-

Dave Uejio, acting director of the Consumer Financial Protection Bureau, promised to protect veterans from predatory loans and to crack down on companies that improperly garnish stimulus checks or mistreat struggling borrowers.

January 28 -

The regulator's demands for ending the action were excessive, Ocwen claimed.

January 6 -

The Consumer Financial Protection Bureau is headed for more disruption in the new year with a Democratic administration likely to reverse several GOP-backed policies. More aggressive relief for mortgage borrowers, a rollback of Trump-era rulemakings and yet another realignment of CFPB offices will all be on the table.

December 29 -

The company was accused of sending borrowers erroneous loan modification information between 2014 and 2018.

December 21 -

The accused, who also faces vehicle title and investment fraud charges, allegedly submitted falsified statements related to the payoff of an earlier mortgage when applying for a new one.

December 18 -

The complaint dates back to 2014 state regulator examinations when the Dallas company was known as Nationstar.

December 7 -

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

The agency’s consolidation of supervision and enforcement policy into one office could compromise the independence of those deciding when to investigate alleged wrongdoing by banks and others, critics of the move say.

October 22 -

The agreement with Florida ends the saga that began in April 2017, when several states sued the company. However, the CFPB's case filed at the same time remains active.

October 15 -

CEO Charlie Scharf disappointed investors by failing to provide either a detailed road map for long-term expense reductions or say when he might release such a plan.

October 14 -

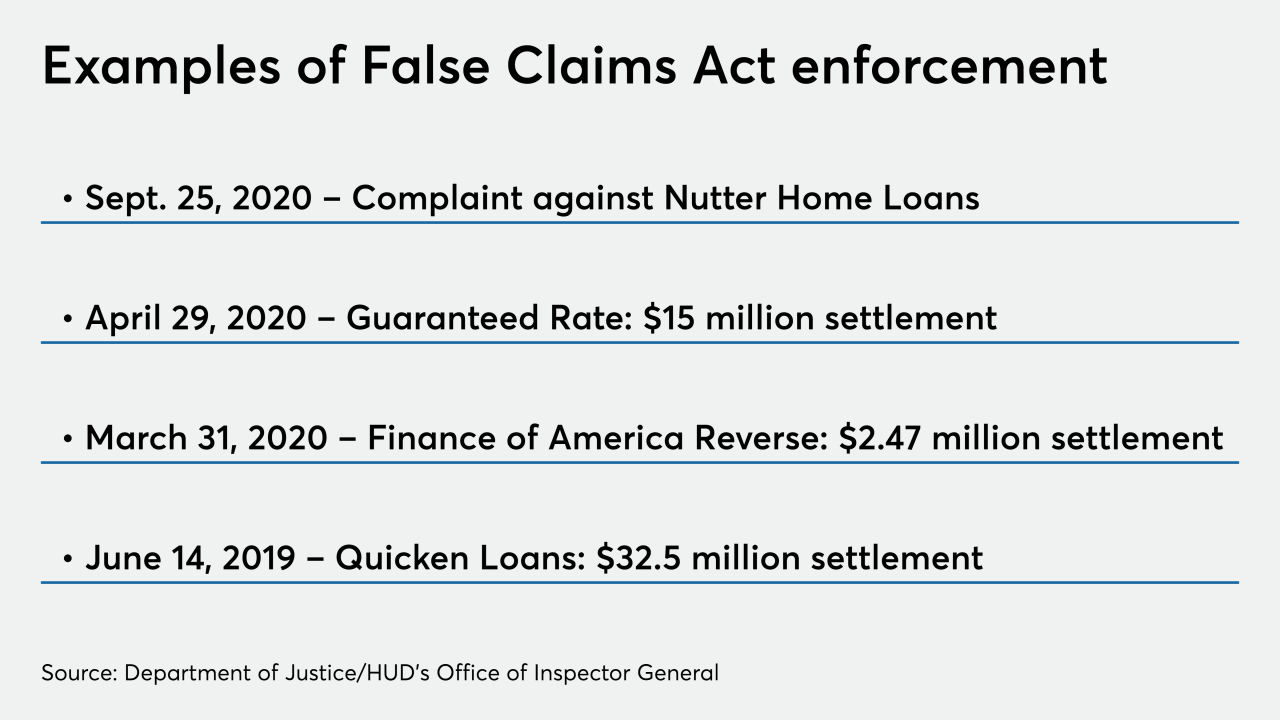

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Through Operation Corrupt Collector, the bureau is coordinating with over 50 other state and federal agencies to target firms for wrongdoing and inform consumers of their rights

September 29 -

The agency’s report on mortgage data submitted by lenders identified persistent disparities between white borrowers and minorities in denial rates and pricing. Some observers say the bureau should have been more explicit as the nation wrestles with systemic racism.

September 24 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

September 1 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

The Detroit lender disclosed that the consumer bureau had sent a civil investigative demand to Rocket Homes Real Estate for potential violations of the Real Estate Settlement Procedures Act.

July 16 -

The consumer agency alleges Townstone Financial's CEO and president made statements on a radio show discouraging applicants living in Black neighborhoods from seeking home loans.

July 15 -

The agency sought to provide certainty that most actions from the past eight years remain in effect despite the ruling that the bureau's leadership structure is unconstitutional.

July 7 -

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

May 29