-

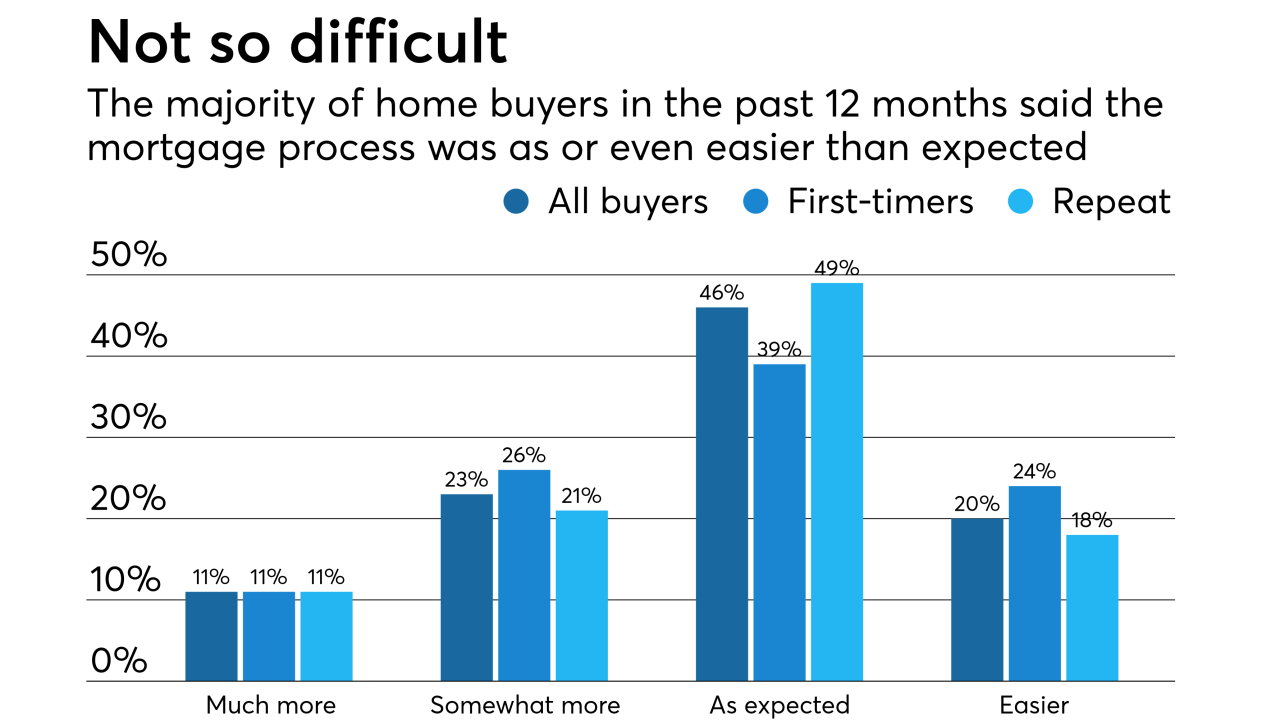

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

Nearly half of all Memphis renters are "cost burdened,'' meaning they spend more than 35% of their household income on housing.

October 19 -

With the housing crisis and the Great Recession well in the rear-view mirror, more and more credit unions are offering mortgage options with low or no down payment requirements.

October 17 -

Rising home prices, wages that haven't kept pace with those increases and high levels of student debt are forcing first-time home buyers on Long Island, N.Y., to find creative ways to afford the biggest purchase of their lives.

October 16 -

Building off the success of policy changes in 2016, there are now even more ways for mortgage lenders to help student loan borrowers become homeowners.

October 4 Bilt Rewards

Bilt Rewards -

CMG Financial is trying out a platform that gives borrowers the ability to raise funds for down payments in conjunction with Fannie Mae loans.

October 3 -

While millennials were the largest group of home buyers in the past 12 months, many had problems with affordability and the down payment.

September 27 -

The plight of Orlando-area renters sheds light on a new set of post-Irma realities — rent payments on uninhabitable homes and apartments, challenges getting rent deposits refunded and few housing options in a tight rental market.

September 25 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

A decade after the financial crisis and housing collapse, more consumers seem in the mood to buy a new home before they sell their existing home.

September 13 -

From debunking down payment myths to making sense of interest rates, here's a look at five essential lessons lenders can teach to millennials preparing for homeownership.

September 12 -

The median down payment for a home purchased in the second quarter was 7.3%, the most in nearly three years, a result of increased competition, according to Attom Data Solutions.

September 7 -

Fannie Mae is extending its property inspection waivers to certain purchase mortgages with large down payments.

August 24 -

Affordability issues along with a lack of knowledge about home buying are holding millennials back from pursuing homeownership, according to a survey from loanDepot.

August 16 -

Low-down-payment purchases are on the rise, but not necessarily with the same pre-crisis practices and risk factors.

August 8 -

From funding sources to home prices, here's a look at five questions lenders must ask themselves before they can safely originate 1% down mortgages.

August 7 -

Freddie Mac is on track to double the number of low down payment mortgages it will buy in 2017, while continuing to see its serious delinquency rate fall to record lows.

August 1 -

Garden State Home Loans has launched a 1% down payment program for first-time buyers, opening the door for millennial purchasers.

August 1 -

Freddie Mac has set a November implementation date for its plan to tighten restrictions on seller-funded down payments.

July 28 -

JPMorgan Chase’s home lending unit is trying to position itself as the solution for millennials who increasingly want to buy their first homes despite rising prices and other affordability hurdles.

July 26