-

Hardly a day goes by where a Covius client doesn’t have a question about the timing of various federal and state deadlines, its vice president of compliance writes.

June 8 Covius

Covius -

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

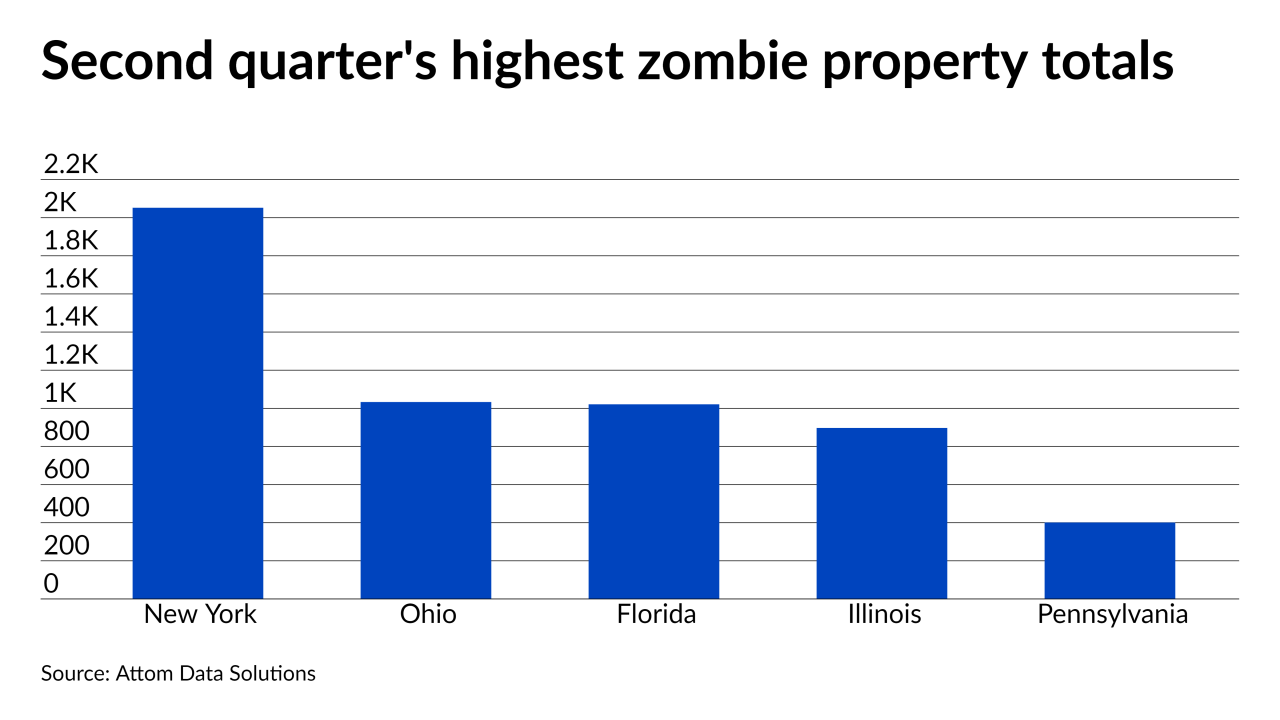

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

Federal Housing Finance Agency Director Mark Calabria said he wants to work with the consumer bureau on an “exit strategy” for borrowers approaching the end of their forbearance periods.

April 20 -

Also, even with bans in place, the total number of filings keeps inching up due to actions taken on vacant properties.

April 15 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

Servicers of loans not related to the government most often capitalized missed payments and converted them into a deferred, non-amortizing balance, said Vadim Verkhoglyad of dv01.

April 12 -

One official at the bureau said this fall could be an “unusual point in history” for the mortgage market as delinquent borrowers exit forbearance plans. The agency proposed new steps for servicers to help consumers stay in their homes.

April 5 -

Mortgage companies could face penalties if they don’t take steps to prevent a deluge of foreclosures that threatens to hit the housing market later this year, a U.S. regulator said Thursday.

April 2 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

While foreclosure moratoria keep the overall numbers down, zombie foreclosure rates jumped in the majority of states, according to Attom Data Solutions.

February 25 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24 -

The decision provides more clarity to noteholders in the state about when the six-year statute of limitations to bring a foreclosure action begins.

February 23