-

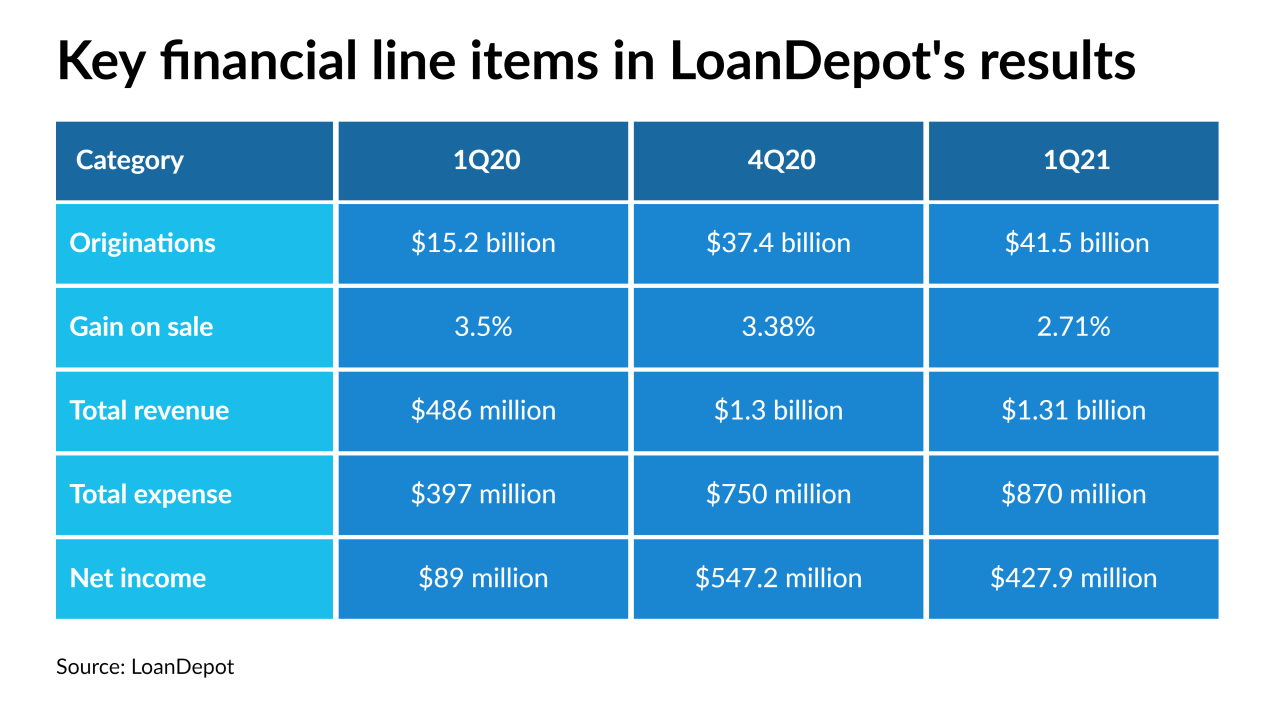

While the unit saw a bigger increase in purchase volume compared to its competitors, net income, loan sales margins and total volume was lower compared with prior periods.

July 21 -

The cloud-based mortgage software company plans on trading on the New York Stock Exchange with a starting price of $24 to $26 per share.

July 19 -

The software provider’s offering hit the top of its price range estimate and started trading at $18 per share.

July 16 -

The bank's second quarter production revenue was down 32% from the first quarter, even as volume increased 4%.

July 13 -

The $16 billion Champion Mortgage portfolio sale follows Ocwen Financial’s purchase of different assets from MAM a few weeks prior.

July 6 -

The company is looking to sell 20 million shares, with a 3 million underwriters' option, at between $16 and $18 per share.

July 6 -

It is only a modest positive for new publicly-traded mortgage companies if acting Federal Housing Finance Agency head Sandra Thompson rolled back the caps put in place by the agreement with the Treasury.

July 2 -

How the pandemic is accelerating trends in financial advice and changing the way Americans manage their money.

-

The company plans on trading on the New York Stock Exchange under the ticker symbol BLND

June 21 -

Investors appear to support the notion that lending to borrowers who don’t have traditional incomes could be a growth engine for lenders as other sources of volume weaken.

June 17 -

While the company did notify the public and regulators in May 2019, executives were not aware at the time that there was previous knowledge of the security vulnerability within the company.

June 15 -

The alternative minimum tax would challenge at least one influential nonbank and big depositories, according to a new Keefe, Bruyette & Woods report.

June 7 -

The transaction goes a long way toward the company’s goal to amass MSRs with a total unpaid principal balance of up to $150 billion.

May 25 -

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Stock prices for the four stand-alone MI companies have declined significantly since the start of May.

May 13 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

After the spinoff and a concurrent private sale to Bayview Asset Management, Genworth Financial will still own 80% of the rebranded Enact.

May 4 -

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3