-

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

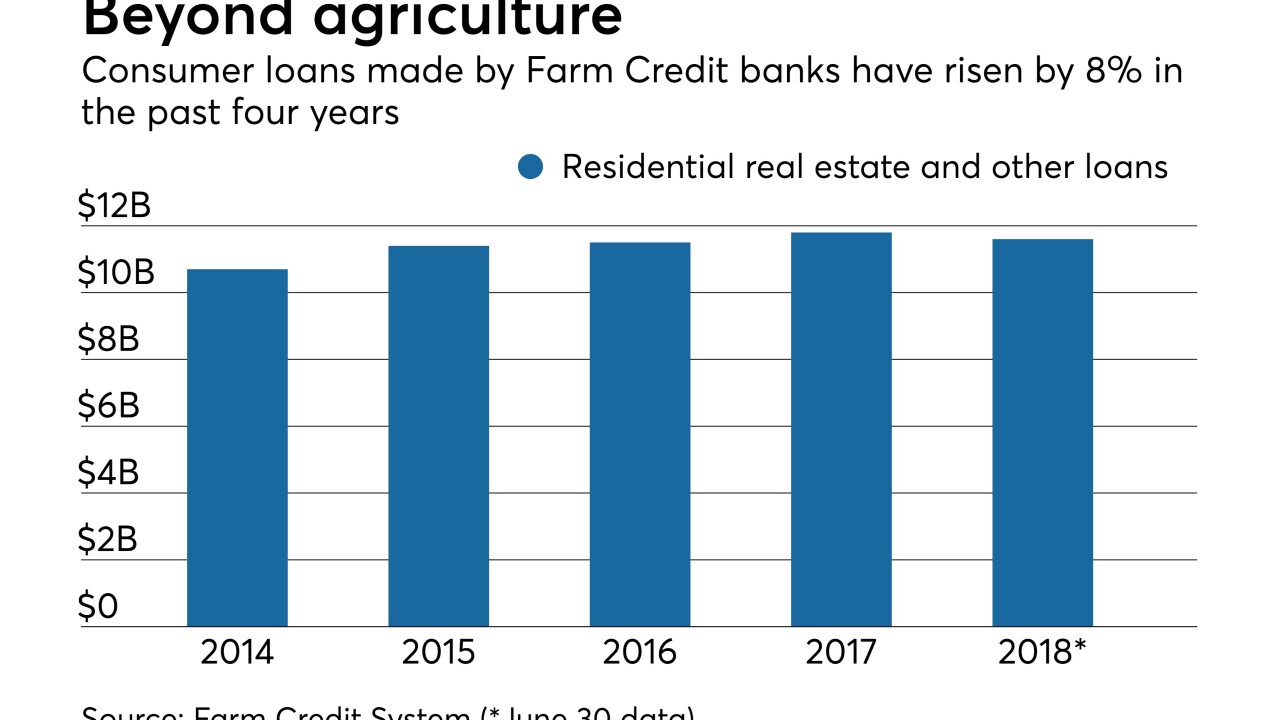

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

The dominant player in manufactured housing lauded the Trump administration's review of construction standards, but other commenters worry the plan will undermine housing quality.

April 3 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9 -

The U.S. Department of Agriculture's Rural Housing Service is piloting a new construction-to-permanent loan program after a previous venture in 2016 to spur construction lending in rural areas failed to attract many participants.

January 29 -

Housing finance reform proposals could make it challenging for community banks and credit unions to serve rural mortgage markets, according to a report issued Wednesday by Brookings and the Center for Responsible Lending.

January 10 -

The Federal Housing Finance Agency's Duty to Serve program must increase manufactured housing lending in rural communities.

September 29 NeighborWorks America

NeighborWorks America -

Farmer Mac's second-quarter net earnings increased 46% year-over-year, driven by a boost in net interest income that was enhanced by its growing loan and securities portfolio.

August 9 -

New home purchase loan application activity reached its highest point in March as builders looked to fill the growing demand for housing.

April 13 -

The lender relationships resulted from a partnership the government-sponsored enterprise entered into with a non-profit housing group.

April 11 -

Refinance applications reached their lowest share in more than seven years even as mortgage rates fell last week, according to the Mortgage Bankers Association.

March 29 -

Mortgage applications decreased 2.7% from one week earlier after the Fed announced a rate hike, according to the Mortgage Bankers Association.

March 22 -

Mortgage applications increased 3.1% from one week earlier even as rates reached their highest level in three years, according to the Mortgage Bankers Association.

March 15 -

Application activity increased 3.3% from one week earlier, even though mortgage interest rates rose on speculation the Federal Open Market Committee could act in March.

March 8 -

Mortgage application activity increased by 5.8% during the week of Feb. 24.

March 1