-

The company could be seeking a cash infusion to handle market difficulties ahead, but representatives are keeping mum on the matter.

June 12 -

The company's planned two-week halt on originations turned into more than two months on hiatus because of coronavirus-related market disruptions.

June 4 -

The company's pricing of its secondary stock option partially alleviated worries about the need to obtain new funds and the risk of dilution for existing shareholders.

June 1 -

The funds will allow the company to make further investment in its machine language technology.

May 21 -

The lenders also are receiving warrants to purchase New Residential stock.

May 20 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

Three of the four had fewer new notices of delinquency for the quarter, but that should change going forward.

May 8 -

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

But Black Knight and Arch Capital's mortgage insurance business aren't as affected, at least so far.

May 5 -

Net income grew by nearly 1,990% year-over-year as its core mortgage services businesses gained scale.

May 1 -

The first-quarter loss ended a two-quarter profitability streak the company hoped to maintain.

April 30 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26 -

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

March 17 -

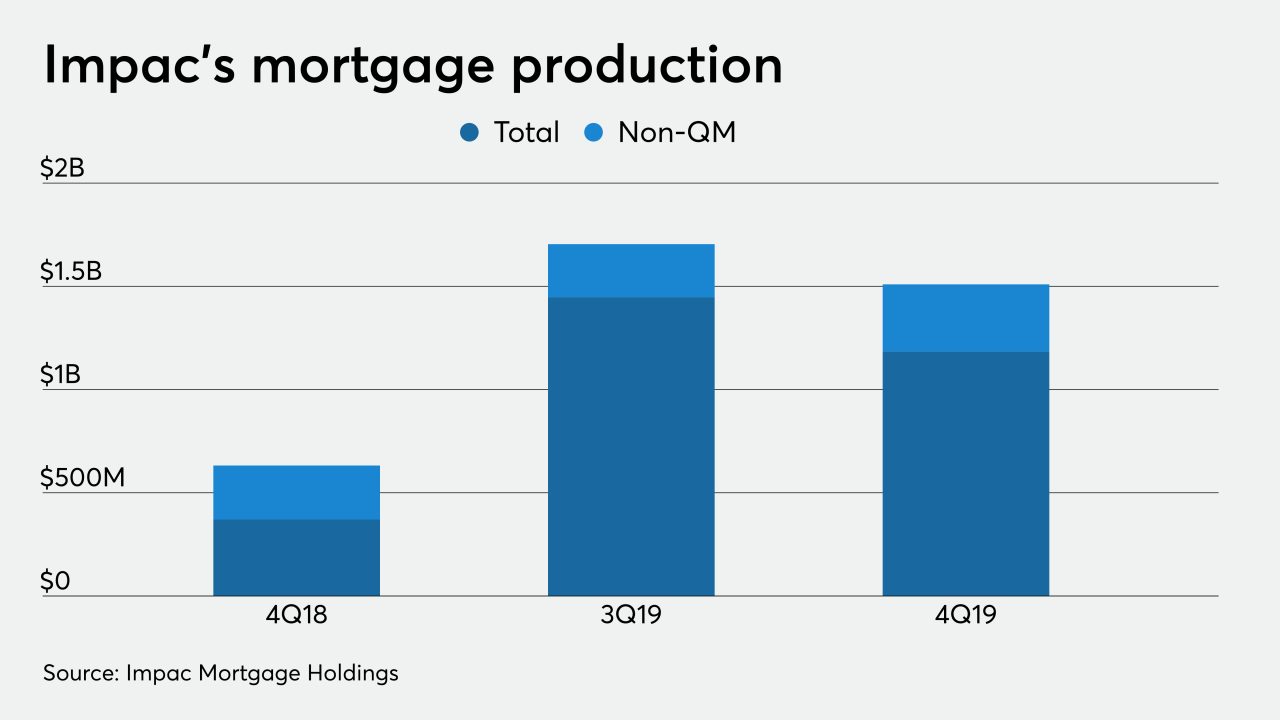

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9