-

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Since its inception, the qualified mortgage rule has been synonymous with loans purchased by Fannie Mae and Freddie Mac or guaranteed by government agencies. But a broader QM definition could change that by creating more competitive private-label options.

June 5 -

Anticipated changes to the qualified mortgage rule will give lenders more options and force them to rethink their views on risk.

June 4 -

MountainView is brokering a $3.6 billion nonrecourse package of Fannie Mae mortgage servicing rights with a high refinance loan concentration.

June 4 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

A group of low- and moderate-income first-time homebuyers tracked in a Fannie Mae study did not properly prepare to get a mortgage, which created a prolonged and complicated purchase process.

May 24 -

From the latest economic news to the latest developments in digital mortgages, here's a look at six things we learned at the MBA Secondary Conference 2018.

May 23 -

Republican Bob Corker of Tennessee and Democrat Mark Warner of Virginia are acknowledging the legislative efforts to end government control of Fannie Mae and Freddie Mac are dead, at least for now.

May 23 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18 -

For nearly a decade, the FHFA has restricted Fannie Mae and Freddie Mac from trying to influence the raging debate over whether they should live or die.

May 18 -

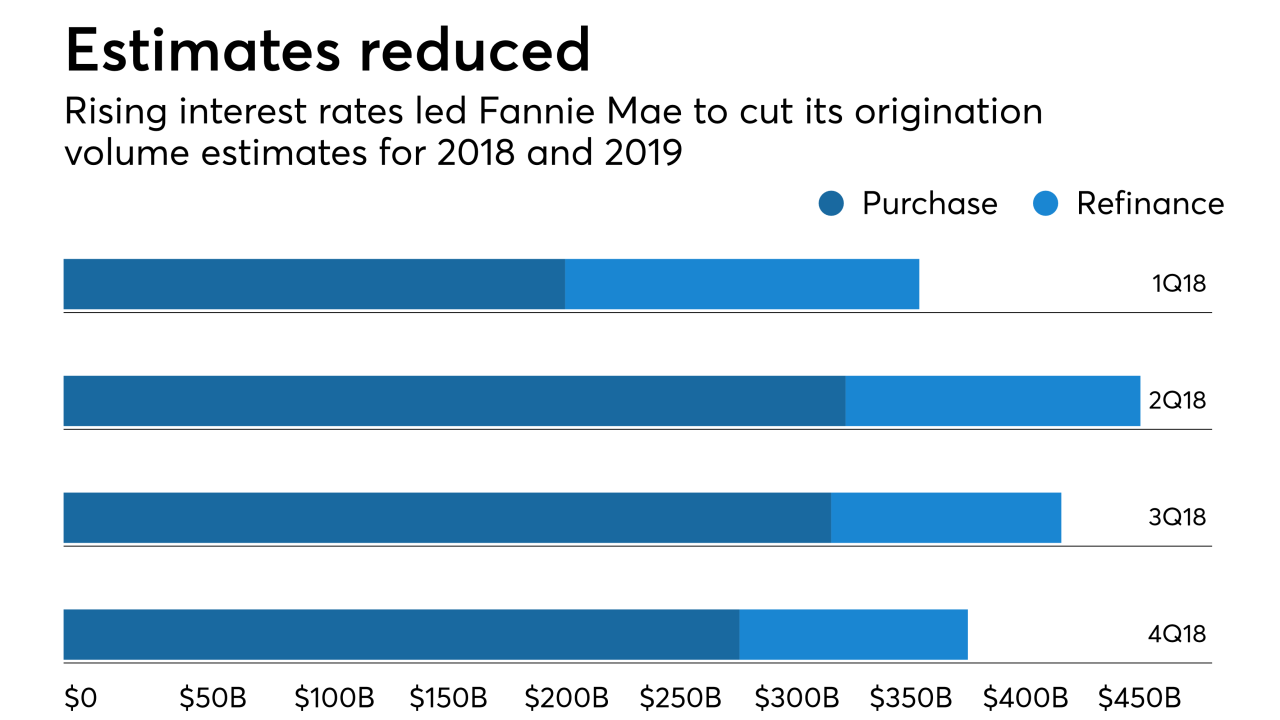

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Commercial and multifamily loan originations may not be up by much from a year ago, but borrowing and lending behaviors were drastically different in the first quarter.

May 17 -

John Krenitsky, who previously managed compliance for Discover Financial Services and various banks, is joining Freddie Mac as senior vice president and chief compliance officer on June 1.

May 15 -

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

May 8 -

In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7