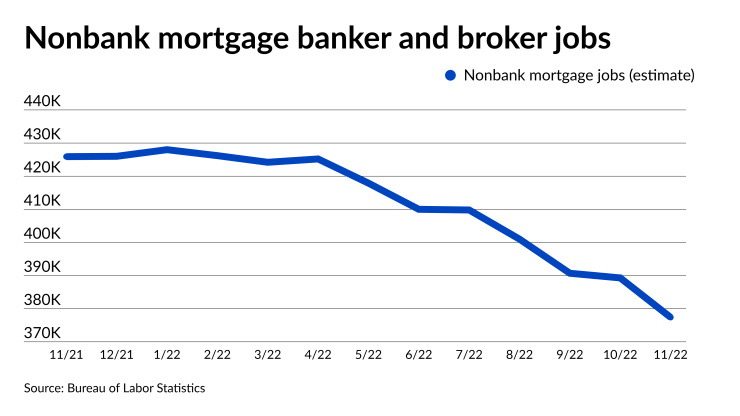

Although mortgage industry employment continued to slide, the overall jobs picture beat expectations, December data from the Bureau of Labor Statistics found.

Preliminary estimates found mortgage banker and broker payrolls totaled 377,400 in November, compared with an upward revision of 389,300

This is the lowest level of mortgage employment since October 2020, when jobs totaled 373,600.

Given that more companies announced layoffs in December, including

"Although there are an increasing number of high-profile layoffs, particularly in the technology sector and also in the mortgage industry, hiring in other sectors of the economy are more than offsetting these on net," said Mike Fratantoni, chief economist at the Mortgage Bankers Association, in a statement. "Additionally, November data showed that there were still more than 10 million job openings in the economy."

The mortgage industry data lags the overall BLS report by one month.

In what might be good news for mortgage servicers, total nonfarm jobs increased by 223,000 in December compared with a downwardly revised November total, the BLS said. Industry economists have correlated total U.S. employment with

The December numbers were higher than the 205,500 increase expected by Beth Ann Bovino, U.S. chief economist at Standard & Poor's.

"Payrolls should slow in 2023 as the economy weakens," Bovino said in a statement issued prior to the BLS release. "As consumers trade down and shop for value, reduced revenue will force businesses to reduce their need for new workers this year."

Another beneficiary of the positive general jobs numbers is the 10-year Treasury yield, a measure that the 30-year fixed rate mortgage is compared with. The 10-year yield dropped 14 basis points on Friday morning to 3.58% as of 11 a.m. eastern time.

But Fratantoni warned the Federal Reserve is still likely to

"Today's report will not lead the Fed to quickly change course with respect to the path of interest rates, and we expect a 25-basis-point hike at the next meeting," he said. "Mortgage rates are off their highs from last year and we expect them to trend down over the course of 2023."

Residential building construction employment increased by 0.3% in December from November, while non-residential rose by 0.7%.

This interest-rate sensitive sector is gaining jobs even with the Fed's tightening and a slow housing market, Odeta Kushi, deputy chief economist at First American Financial, pointed out.

"There are lots of homes under construction, and you need more hammers at work to build more homes," said Kushi in a statement. "But the slowdown in single-family homebuilding will likely stall future growth in residential building jobs."