-

Nondepository mortgage companies cut another 1,500 workers in March as the housing market's peak season got underway, suggesting that even with business potentially picking up, lenders remain cautious about hiring.

May 3 -

Nondepositories in the mortgage business cut 2,900 more jobs in February, bringing industry employment to its lowest point in nearly three years.

April 5 -

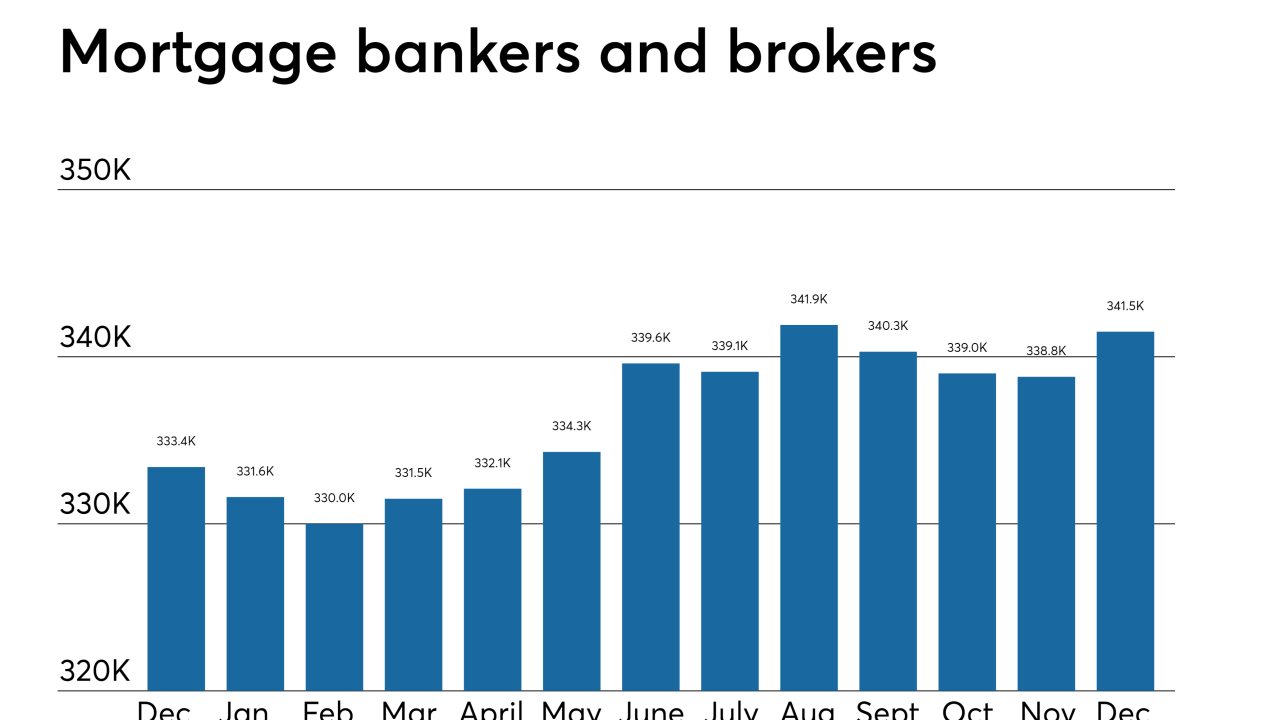

As 2019 got underway, weakness in the housing market drove the number of workers employed by nondepository mortgage companies down to a low not seen since August 2016.

March 8 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

Employment at nondepository mortgage companies dropped considerably in November, as the combined effects of lower volumes and seasonal slowing reduced hiring needs.

January 4 -

The number of workers employed by non-depository mortgage companies experienced a typical seasonal drop month-to-month, but employment remained higher than a year ago due to the persistence of competitive hiring practices.

December 7 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

JPMorgan Chase is eliminating 400 positions in its mortgage banking unit, the latest lender to trim staff as a result of lower-than-expected demand in 2018.

October 5 -

Hiring by nonbank mortgage lenders and brokers reversed course again and got slightly higher in August as originators made a last-ditch effort to reach seasonal homebuyers before fall.

October 5 -

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

The number of workers employed by nonbank mortgage lenders and brokers reversed course and inched lower in July as affordability constraints and limited income gains reduced demand.

September 7 -

Employment by nondepository mortgage companies in June increased for the third consecutive month as seasonal hiring continued even though home resales inched down another notch.

August 3 -

Despite recent industry consolidation, demand from seasonal homebuyers spurred hiring among nonbank mortgage companies for the second consecutive month in May.

July 6 -

Seasonal hiring gave employment among nonbank mortgage lenders and brokers a boost in April and partially reversed an earlier decline despite growing signs of consolidation in the industry.

June 1 -

Employment among nonbank mortgage lenders and brokers fell in March, erasing the unexpected gains in the previous month.

May 4 -

Employment in the nonbank mortgage lender and brokerage sector unexpectedly rose in February after several months of layoffs.

April 6 -

Employment in the nonbank mortgage lender and brokerage sector is falling in the face of rising interest rates and the limited supply of homes for sale.

March 9 -

The deadline to participate in the Top Producers Survey is Wed. Feb. 28 at 6 p.m. EST. The 20th annual loan officer ranking has a number of new features to highlight the accomplishments of the industry's top performers.

February 21 -

A December hiring spike at nondepository mortgage originators ended a three-month skid and solidified the fourth straight year of job gains in the sector. But with loan volume projected to decline again in 2018, it remains to be seen whether nonbanks will add more workers or start making cuts.

February 2