-

A gauge of builder sentiment climbed to 85, the highest in records back to 1985, from 83 a month earlier, according to the National Association of Home Builders/Wells Fargo Market Index released Monday.

October 19 -

The CEO of SWBC Mortgage discusses her top priorities for the Mortgage Bankers Association, the election, the CFPB's seasoned QM proposal and what to expect at this week's conference.

October 19 -

The predominantly white universe of real estate investors may be used to working with people and companies with enough financial resources to have a track record in the business, but historic inequities have limited those opportunities for Black executives.

October 16 -

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 16 -

One could change how commercial property is taxed, the other could change rent control policies. Both might affect financing.

October 14 -

But current owner Blackstone and FOA management will keep 70% of the company after its merger with a SPAC.

October 13 -

The expanded relief on tax income data will become accessible this fall, according to a press release LoanBeam issued this week during Freddie Mac's Connect client conference.

October 9 -

Four years ago, Donald Trump thrilled the real estate industry as he ascended to the White House, calling himself the “builder president” and promising a trillion dollars of infrastructure spending.

October 9 -

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

Three nonprofits look to create or preserve 10,000 units, vowing to fight off firms like Blackstone and Colony Capital, which bought up foreclosed homes after Great Recession.

October 6 -

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

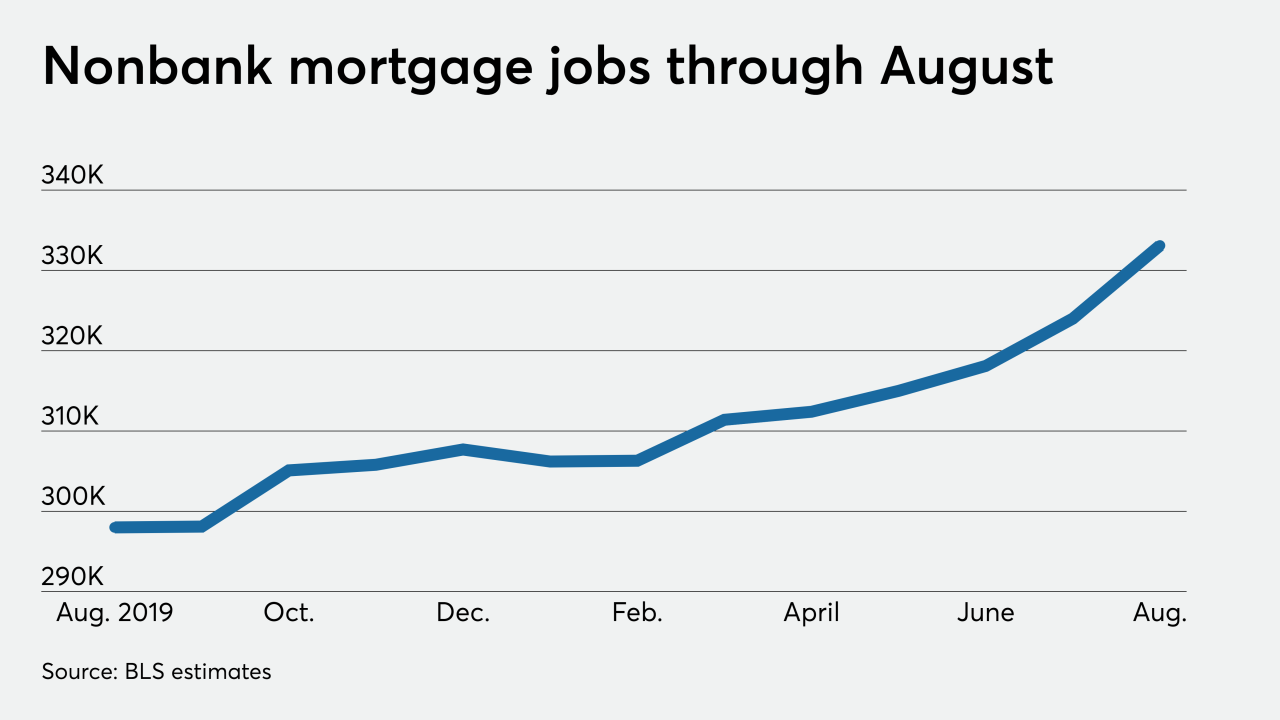

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

The bar to prove discriminatory patterns is so high that plaintiffs would have slim odds of winning lawsuits against housing providers.

October 2 George Washington University

George Washington University -

The government-sponsored enterprise's first multifamily sustainability bond transaction, totaling $600 million, is part of Freddie's K-Deal program.

October 1 -

Student housing and assisted/independent living centers were small portions of Freddie's multifamily securitizations prior to COVID, but Kroll noticed they've been missing in most rated deals since spring.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29