Fraud

Fraud

-

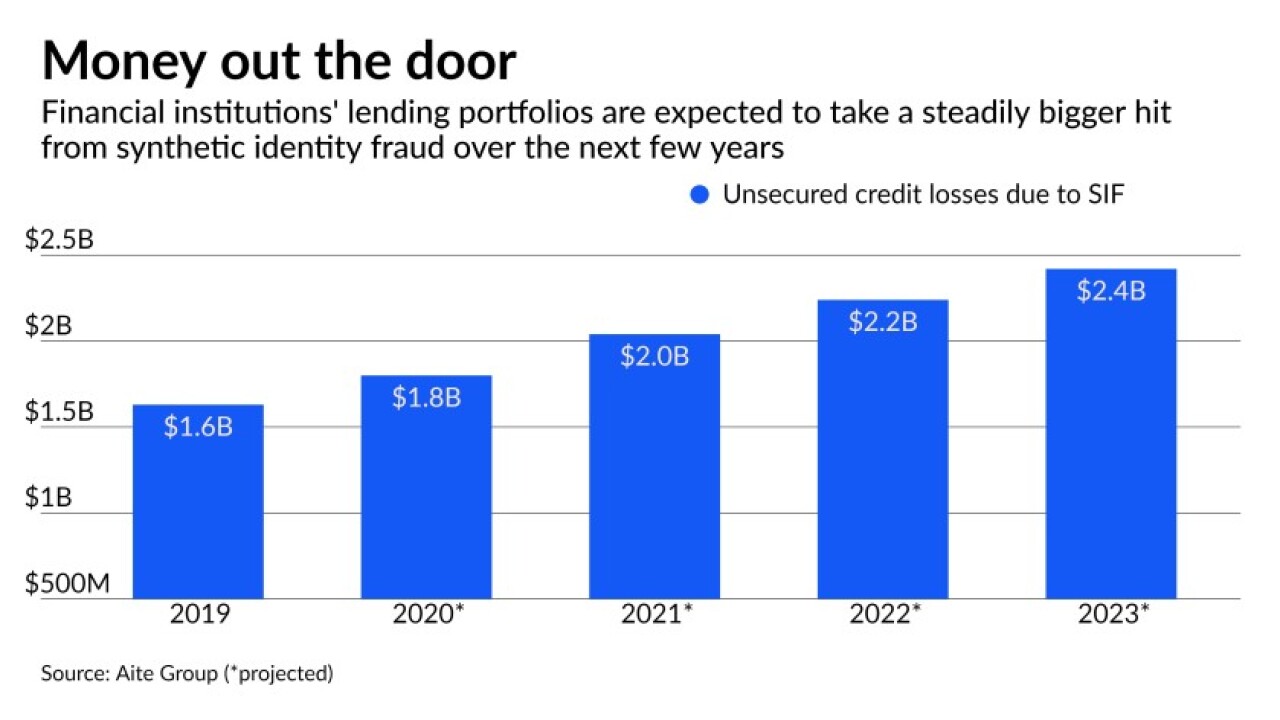

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

The individuals allegedly defrauded Freddie Mac and CBRE Capital Markets by misrepresenting information used to refinance a small-balance loan.

May 20 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

The defendants face 133 felony counts that include allegedly stealing identities to commit mortgage fraud between 2014 and 2020, resulting in the theft of $15 million.

May 7 -

The complaint exemplifies the Department of Housing and Urban Development’s focus on “fair servicing” in addition to fair lending.

May 1 -

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

New entrants in the market may believe: “We’re doing everything right. Fraud isn’t a problem, and we have a fraud alert tool in place anyway.” This, of course, is exactly when fraud risk grows, warns Paul Harris of First American Data & Analytics.

March 29 -

-

While many lenders have verification processes and systems of record in place for their structured data, they lack digital solutions capable of addressing the volume of customer data from documents that create a broad area of vulnerability for them, writes Reggie Twigg, director of digital enterprise at ABBYY.

March 4 -

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2 -

With extreme winter weather about to give way to ballooning insurance and mortgage forbearance claims in Texas, servicers will need to get through their pipelines with urgency while weeding out fraud.

