-

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.

March 16 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

October 16 -

The Minneapolis bank says recent investments in its retail operation contributed to strong improvement in home lending and mortgage banking fees.

October 16 -

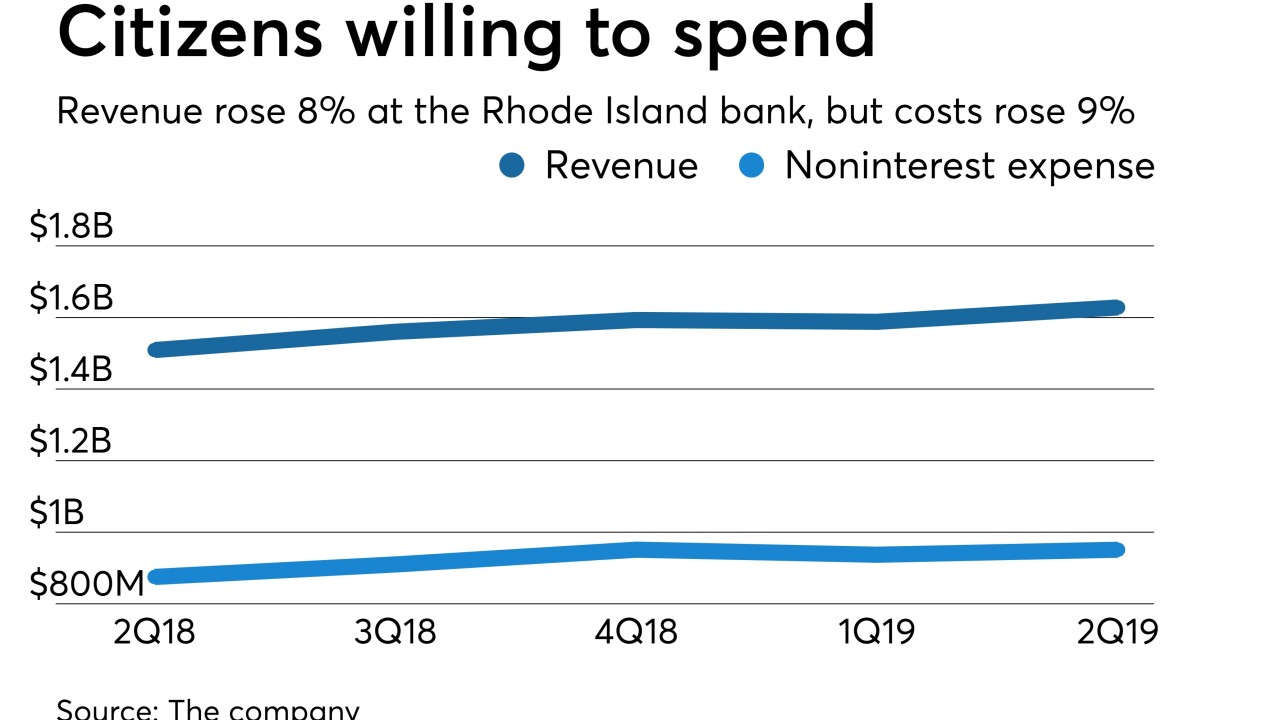

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

The Ohio company agreed to buy TransCounty Title Agency, which has five offices around Columbus.

September 4 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

The bank plans to contact all customers who paid fees for rate lock extensions during a three-and-a-half-year period and to refund any who believe they should not have been charged.

October 4 -

Quaint Oak in Pennsylvania is making a big push in real estate brokerage, a business that many state-chartered banks might think is illegal for them to pursue.

September 5