-

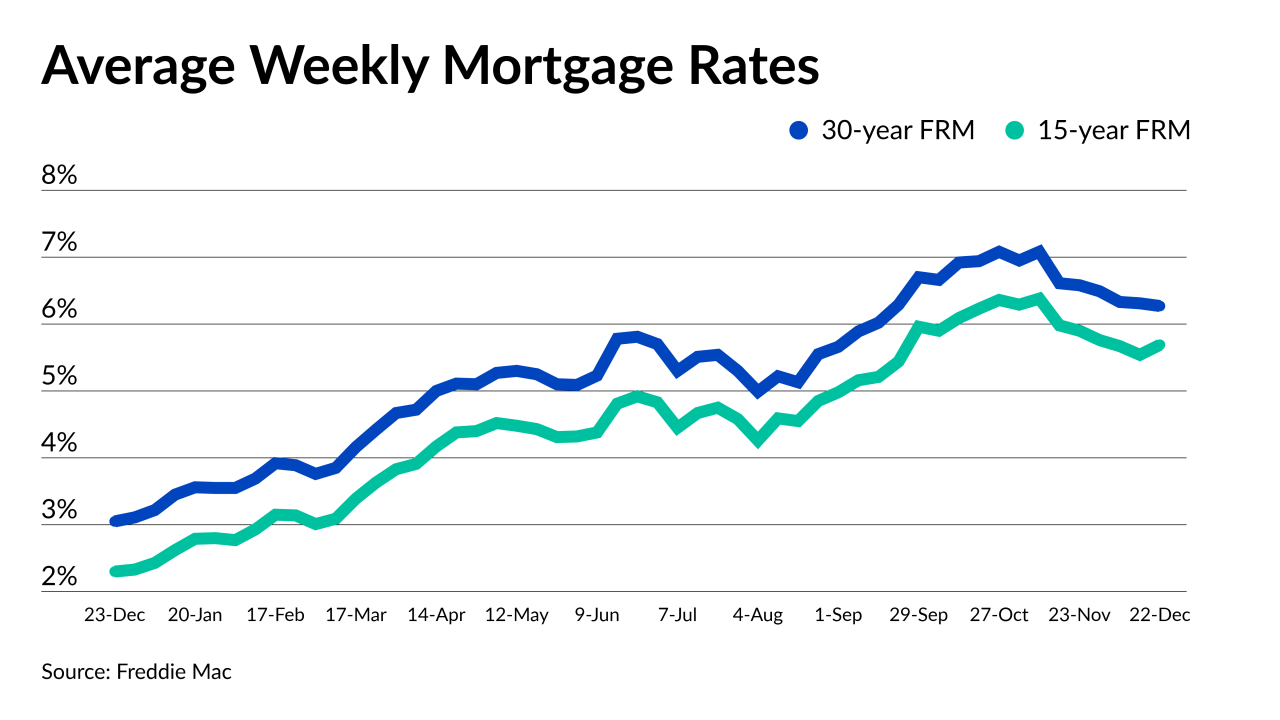

The 30-year fixed loan rate dropped 15 basis points compared with last week as bond market investors acted in advance of this morning's Consumer Price Index report.

January 12 -

The U.S. Supreme Court turned away four appeals from shareholders of the government-sponsored enterprises who said they were entitled to compensation after the Treasury collected more than $100 billion in profits from the government-sponsored enterprises.

January 9 -

Declining mortgage rates and home prices drove more positive views compared to the prior month, but December's overall outlook remained negative, Fannie Mae said.

January 9 -

However, the jobs picture for December was better than what was expected, the Bureau of Labor Statistics data found.

January 6 -

The sector is not immune to the same economic instability that affects the single-family residential market, the Mortgage Bankers Association said.

January 5 -

However, trackers from Optimal Blue and Zillow found that rates moved in line with the drop in the 10-year Treasury yield.

January 5 -

Difficult economic conditions will persist, with inflation and a potential recession weighing on minds, but investment in mortgage technology remains a priority, according to new survey research.

January 5 -

Special purpose credit programs, down payment assistance and potential mortgage insurance premium cuts came into focus over the past year.

December 29 -

The past 12 months were chock full of impactful changes to the home lending industry but keep an eye on these in particular in the new year.

December 28 -

But the 15-year interest rate rose last week, in line with 10-year Treasury yields, as bond investors used a quiet week to reflect on broader trends.

December 22 -

But the lower rates of the past month did result in a $7-billion boost to its origination forecast for 2022.

December 19 -

Former Treasury Secretary Lawrence Summers said that the latest U.S. inflation numbers were encouraging and that the coming likely recession may arrive later than previously thought.

December 16 -

This was the fifth week in a row the Freddie Mac Primary Mortgage Market Survey reported a decline in the 30-year rate after peaking at 7.08%.

December 15 -

New data offered the strongest evidence yet that price pressures have peaked.

December 13 -

Nonbanks would have to inform the CFPB of any state or local court decisions against them involving consumer financial products, under a new proposed rule. That information would be pooled with data about federal violations and be made available to the public.

December 12 -

The cut occurred across departments and included the dismissal of the company's head of mortgage.

December 12 -

Following peaking at 7.08% on Nov. 10, the 30-year fixed has come down three-quarters of a percentage point, Freddie Mac said.

December 8 -

New York, Chicago and Philadelphia led the list of large metropolitan markets considered vulnerable to a downturn, based on analysis from Attom.

December 1 -

The benchmark 10-year Treasury in particular tumbled 11 basis points between Wednesday's close and Thursday's open.

December 1 -

Allowing Fannie Mae and Freddie Mac to buy these loans encourages consumers to purchase more expensive homes, the group said.

December 1