-

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

December 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Fannie Mae is starting to relocate staff in the Dallas area into a new office and will soon move its Washington, D.C., headquarters.

December 8 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

Farmer Mac has terminated President and CEO Timothy Buzby for violating company policies not related to its financial and business performance.

December 7 -

Freddie Mac on Thursday priced the first transaction to result from its pilot in the single-family rental market.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

Cutting payments helps stave off default, but principal reduction on underwater loans and lower consumer debt levels are less effective, according to JPMorgan Chase Institute's new study of post-crisis modifications.

December 5 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

A provision in the original Senate tax reform bill would have required companies acquiring mortgage servicing rights to pay taxes upfront for their anticipated servicing income.

December 1 -

Borrowers will be able to take out a substantially bigger home loan backed by Fannie Mae and Freddie Mac next year, thanks to a 6.8% increase in home prices nationwide.

November 30 -

The Federal Housing Finance Agency's final guidelines for evaluating "duty to serve" activities create new ways for Fannie Mae and Freddie Mac to get extra credit for going above mandatory levels of lending to underserved markets.

November 30 -

After 10 years of operation, RoundPoint Mortgage Servicing Corp. has launched a retail mortgage lending division.

November 30 -

The financial services industry has cheered a proposed reduction in the corporate tax rate, but a lower rate could force Fannie Mae and Freddie Mac to write down assets, increasing the odds that the companies will need Treasury support.

November 29 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

The White House and congressional GOP leaders are eyeing a tight window between tax reform passage and the 2018 midterms to pass housing finance reform. And with key policymakers readying their exit, the effort could be the most concerted push yet.

November 17 -

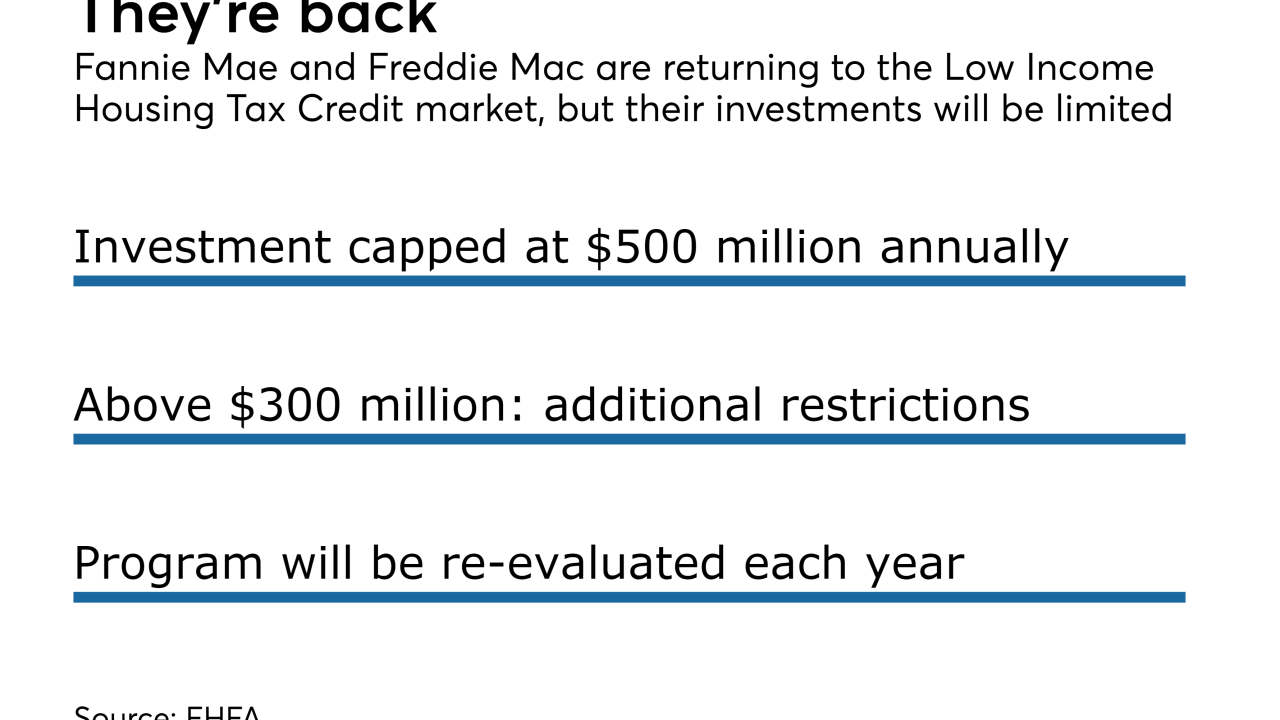

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

The battle lines are drawn between those seeking to protect the mortgage interest deduction and a legislative effort to greatly reduce its use. Hopefully, this is a battle that taxpayers will win.

November 10 American Enterprise Institute

American Enterprise Institute