-

A California man and his unnamed co-conspirator netted a total of at least $5 million from thousands of homeowners, federal prosecutors said.

March 9 -

Meanwhile, 707,104 mortgages remain in forbearance, accounting for a combined $136 billion in unpaid balances.

February 28 -

Real-estate owned, auction and default activity tracked by Attom have rebounded slightly, but the latest Mortgage Bankers Association’s number for late payments show they’re still very near or at historic lows.

February 11 -

Housing rights advocates said minority home-buyers and homeowners in 39 U.S. metropolitan areas will receive the funds as a result of a legal action alleging racial discrimination in the government-sponsored enterprise's foreclosure practices.

February 8 -

The defendants and an attorney convinced homeowners to hand over their properties while the pair filed bogus claims to keep creditors’ foreclosures at bay.

January 31 -

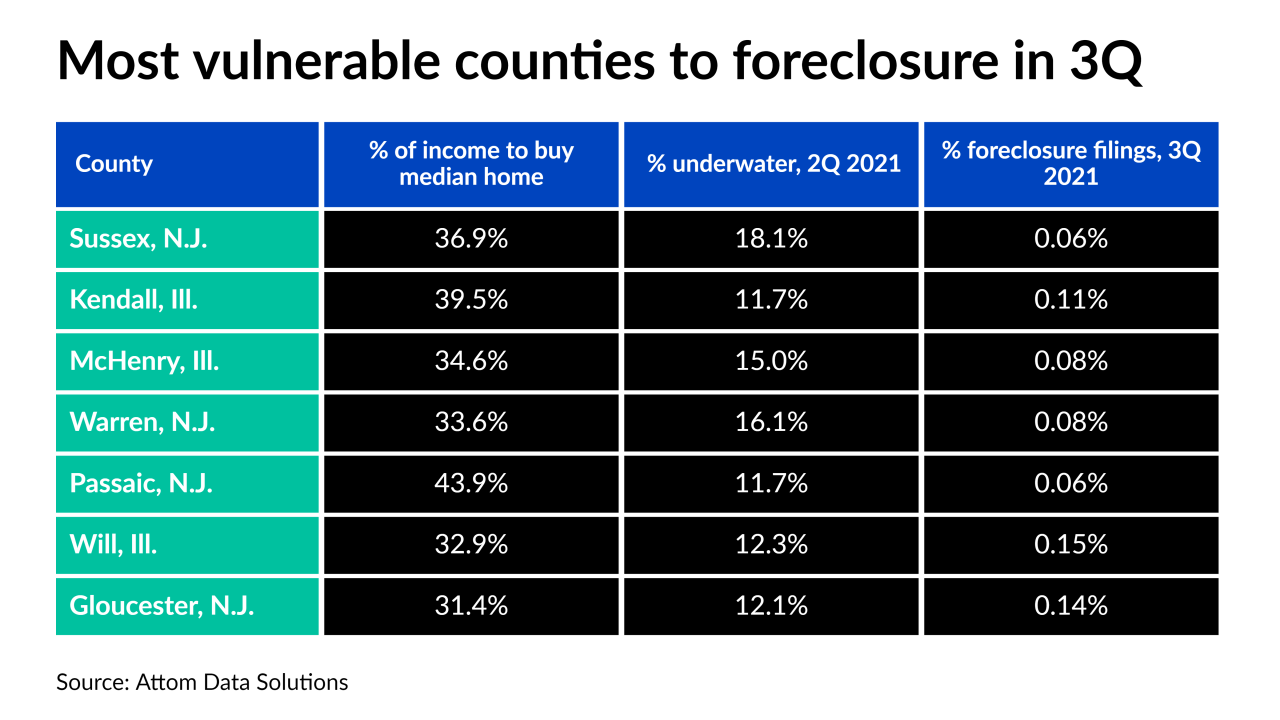

The residential market is generally healthy, but distress is growing in areas where foreclosures are more common, homes are less affordable, and more properties are underwater, Attom finds.

January 20 -

COVID loan forbearance championed by progressives has created a new, permanent class of distressed borrower, Whalen writes.

January 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Borrowers accepting federal loan modifications saw payments on principal and interest reduced between 27% and 33%, according to estimates by the Federal Reserve Bank of Philadelphia.

December 29 -

The state has distinct loss mitigation policies, and particularly complex rules for foreclosures scheduled to fully restart when its ban ends — and other states could write similar rules.

December 27 -

However, the serious delinquency rate dropped to a point significantly below the market-wide average, and much of the foreclosure activity allowed to proceed did so with new consumer protections in place.

December 22 -

The Servicemembers Civil Relief Act includes extra protections aimed at preventing foreclosure for homeowners in the military.

December 20 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

However the numbers for November were still up from a year ago, when bans and forbearance were still largely in place.

December 9 -

Bargain-hunting buyers are willing to make a purchase on the courthouse steps or via online sale, according to ServiceLink.

November 16 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

Around 432,000 homeowners exited their pandemic-related payment suspensions in the first 19 days of October and more than 280,000 plans have month-end review dates, but the number of private-loan plans increased.

October 22 -

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

There is $900 million in debt on the land alone, including the $150 million junior loan that is for sale by Jones Lang LaSalle.

October 4 -

The rate at which borrowers went past due on their home loans showed near-term improvement in July, according to Black Knight, but servicers fear those who still have forborne payments won’t recover.

August 20 -

The most vulnerable areas all have the same things in common: relatively moderate price appreciation and affordability hurdles — either due to high home values or employment issues.

August 17