-

The Rhode Island Association of Realtors reports that single-family home sales in the state actually rose slightly year-after-year in March, despite the onset of the coronavirus crisis.

April 13 -

Forbearance requirements under the CARES Act raised immediate concerns about servicing advances and performance, but experts suggest there are other outcomes to brace for, too.

April 9 -

With the onset of the pandemic, real estate agents say deals that were in the works are encountering all types of problems, creating havoc in the market as buyers try to back out of contracts.

April 9 -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

The lender is one of many taking advantage of the disruption in the market to grow their businesses.

April 8 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

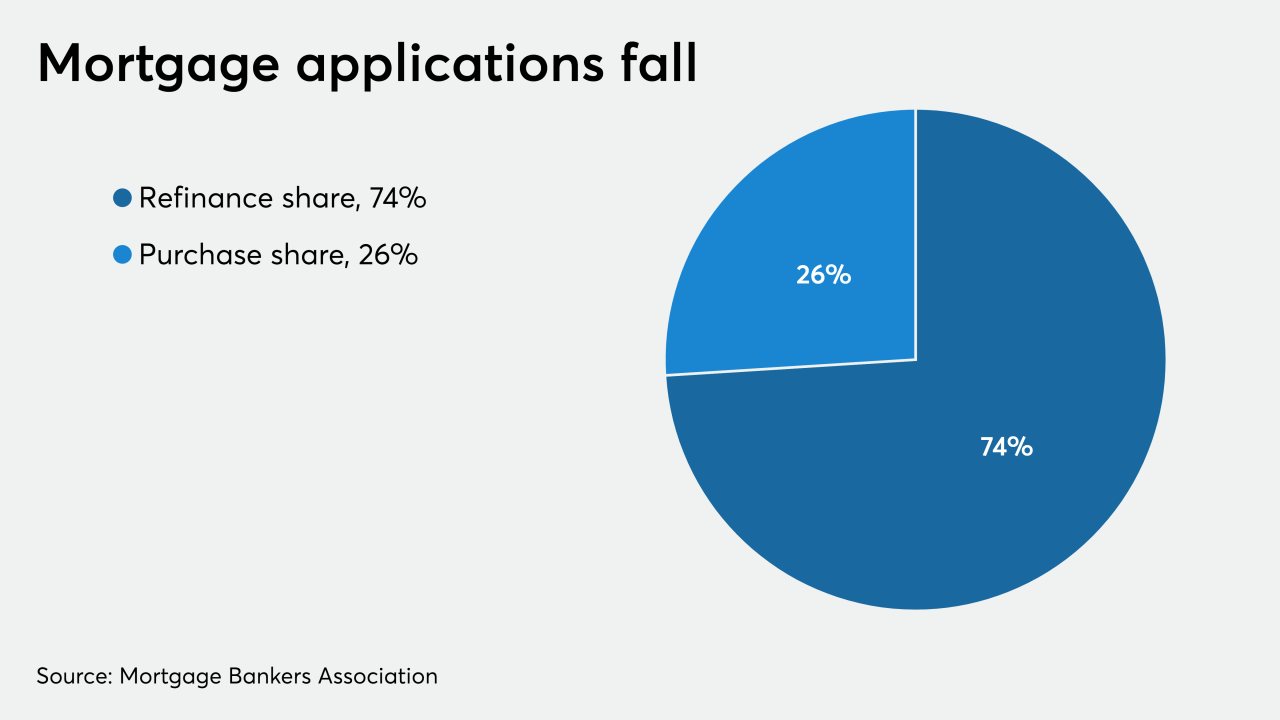

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Consumer confidence for home buying fell to its lowest point since December 2016, according to Fannie Mae.

April 7 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP