-

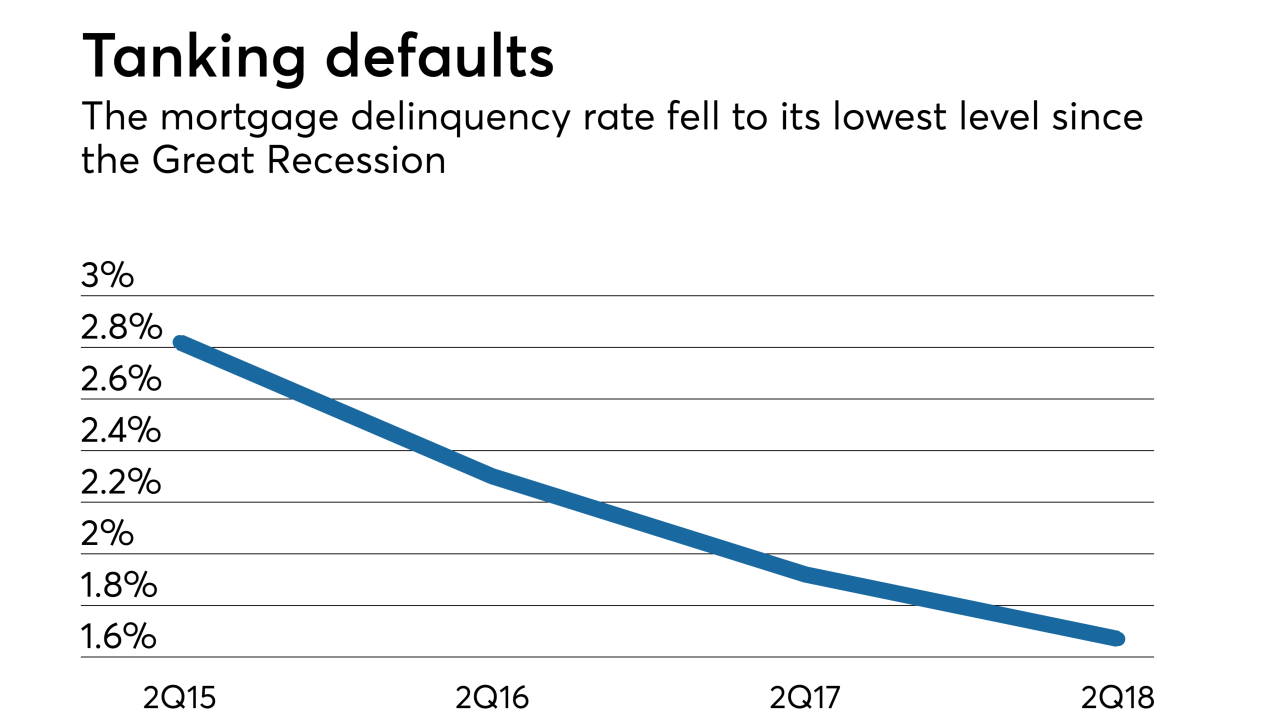

The number of Americans who are behind on their mortgage payments is the lowest in more than a decade.

September 12 -

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

More flip-and-fix property buyers seek financing for their purchases as fewer distressed homes come on the market and sales margins narrow, said Attom Data Solutions.

September 6 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

Tax foreclosure filings in Philadelphia have skyrocketed 1,200% since 2010, so the city is promoting its homestead exemption to keep people in their homes.

August 31 -

A decade after a collapse in the housing market triggered the 2008 Great Recession, South Florida still has many homeowners who owe far more money than their property is worth.

August 29 -

A 75-year-old Florida real estate developer was sentenced to six months in prison after admitting he lied to banks to keep money flowing so he wasn't forced to scuttle an oceanfront hotel and condominium in Vero Beach.

August 29 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

Foreclosures on Metro Orlando homes are up 23% from July 2017, though the numbers are still well below the peak of the recession, and local sales agents say there's not much impact in the market yet.

August 21 -

The new policy, meant to assist borrowers in Puerto Rico and the U.S. Virgin Islands, will let servicers evaluate borrowers using pre-disaster payment information.

August 16 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14 -

Foreclosures, short sales and other troubled properties continue to dwindle in central Ohio, according to a report from the Columbus Realtors trade group.

August 13 -

The Fed's order targets affidavits prepared by employees of CitiFinancial in connection with the company's exiting the mortgage servicing business.

August 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

Sen. Brian Schatz, D-Hawaii, said it is hard to imagine how Wells Fargo's $8 million remediation plan would correct a mistake that led to 400 wrongful foreclosures.

August 9 -

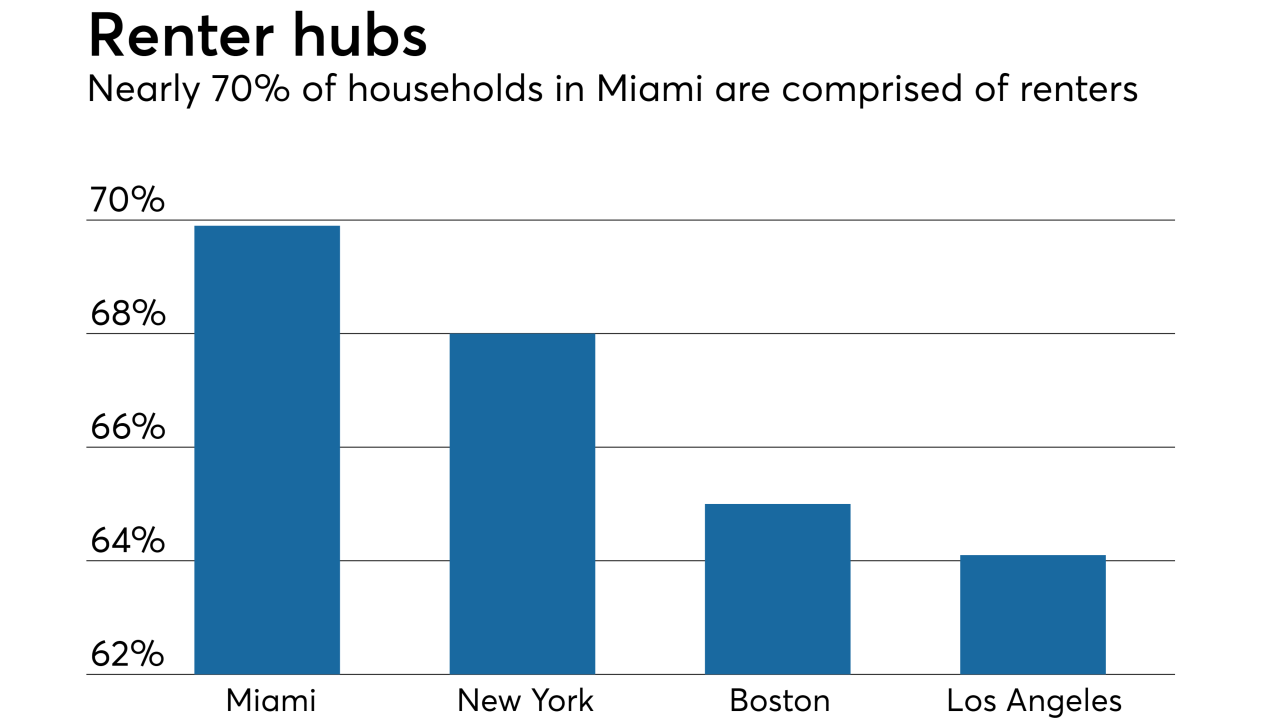

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8 -

The priciest house for sale in the Tampa Bay, Fla., area could soon become its biggest foreclosure.

August 7