-

In 2017, Spokane County reported the second-highest number of home sales in 30 years.

January 22 -

From San Francisco to Dallas, here's a look at the 10 top housing markets where homes sell above the asking price.

January 16 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

Consumer credit scores are improving, but many qualified borrowers are still hesitant about buying a house. New tools are helping lenders better assess risk and show consumers with lower credit scores they can qualify for mortgages.

January 8 -

Jeanne D'Arc Credit Union has begun thanking home buyers for their business by throwing housewarming parties for them once the process is complete.

January 5 -

The recently enacted tax reform bill is likely to encourage more consumers to rent instead of buy and tamp down the rapid rise in home prices.

January 4 -

Millennials who want affordable home prices in an urban market may want to check out the Gem City.

January 4 -

The gap between the average credit score for homebuyers and other consumers has widened to its highest point in 12 years, and lenders don't know what, if anything, to do about it.

January 3 -

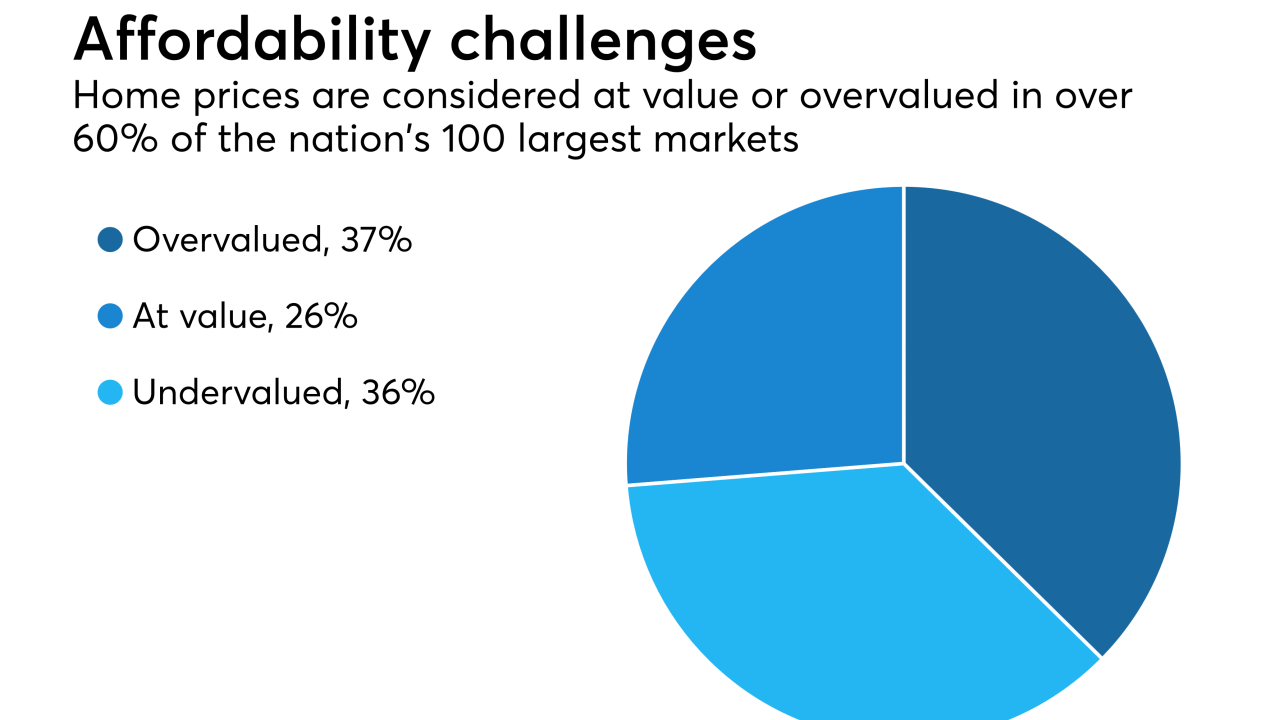

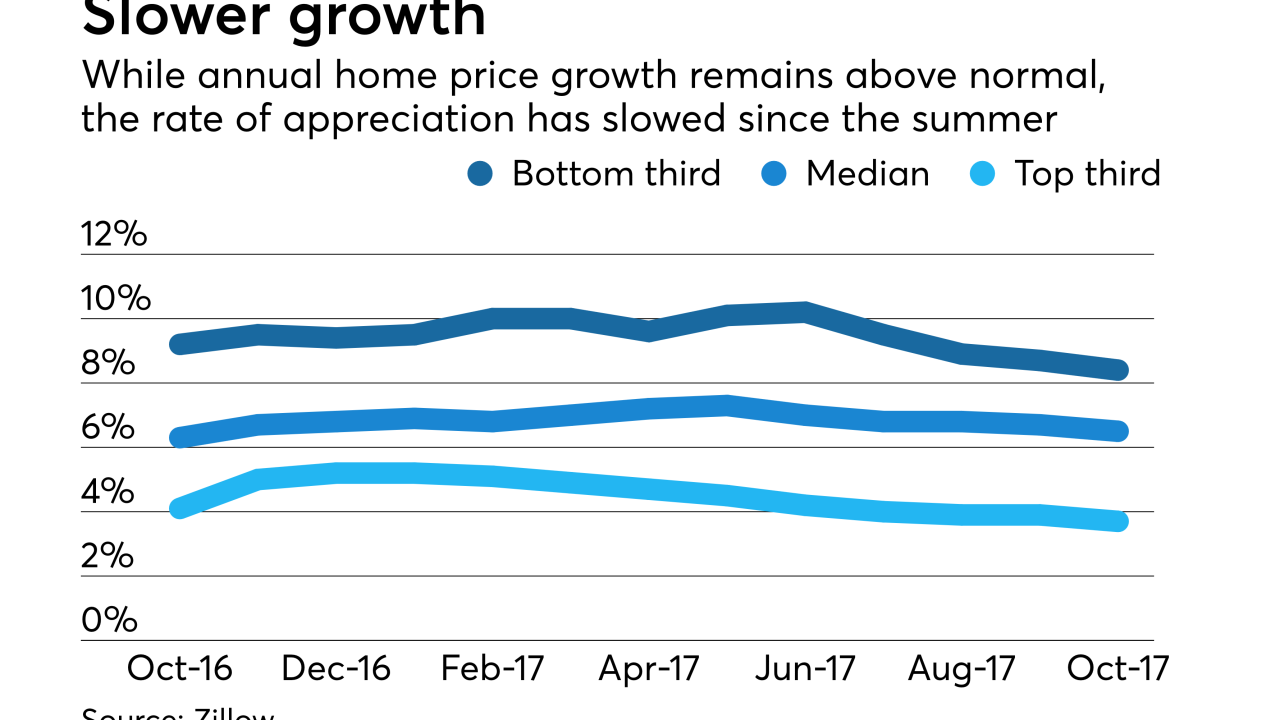

Home price growth is likely to slow in the near future but affordability remains a concern, especially at the lower end of the market, according to CoreLogic.

January 2 -

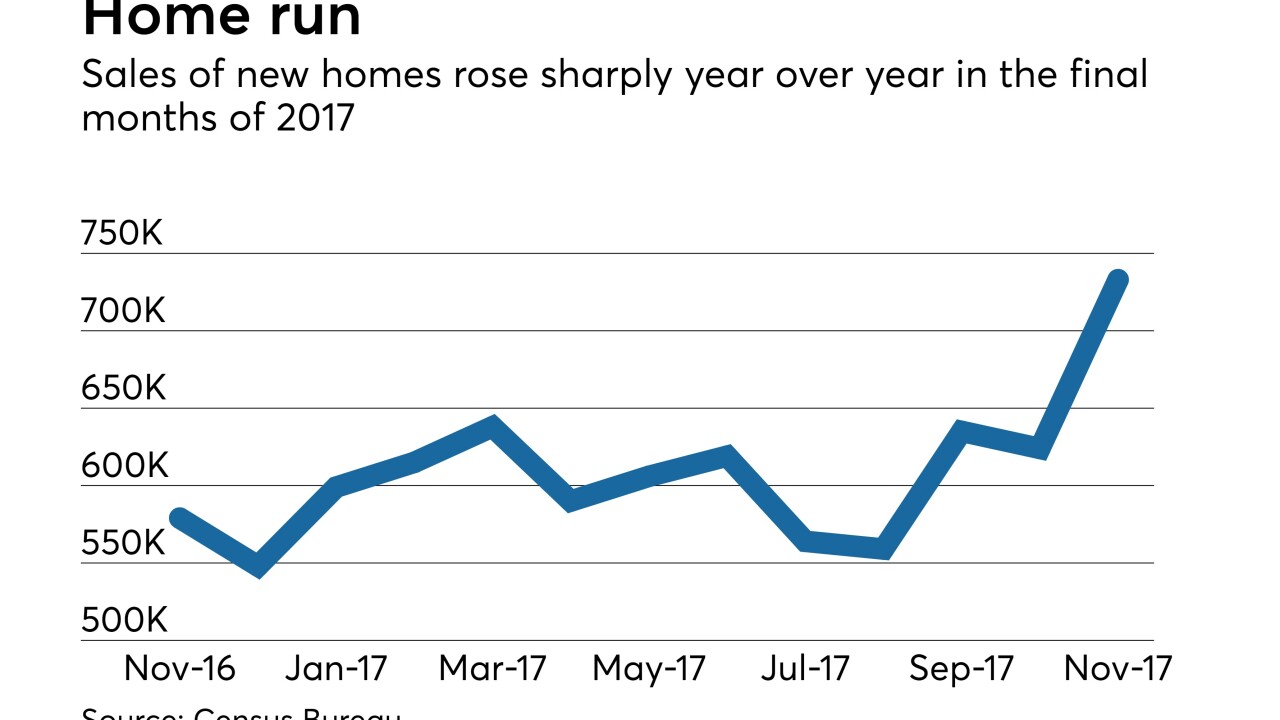

Home values grew during 2017 at their fastest pace in four years and the same supply and demand dynamics behind that increase remain in place for 2018.

December 28 -

Homebuyer interest dipped slightly in November, but remains well above year-ago levels, according to Redfin.

December 27 -

Seattle Mayor Jenny Durkan announced a $100 million-plus investment by the city in affordable-housing projects, including nine new apartment buildings and 26 homes for first-time buyers.

December 21 -

Sales of previously owned homes rose in November to an almost 11-year high, indicating demand picked up momentum heading into the end of the year.

December 20 -

Here's a look at the 11 housing markets where the share of entry-level homes for sale is greater than the share of first time home buyer shoppers.

December 19 -

Supply constraints tempered real estate and title professionals' outlook for the home purchase market over the next year, according to First American Financial Corp.'s fourth quarter Real Estate Sentiment Index.

December 13 -

Nonbank mortgage employment fell for the second consecutive month, according to the Bureau of Labor Statistics.

December 8 -

On the cusp of a new year — and winter — Twin Cities housing construction posted stellar late-season gains.

December 6 -

New Penn Financial has entered into a pilot program to provide mortgage financing to participants in Home Partners of America's Lease Purchase program.

November 29 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

Home price appreciation continues to increase at a much higher than normal pace, although the rate of growth has been slowing since the summer.

November 22