The four stand-alone private mortgage insurers posted positive first-quarter financial results, as they have yet to deal with large amounts of coronavirus-related delinquencies.

But when those delinquencies do ramp up — especially because of forbearance policies instituted under the

"Our opinion has been that the main issue for mortgage insurers … is how delinquencies will be treated under the PMIERs capital framework," said B. Riley FBR analyst Randy Binner in a report on MGIC's results. "MGIC and other MIs have indicated they expect to receive a 70% haircut on additional capital required under PMIERs for delinquent mortgages given FEMA disaster declarations in relation to COVID-19. We see this policy accommodation as the more likely option, as opposed to a

The Private Mortgage Insurer Eligibility Requirements force the MI companies to add to their capital surplus as more loans are added to the delinquent inventory.

For

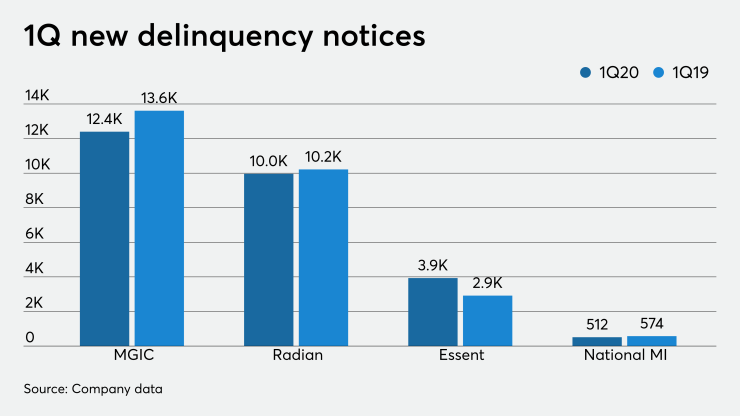

At MGIC, there were fewer additions to the inventory in the first quarter. The company reported 12,398 new notices of delinquency received during the period, compared with 13,694 in the fourth quarter and 13,611 in the first quarter last year.

Radian added 9,960 new notices of delinquency to the inventory, compared with 10,869 in the previous quarter and 10,216 a year ago.

The delinquency story is a little different for Essent and National MI. Both companies' entire insurance-in-force was written after the Great Recession. Many of their loans are just entering what is considered in normal times to be the peak period for missed payments.

Essent received 3,933 new notices during the quarter, compared with 3,826 in the fourth quarter and 2,918 in the first quarter of 2019. The total inventory grew to 5,841 loans on March 31, from 4,096 one year earlier.

National MI had fewer new notices on a year-over-year basis, 512 for the most recent period, versus 574 in 2019. But the total inventory grew significantly to 1,449 loans on March 31 from 940 one year earlier — a sign that cures and claims are only keeping pace with new defaults.

All four companies were profitable for the period. MGIC earned $149.8 million,

The refi share of NIW remained elevated at 35% for the first quarter, compared with 30% in the fourth quarter, but 8% a year ago.

Radian's net income fell to $140.5 million from $170 million for the first quarter of 2019. The company sold its money-losing

Its PMIERs cushion grew during the quarter by $324.5 million to $1.1 billion.

First quarter NIW was $16.7 billion, down from $20 billion

The two newer entrants to the MI business both recorded higher year-over-year results.

Essent reported net income for the quarter of $149.5 million, compared with $127.7 million the year prior.

But it showed slower growth in its NIW, at $13.5 billion for the most recent period, down from $15.8 billion in the fourth quarter and $11 billion in the first quarter of 2019.

National MI's parent company, NMI Holdings, had net income of $58.3 million, versus $32.9 million for last year's first quarter.

"Our company was founded in the wake of the 2008 financial crisis and our approach in the ensuing years has been directly informed by the lessons of that experience. Our conservative stance heading into this period gives us confidence about the strength of our business today," CEO Claudia Merkle said in a press release.

That conservative posture included