Loan application defect risk for purchase mortgages has continued to rise as the

"More important for fraud risk is the continued sellers' market, which may pressure home buyers to misrepresent information on their loan application to win the bid for a home," Odeta Kushi, First American's deputy chief economist, said in a statement. "The winter months should cool the hot sellers' market, which may relieve pressure on overall fraud risk."

Cooling off may be a relative term, however. The Mortgage Bankers Association's latest forecast predicts that $406 billion in closed purchase loans will be logged in the fourth quarter. In the first quarter of 2021, the total is expected to slip to $355 billion before trending upward again on the way to

Kushi believes a further increase in fraud risk could be mitigated by the increasing use of automation and other fintech tools, "which have enhanced the mortgage manufacturing and underwriting process, producing declining levels of defect risk."

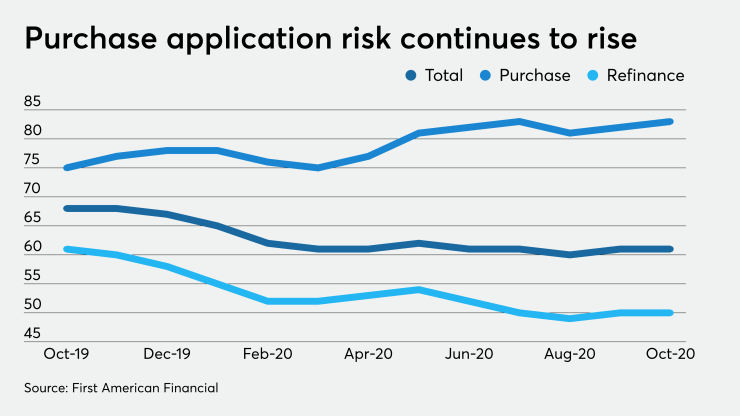

While the overall Loan Application Defect Index remained unchanged at 61 for October, the purchase component rose to 83, its highest level since June 2019. In

An application defect is a red flag for — but not a definitive sign of — mortgage fraud.

The purchase index has increased in each month but one since the home sales market collapsed in March

Refinancings, particularly the rate and term variety that predominate the market right now, are less prone to application defects because they are not need-based, unlike most cash-out loans. The refi component was unchanged from September at 50; for October 2019, it was at 61.

Because of the

"The stability in single-family fraud risk is contributing to the steadiness of overall fraud risk, especially as market preferences tilt towards single-family homes," Kushi said.

For multi-unit properties, the risk increased in October to 84 from September's 83. For condominiums, it was unchanged at 70, while for planned unit developments, it increased to 65 from 64.