-

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

Around 432,000 homeowners exited their pandemic-related payment suspensions in the first 19 days of October and more than 280,000 plans have month-end review dates, but the number of private-loan plans increased.

October 22 -

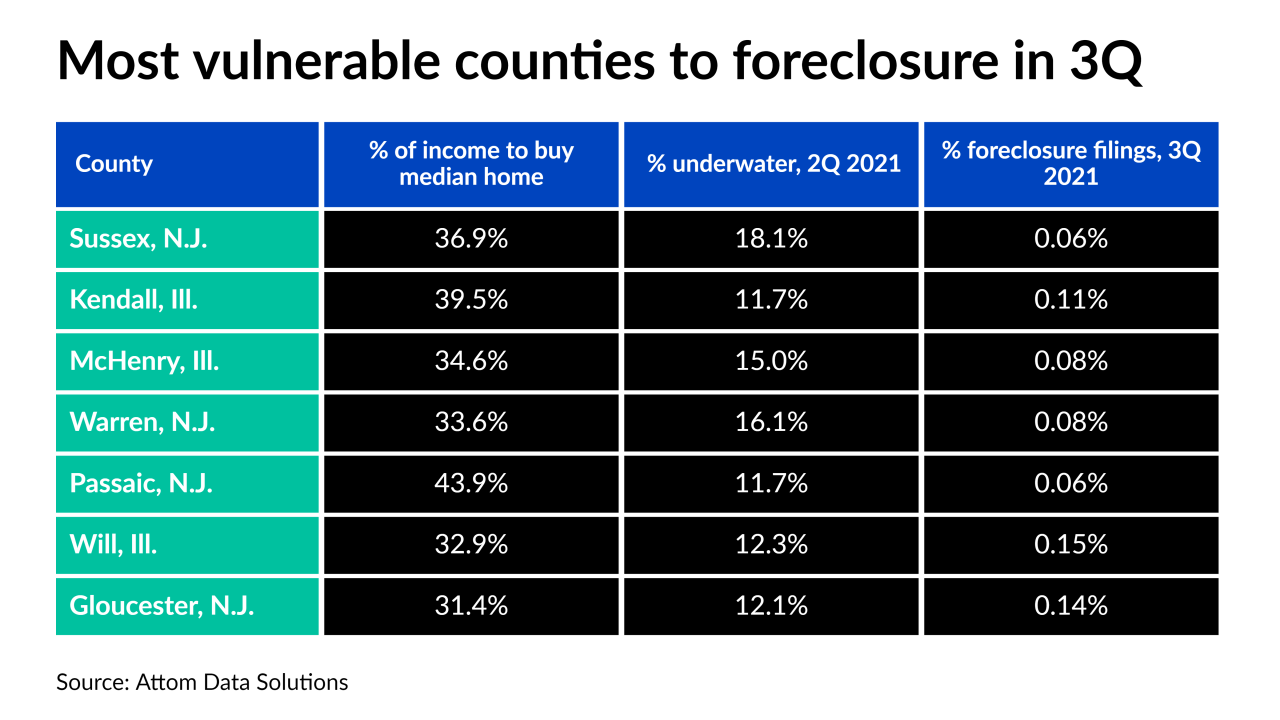

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

There is $900 million in debt on the land alone, including the $150 million junior loan that is for sale by Jones Lang LaSalle.

October 4 -

The rate at which borrowers went past due on their home loans showed near-term improvement in July, according to Black Knight, but servicers fear those who still have forborne payments won’t recover.

August 20 -

The most vulnerable areas all have the same things in common: relatively moderate price appreciation and affordability hurdles — either due to high home values or employment issues.

August 17 -

In a best-case scenario, the money could wipe out almost one-third of the pandemic-related increase in missed payments, but it won’t exclusively be used for that purpose.

August 16 -

The agency developed measures taking effect Aug. 31 that, among other things, will allow lenders to prioritize foreclosures of the most impaired loans and then focus on modifying salvageable ones.

August 11 -

Nearly half the country saw foreclosure starts rise year-over-year during the final month of the moratorium, according to Attom Data Solutions.

August 10 -

The congresswoman urged the Federal Housing Administration to double the six-month term it offers for more recent forbearance requests.

August 9