-

Market turmoil is driving the 10-year Treasury yield downward and taking mortgage rates with it, putting more borrowers in the money to refinance, Intercontinental Exchange said.

August 5 -

Bond traders now see a roughly 60% chance of an emergency quarter-point cut by the Federal Reserve within one week because of the market turmoil.

August 5 -

There were reports of rates plummeting after new numbers Friday showed a notable drop in overall jobs but then moderating later in the day.

August 2 -

The 30-year fixed rate mortgage was at its lowest level since early February as the benchmark 10-year Treasury dropped under 4%.

August 1 -

A measure of expectations for the next six months climbed to 78.2 in July, the highest since January.

July 30 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

Despite being a top concern for a wide swath of voters, housing affordability has largely been absent from presidential politics.

July 26 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

Lower inflation and a slowing jobs market is the driver of the new forecast, but housing will not see any immediate benefits.

July 23 -

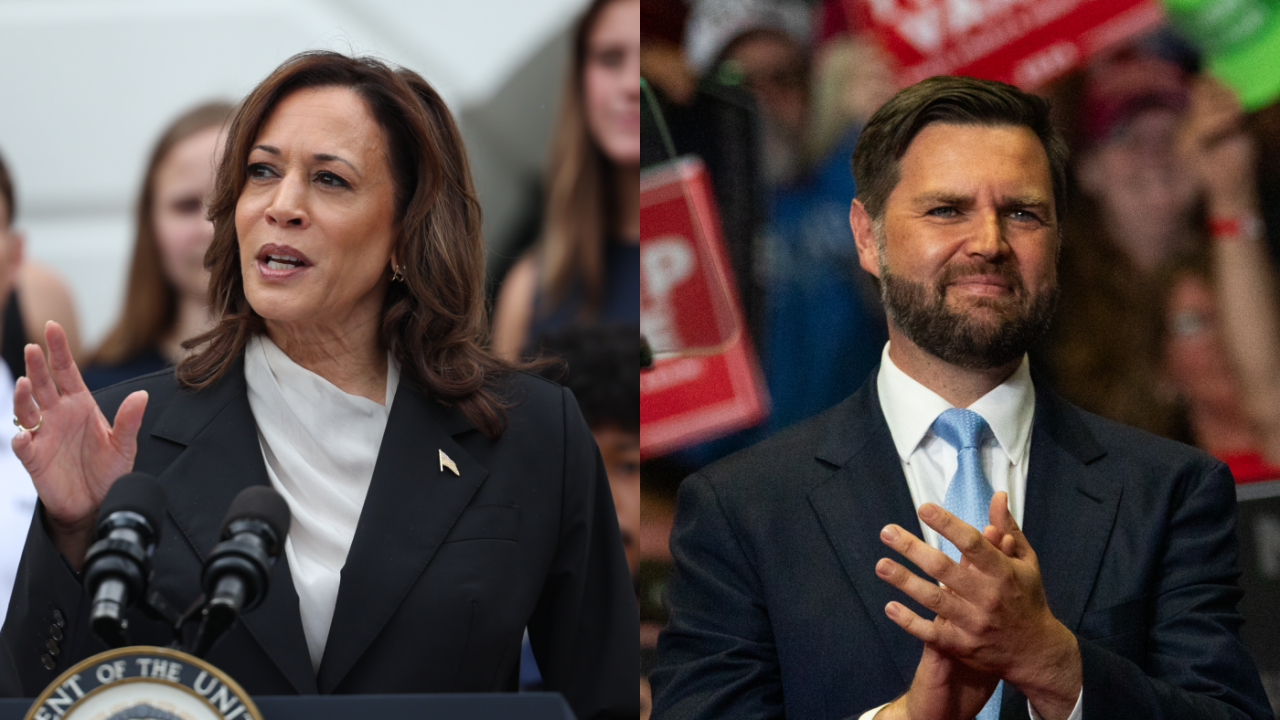

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

The guidance is largely unchanged from what the agencies proposed last year. It directs institutions to craft policies that consider a wide array of potential shortcomings.

July 18 -

Even though the 30-year fixed rate mortgage is at its lowest level since mid-March, consumers are being cautious in returning to the market, Freddie Mac said.

July 18 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

July 18 -

Nearly all of the economists surveyed by Wolters Kluwer in July expect the FOMC to reduce short-term rates, but less of them expect it to happen at the September meeting than the number who believed so last month.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The Congressional Budget Office acknowledged limitations in its research of expected flood damage data.

July 16 -

Positive signs on jobs and inflation help drive the 10-year Treasury yield lower, and lead investors to forecast a short-term rate cut sooner than later, Freddie Mac said.

July 11 -

More than 50% of aspiring buyers expect their next purchase will cost less than the latest median value, according to the National Association of Home Builders.

July 8 -

The Federal Reserve's struggle in bringing inflation down from its current level to its 2% target may come down to how the government measures shelter costs in the U.S., leading some experts to question whether the problem is in the economy or in how it is measured.

July 4 -

News on the jobs front on Wednesday eliminated two-thirds of the six-day gain in Treasury yields.

July 3