-

DLJ Mortgage Capital, a subsidiary of Credit Suisse, is securitizing $91 million of loans insured by the Federal Housing Administration that were once delinquent but are now making timely payments.

May 30 -

Nearly 10 years after the housing bubble burst, the median home-sale price in the Philadelphia suburbs is down 11%, having dropped $27,000, from $242,950 in the first quarter of 2007 to $216,000 in 2017.

May 30 -

Maryland Gov. Larry Hogan has signed a bill that will expedite foreclosures of vacant and abandoned properties this fall.

May 26 -

Dozens stood out in the rain Thursday morning to protest the foreclosure eviction of an elderly man and his son from their Sixteen Acres home in Springfield, Mass.

May 26 -

Mortgage delinquencies increased 13% in April from March, but the calendar and seasonality were the primary reasons for the spike, said Black Knight Financial Services.

May 24 -

Fidelity National Financial has acquired Hudson & Marshall, a real estate auction company, and in a related move its ServiceLink subsidiary introduced a foreclosure auction product.

May 23 -

Nationstar Mortgage is issuing its seventh securitization of nonperforming reverse mortgages.

May 22 -

It was a rare lucrative business for Wall Street in the aftermath of the financial crisis: snapping up properties in foreclosure and renting them out. So good, in fact, that now, as the distressed pool dries up, some investors are refusing to let the rental-model fizzle.

May 22 -

A Tamarac, Fla., man scammed tens of thousands of dollars from three homeowners who were falling behind on their monthly payments during the mortgage crisis, investigators say.

May 22 -

A Newport Beach, Calif., man was arraigned on charges of impersonating an attorney and defrauding clients through debt consolidation and mortgage modification schemes, according to the Orange County District Attorney's office.

May 19 -

Philadelphia homeowners at risk of foreclosure over past-due property taxes could be given free housing counseling and have their debt deferred under a program being developed by City Council.

May 19 -

Foreclosure activity continued to sink in Southwest Florida last month, tracking the statewide and national trends.

May 17 -

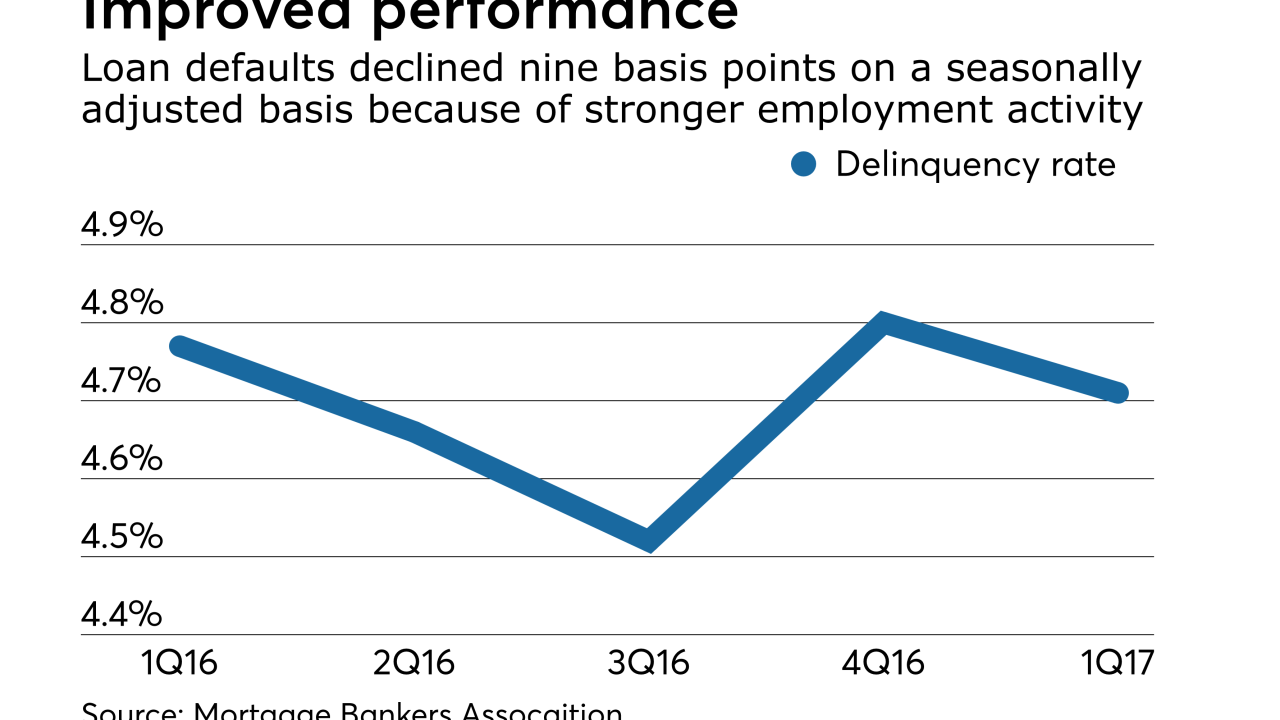

Lower defaults among government-guaranteed mortgage borrowers drove the overall delinquency rate down, the Mortgage Bankers Association said.

May 16 -

Fannie Mae has a $1.8 mortgage foreclosure lawsuit pending with FFH of Fort Smith Limited Partnership and several other local entities over the Rock Creek apartments on North 50th Street in Fort Smith, Ark.

May 16 -

Across the nation, the once-pernicious foreclosure crisis nearly has abated, but in Lucas County, Ohio, foreclosure activity is stronger than it was a year ago.

May 16 -

The city joins a growing list of municipalities that have filed similar lawsuits, just two weeks after the Supreme Court ruled that municipalities have standing to sue lenders under the Fair Housing Act.

May 15 -

Daytona Beach has a message for the hundreds of property owners who collectively have stiffed the city on $4.46 million in code violation fine payments: Pay up soon, or the city's coming after your land and buildings with foreclosure actions.

May 15 -

Connecticut had 23% more foreclosure actions under way in April than a year earlier, according to a new study, with newly commenced foreclosures spiking 40%.

May 12 -

Foreclosure filings in April were at their lowest level since November 2005 at 77,049 properties, down 7% from March's 83,145 and 23% from April 2016.

May 11 -

There's a deep connection between the history of redlining on the East Side of Cleveland and the continuing decline of neighborhoods hollowed out by subprime lending and the mortgage foreclosure crisis of the 2000s.

May 11