-

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

The number of workers employed by nonbank mortgage lenders and brokers reversed course and inched lower in July as affordability constraints and limited income gains reduced demand.

September 7 -

Employment by nondepository mortgage companies in June increased for the third consecutive month as seasonal hiring continued even though home resales inched down another notch.

August 3 -

Despite recent industry consolidation, demand from seasonal homebuyers spurred hiring among nonbank mortgage companies for the second consecutive month in May.

July 6 -

Seasonal hiring gave employment among nonbank mortgage lenders and brokers a boost in April and partially reversed an earlier decline despite growing signs of consolidation in the industry.

June 1 -

Employment among nonbank mortgage lenders and brokers fell in March, erasing the unexpected gains in the previous month.

May 4 -

Employment in the nonbank mortgage lender and brokerage sector unexpectedly rose in February after several months of layoffs.

April 6 -

Employment in the nonbank mortgage lender and brokerage sector is falling in the face of rising interest rates and the limited supply of homes for sale.

March 9 -

The deadline to participate in the Top Producers Survey is Wed. Feb. 28 at 6 p.m. EST. The 20th annual loan officer ranking has a number of new features to highlight the accomplishments of the industry's top performers.

February 21 -

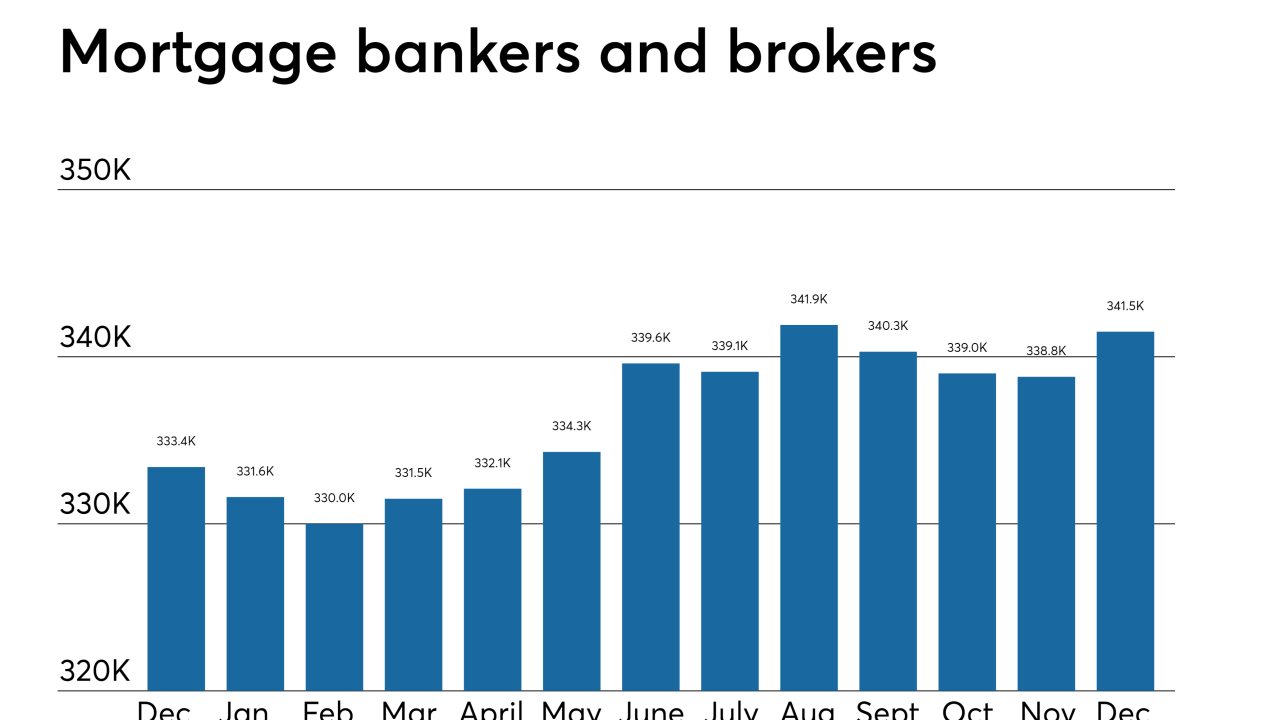

A December hiring spike at nondepository mortgage originators ended a three-month skid and solidified the fourth straight year of job gains in the sector. But with loan volume projected to decline again in 2018, it remains to be seen whether nonbanks will add more workers or start making cuts.

February 2 -

With compensation accounting for 80% of the cost to originate a mortgage, lenders are developing new strategies to attract and retain top talent, while keeping wage expenses in check.

January 29 -

Refinance volume fueled recent market gains by nonbank mortgage originators. But lower volume amid the shift to purchase lending has nonbanks trimming headcounts and may position banks to recapture market share.

January 5 -

Nonbank mortgage employment fell for the second consecutive month, according to the Bureau of Labor Statistics.

December 8 -

Nonbank mortgage employment took its biggest drop since January following the recent hurricanes, according to the Bureau of Labor Statistics.

November 3 -

Nondepository mortgage bankers and brokers increased their headcounts in August, but hurricane recovery efforts and other macro factors may stymie additional growth.

October 6 -

Fewer new homes will be finished and added to the housing stock as construction crews go to Texas and Florida to help repair or replace damaged properties.

September 27 -

Nondepository mortgage bankers and brokers employment dipped slightly in July, ending a four-month run of hiring pickups.

September 1 -

The nonbank mortgage sector had its largest one-month employment gain in a year, as independent mortgage bankers and brokers enjoyed stronger-than-expected originations during the second quarter.

August 4 -

Nearly 10% of Walter Investment Management Corp.'s employees will lose their jobs after it closes Ditech's Irving, Texas, office, a notice filed with the Texas Workforce Commission said.

July 17 -

Walter Investment Management Corp. will close its Ditech subsidiary's Irving, Texas, office by the end of 2017, according to an internal memo. It's the first step in an effort to ultimately reduce Walter's physical footprint from 13 offices to as few as four.

July 14