-

New licensing rules for mortgage professionals servicing loans secured by New Jersey properties will go into effect this summer, adding to a trend toward tighter state regulation of standalone servicers.

April 30 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

Two Sacramento, Calif., defendants were found guilty of wire fraud stemming from a fraudulent real estate company that targeted members of Sacramento's Latino community, according to the U.S. Attorney's Office.

April 26 -

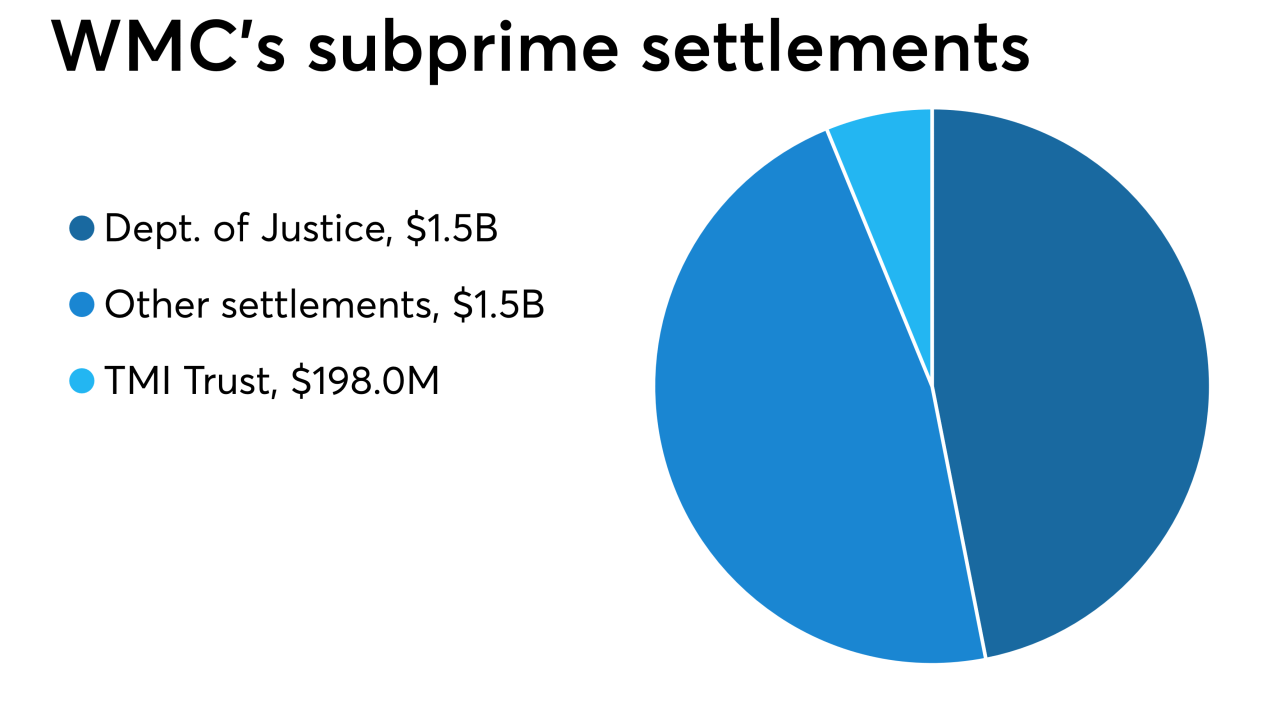

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

A Staten Island, N.Y., man involved in a $2.5 million real estate investment scheme that targeted investors, many of whom were elderly and some of whom had dementia, was sentenced to three years in prison.

April 8 -

The legislation comes a day before CFPB Director Kathy Kraninger is set to testify to Congress.

March 6 -

Ginnie Mae has restricted loanDepot's ability to securitize Veterans Affairs mortgages because of apparent churning of recent originations.

January 30 -

The same TILA-RESPA integrated disclosure errors continue to plague mortgage lenders, though those documents have been required for over three years, a report from MetaSource said.

January 29 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

A Wilmington Township, Pa., man accused of illegally purchasing properties he formerly owned through a tax sale has pleaded guilty to a felony charge of deceptive business practices.

December 24 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19 -

A Flora Vista, N.M., man accused of five felony charges for forging a signature on real estate paperwork then ordering an employee to dispose of property from the victim's residence has agreed to a plea agreement.

December 19 -

Five Florida Keys men ripped off the federal government and received thousands of dollars in recovery money after Hurricane Irma struck last year, the Monroe County State Attorney's Office said.

December 14 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 11 -

Orlando real estate broker Geo Geovanni, 49, was found guilty in federal court of one count of conspiracy to commit bank fraud and three counts of bank fraud, the U.S. Attorney's office announced.

December 3 -

The Federal Savings Bank is trying to persuade a judge to look beyond its CEO's alleged complicity in a fraud perpetrated by President Trump's former campaign chair.

November 29 -

Two more real estate investors have admitted conspiring to rig bids at foreclosure auctions, bringing to nine the total who say they cheated at the public auctions held at South Mississippi courthouses.

November 29 -

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15