February 25 -

Come away better prepared for what’s ahead after hearing Satish Kini and David Sewell of Debevoise & Plimpton and Darin Jarrett, Deputy BSA/AML Officer at American Express, in conversation with Bonnie McGeer, Executive Editor of American Banker, as they explore: •How the new administration might change the BSA/AML Act •Are there easy wins in relieving the burden of suspicious activity reports without undermining effectiveness? •New ways that companies are innovating within AML compliance and risk •What banks are doing to drive next-gen efficiency and effectiveness of risk and compliance

-

The former executive at Lend America, who has remained out of prison since his 2011 guilty plea, will not be incarcerated for his acts.

January 20 -

The complaint unsealed Monday alleges three individuals and several companies they owned or controlled engaged in False Claims Act violations involving short sales of properties that had Federal Housing Administration-insured mortgages.

January 5 -

The accused, who also faces vehicle title and investment fraud charges, allegedly submitted falsified statements related to the payoff of an earlier mortgage when applying for a new one.

December 18 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

Tough competition for home listings makes consumers more likely to misrepresent themselves on loan applications.

December 1 -

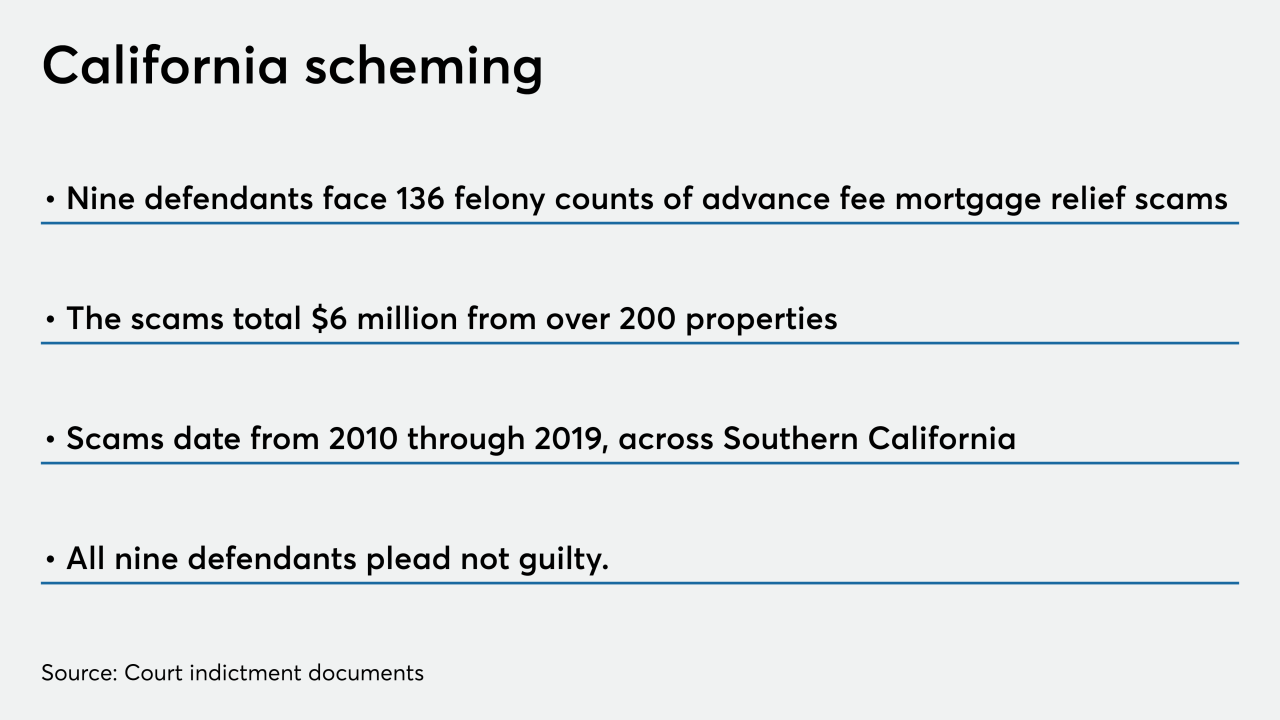

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12 -

More than six months after the CARES Act became law, the two entities joined a host of industry organizations in launching the COVID Help for Home campaign to educate borrowers on the next steps in forbearance.

November 11