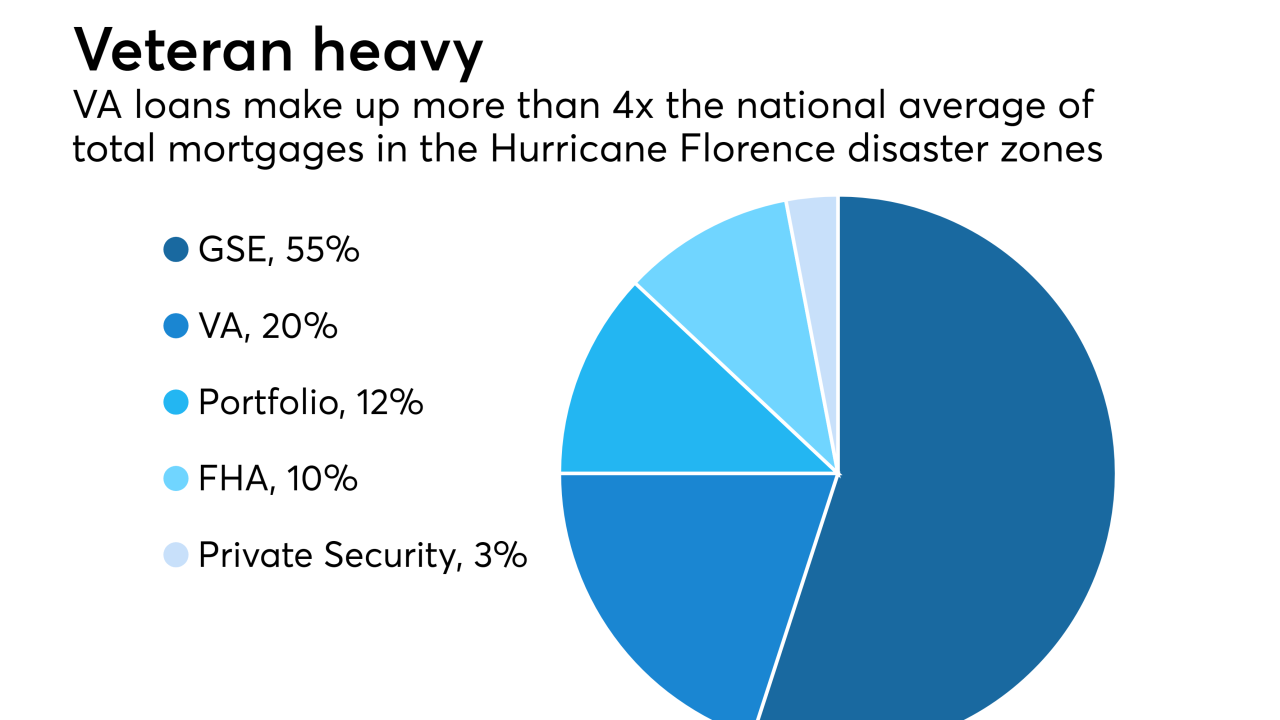

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

During the foreclosure crisis, thousands of Floridians turned to Mark Stopa for help in saving their homes.

October 1 -

Foreclosure starts increased 9% in August compared with July, slightly higher than the historic norm between the two months, according to Attom Data Solutions.

September 27 -

Florence's flooding and wind destruction affected about 700,000 residential and commercial properties across North Carolina, South Carolina and Virginia, according to CoreLogic's latest estimates.

September 25 -

Real estate crowdfund lender Sharestates introduced a new program to provide financing to investors to purchase nonperforming mortgage loans.

September 24 -

The mortgage delinquency rate dropped to its lowest level in over 12 years, but servicers should expect an increase following the impact of Hurricane Florence, according to Black Knight.

September 24 -

A Jacksonville, Ill., church facing foreclosure has a new lease on life after months of fundraising.

September 20 -

A new financial technology company called Scratch is planning to use a new web-based platform along with an alternative pricing model to compete with companies that service mortgages and other consumer loans.

September 20 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

More flip-and-fix property buyers seek financing for their purchases as fewer distressed homes come on the market and sales margins narrow, said Attom Data Solutions.

September 6 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

A decade after a collapse in the housing market triggered the 2008 Great Recession, South Florida still has many homeowners who owe far more money than their property is worth.

August 29 -

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

Foreclosures on Metro Orlando homes are up 23% from July 2017, though the numbers are still well below the peak of the recession, and local sales agents say there's not much impact in the market yet.

August 21 -

Foreclosures, short sales and other troubled properties continue to dwindle in central Ohio, according to a report from the Columbus Realtors trade group.

August 13