-

Republican Bob Corker of Tennessee and Democrat Mark Warner of Virginia are acknowledging the legislative efforts to end government control of Fannie Mae and Freddie Mac are dead, at least for now.

May 23 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

Test your knowledge of the secondary mortgage market with this quiz of key industry abbreviations.

May 18 -

For nearly a decade, the FHFA has restricted Fannie Mae and Freddie Mac from trying to influence the raging debate over whether they should live or die.

May 18 -

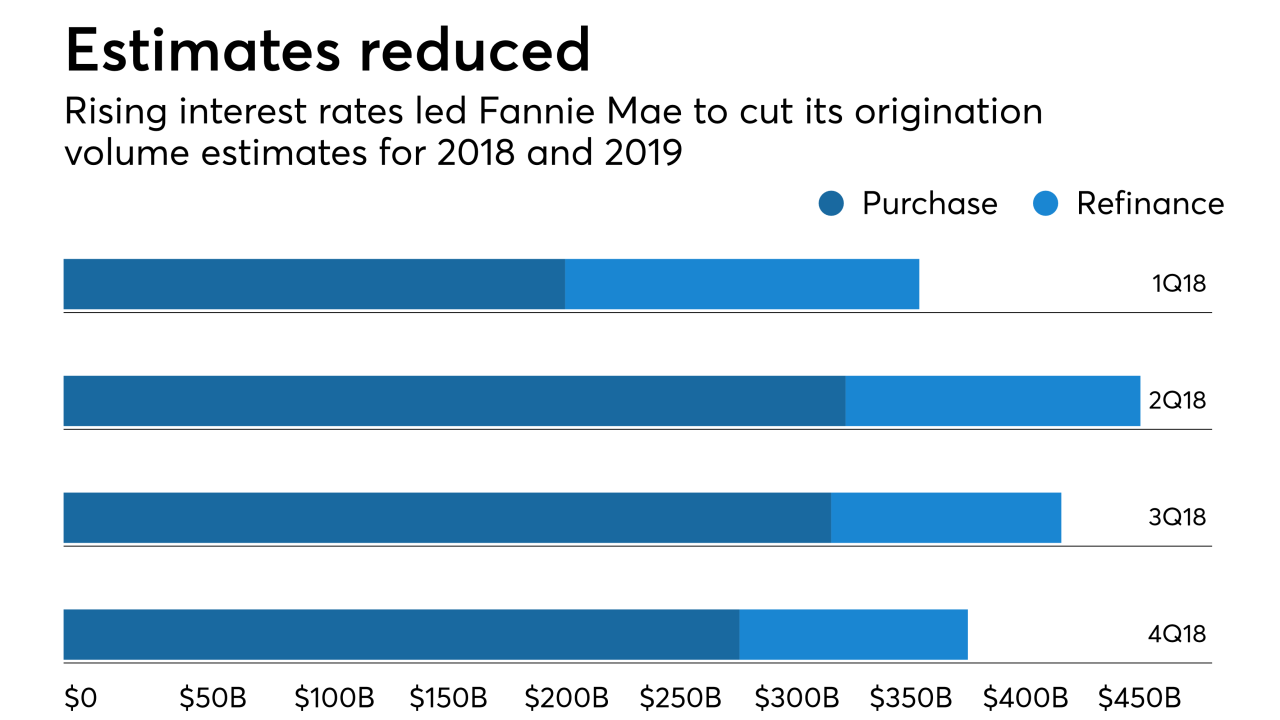

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

Commercial and multifamily loan originations may not be up by much from a year ago, but borrowing and lending behaviors were drastically different in the first quarter.

May 17 -

John Krenitsky, who previously managed compliance for Discover Financial Services and various banks, is joining Freddie Mac as senior vice president and chief compliance officer on June 1.

May 15 -

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

May 8 -

In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Demands for loan quality aren't just coming from regulators and the government-sponsored enterprises. Secondary market partners and investors don't want to be left holding the bag if loans that lenders create have quality issues.

May 4 LoanLogics

LoanLogics -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

In its latest effort to reach first time home buyers, Freddie Mac is launching a new 3% down payment program that casts aside a number of restrictions in its existing low down payment offerings.

May 2 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

A special agent who used to work for an investigative arm of Immigration and Customs Enforcement pleaded guilty to defrauding Freddie Mac and SunTrust Mortgage through a short sale.

April 23 -

A data validation integration Freddie Mac is adding to its technology platform could also deliver representation and warranty relief to lenders when it verifies self-employed borrowers' incomes.

April 20 -

From the latest developments in digital mortgages to information about agency technology implementation, here's a look at eight things we learned at the 2018 MBA Tech conference.

April 18 -

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

April 16