-

A $2.38 million loan Remax founder and former CEO David Liniger provided to the company's then-chief operating officer, Adam Contos, violated the company's code of ethics because its board of directors was never told about it, the company said as it announced it had completed an internal investigation.

February 23 -

Ditech Holding Corp. promoted Jeffrey Baker to interim CEO of the company, replacing Anthony Renzi who left the company.

February 21 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

The company that holds Washington Mutual's legacy reinsurance business has agreed to purchase a controlling interest in Nationstar Mortgage and invest in its growth.

February 13 -

Ellie Mae's fourth-quarter and full-year revenue increased over the corresponding prior periods following its acquisition of Velocify.

February 9 -

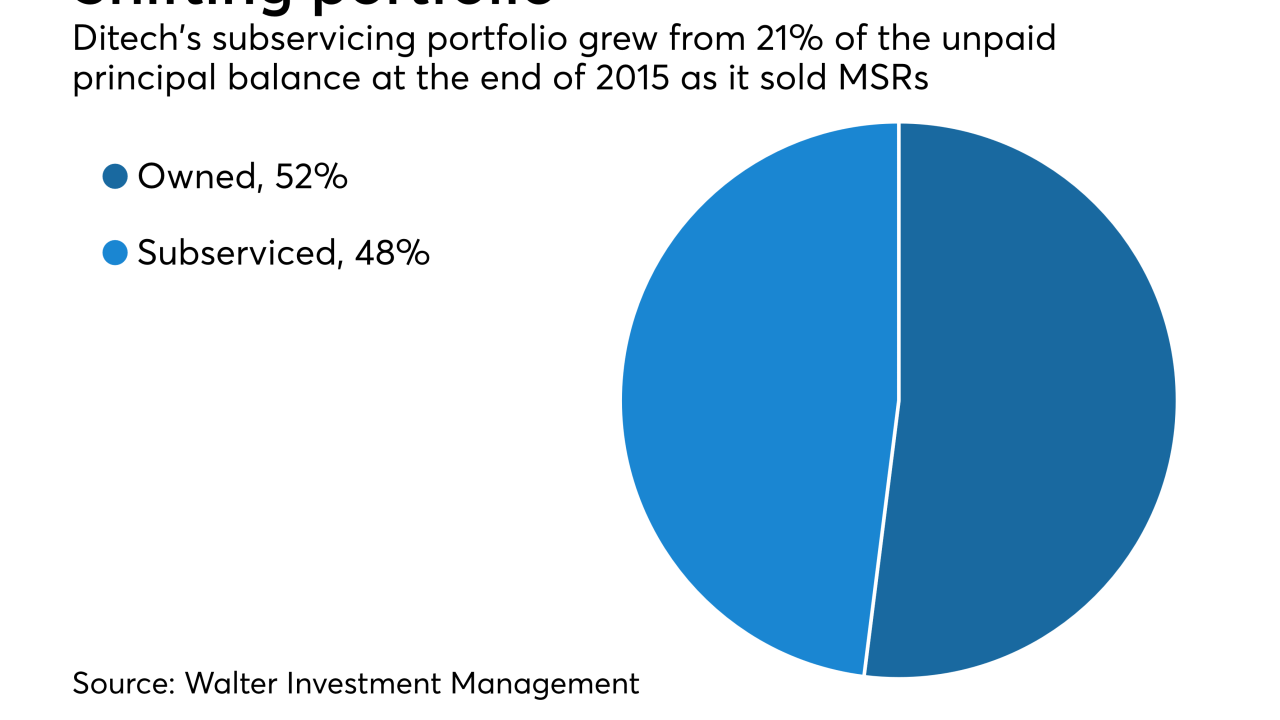

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Shares of homebuilders are now in their 10th straight day of decline, the longest losing streak for the sector since 2002, when it lasted 11 days.

February 5 -

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

The changes to the tax code reduced Radian Group's fourth-quarter net income as the company took an incremental provision of $102.6 million.

February 1 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

Financial firms have mostly shrugged off the government's budget woes, but Washington's gridlock might pose a bigger risk than they think.

January 22 -

U.S. home prices are surging to new records. Homebuilder stocks last year outperformed all other groups. And bears? They're now an endangered species.

January 22 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Bank of America's mortgage banking business reported a loss for the fourth quarter driven largely by representations and warrants provisions.

January 17 -

Citigroup's fourth-quarter residential mortgage banking revenue was 22% lower from the previous year because the company sold the vast majority of its servicing rights.

January 16 -

JPMorgan Chase reported lower mortgage banking revenue in the fourth quarter as the returns from its servicing business declined from the previous year.

January 12 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21