-

The Servicemembers Civil Relief Act includes extra protections aimed at preventing foreclosure for homeowners in the military.

December 20 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

However the numbers for November were still up from a year ago, when bans and forbearance were still largely in place.

December 9 -

Bargain-hunting buyers are willing to make a purchase on the courthouse steps or via online sale, according to ServiceLink.

November 16 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

Around 432,000 homeowners exited their pandemic-related payment suspensions in the first 19 days of October and more than 280,000 plans have month-end review dates, but the number of private-loan plans increased.

October 22 -

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

There is $900 million in debt on the land alone, including the $150 million junior loan that is for sale by Jones Lang LaSalle.

October 4 -

The rate at which borrowers went past due on their home loans showed near-term improvement in July, according to Black Knight, but servicers fear those who still have forborne payments won’t recover.

August 20 -

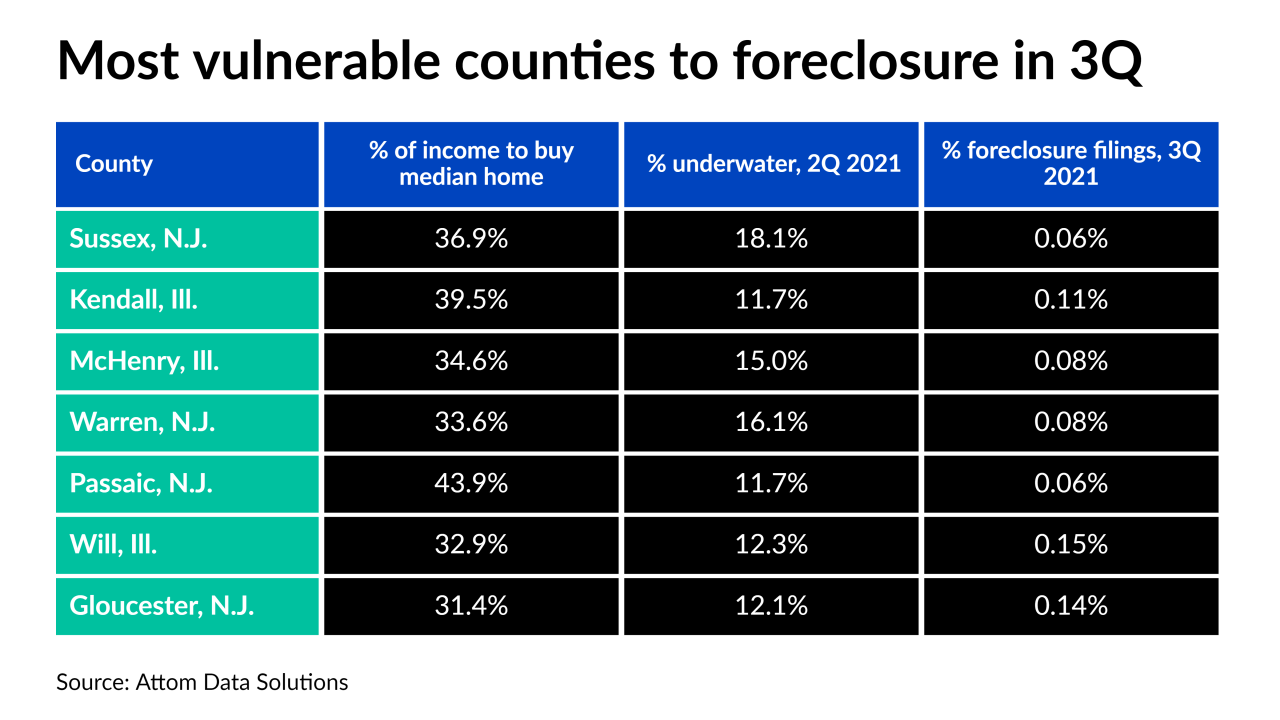

The most vulnerable areas all have the same things in common: relatively moderate price appreciation and affordability hurdles — either due to high home values or employment issues.

August 17 -

In a best-case scenario, the money could wipe out almost one-third of the pandemic-related increase in missed payments, but it won’t exclusively be used for that purpose.

August 16 -

The agency developed measures taking effect Aug. 31 that, among other things, will allow lenders to prioritize foreclosures of the most impaired loans and then focus on modifying salvageable ones.

August 11 -

Nearly half the country saw foreclosure starts rise year-over-year during the final month of the moratorium, according to Attom Data Solutions.

August 10 -

The congresswoman urged the Federal Housing Administration to double the six-month term it offers for more recent forbearance requests.

August 9 -

The number of people exiting pandemic-related payment suspensions starting in September will be daunting to process, according to a Black Knight report published Monday.

August 2 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

The Federal Housing Administration, the agency that oversees government-sponsored enterprises Fannie Mae and Freddie Mac, and the VA extended additional relief to those living in single-family rental, real-estate owned properties.

July 30 -

The plan aims to cut monthly payments by roughly 25% for homeowners in government-backed mortgages who are negatively impacted by the pandemic.

July 23 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

As the distribution of at-risk housing markets spread across more states quarter-over-quarter, vulnerable clusters remained around Chicago, New York and Philadelphia, an Attom Data report finds.

July 22