-

Forbearance requirements under the CARES Act raised immediate concerns about servicing advances and performance, but experts suggest there are other outcomes to brace for, too.

April 9 -

If rising flood waters were the right analogy last time around, this time a tsunami is probably a more accurate description of the wave of delinquencies about to come.

April 8 Mayer Brown LLP

Mayer Brown LLP -

The lender is one of many taking advantage of the disruption in the market to grow their businesses.

April 8 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

The CARES Act does not define what a covered period is when it comes to residential mortgage borrower requests for forbearance.

April 7 McCarter & English LLP

McCarter & English LLP -

The coronavirus relief legislation could result in private mortgage insurers having to hold more capital, a B. Riley FBR analyst report said.

April 6 -

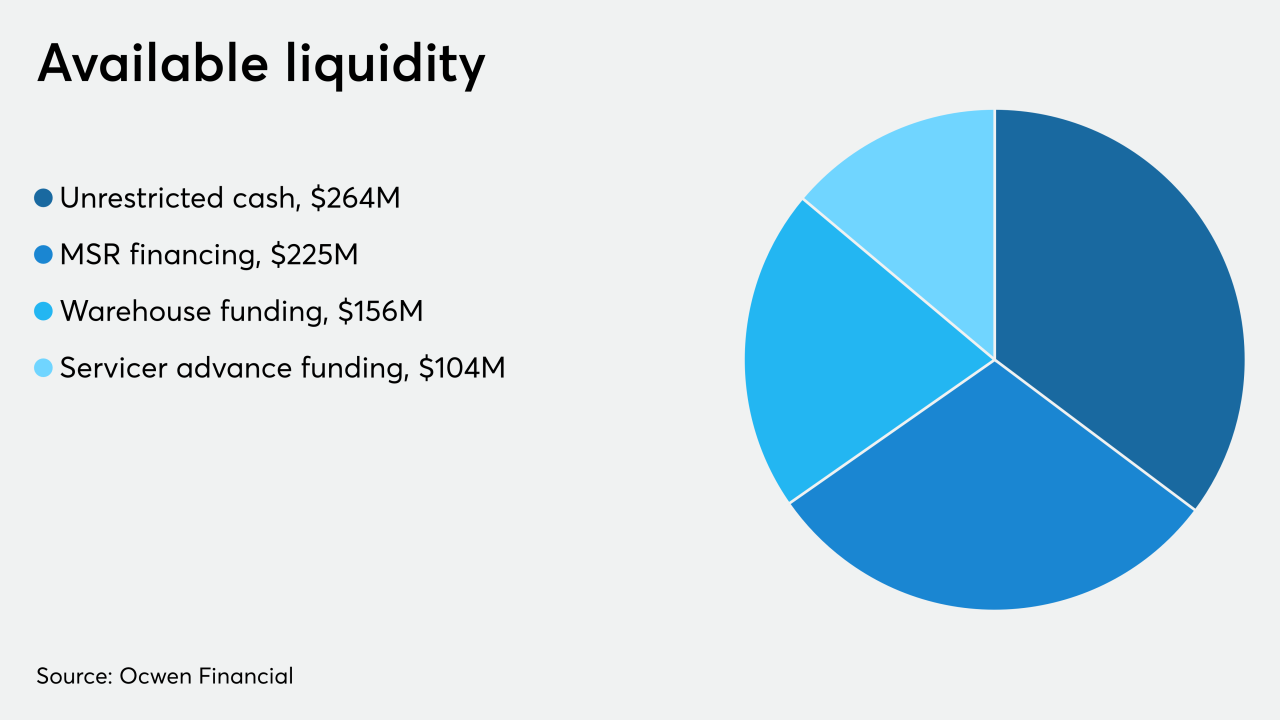

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Simply stated, the federal forbearance of mortgage payments is perhaps the largest unfunded public mandate in American history.

April 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The latest deadline for Genworth Financial's acquisition by China Oceanwide is June 30, but the parties are looking to get the transaction completed by the end of next month.

April 1 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

March 27 Community Home Lenders of America

Community Home Lenders of America -

Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

March 27 -

The Federal Reserve Board should create a dedicated facility for mortgage servicers to access in order to make required advances, industry participants and observers, including its largest trade group, said.

March 24 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to lend additional support to the mortgage-backed securities market and temporarily allow some flexibility in lending requirements to address coronavirus-related concerns.

March 23 -

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

A number of proposals have been floated for debt payment holidays and other types of moratoria, but such approaches offer solutions that are worse than the problems.

March 19 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

A proposal to tighten financial requirements for government-sponsored enterprise counterparties that sought to lower risk in a volatile market should be suspended, a group representing smaller lenders said, arguing it would aggravate current distress.

March 18