-

The top five depositories have a combined HELOC volume of more than $91 billion at the end of Q1 2023.

June 1 -

The transaction is the second of its kind in the past six months and comes as the mortgage leaders take steps to develop document standardization that would ease electronic closings and trading of the home equity loans.

April 25 -

The loans increased their share to more than 20% of home lending volume in the fourth quarter, compared to just 7% a year earlier.

April 17 -

The top five had more than $85 billion in HELOC volume in Q3.

March 16 -

Lenders are seeking to capture homeowner interest amid higher living costs, but home values have collectively fallen from their record-high last summer.

February 22 -

The latest quarterly numbers from TransUnion show both closed end products and HELOCs rose over the course of the past year as mortgage originations fell.

February 1 -

Investor whims and secondary market conditions make any pivot away from fixed-term products a riskier proposition for nonbanks, mortgage advisory group Stratmor said.

December 21 -

The company has incurred a combined $91.8 million in expenses in the past two quarters related to its massive cost-cutting plan, which included the layoff of thousands of professionals.

November 9 -

Both bank and nonbanks are starting in — or returning to — this segment as they look to make up for declining originations. But there are a few key issues to consider before taking on the new line of business.

August 22 -

Several lenders have introduced loan offerings this year to tap into surging property values, as refinances plunge by more than 80%.

August 1 -

But knowledge of HELOCs and HECMs is higher among Gen Z and millennials than boomers.

July 26 -

The new product is an extension of its FraudGuard offering for the first lien mortgage market.

June 23 -

Volumes generated for the home equity product increased by 28% over the past year, showing particular strength in Western markets.

June 10 -

Non-depositories historically haven't been big originators of home equity lines of credit, but fintechs that offer the easily automated countercyclical products are reporting growth.

May 26 -

In the fourth quarter of 2021, home equity line of credit volume was up 31% from the same period the year before.

May 13 -

Forecasting that it will not turn a profit in the 2022 fiscal year, the company plans to make job cuts, suspend dividends and introduce new products.

May 10 -

While first-quarter profits were up considerably, CEO Michael Nierenberg said the company will offer more products to counter market conditions that are “only going to get worse.”

May 3 -

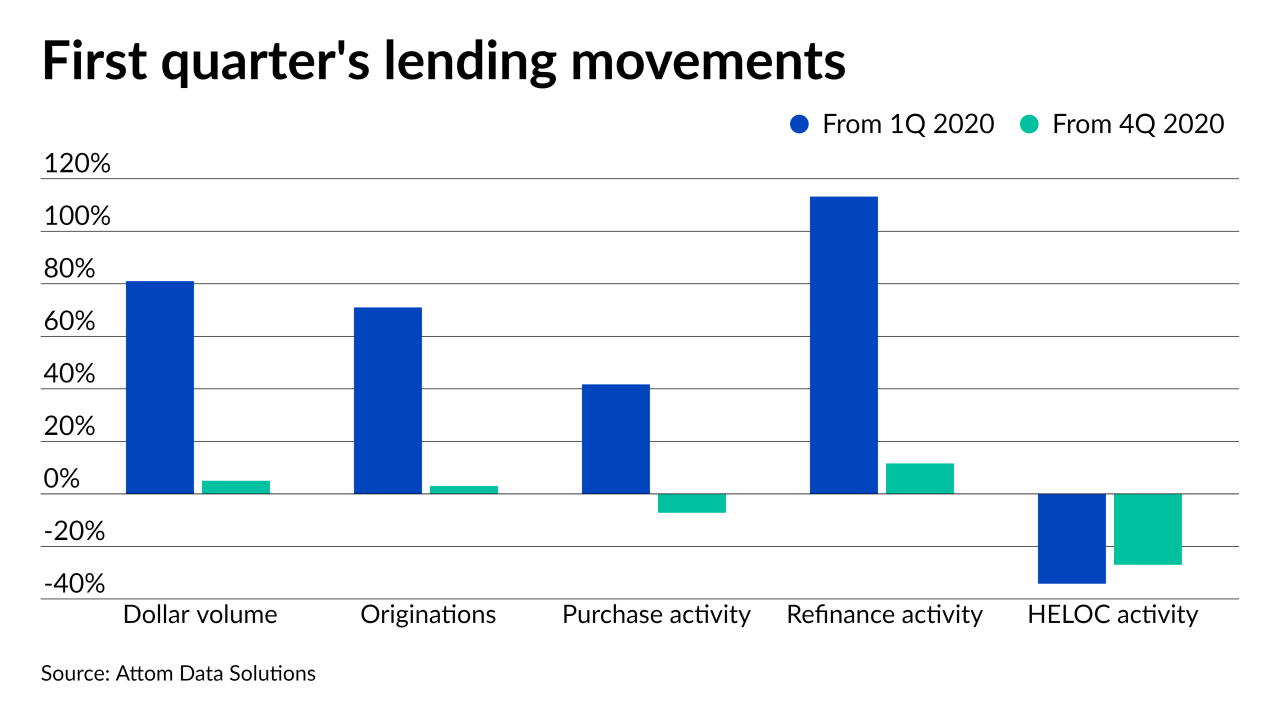

Purchase activity dominated the period and experienced the most growth while refinances cooled off and home equity lines of credit made a comeback, according to Attom Data Solutions.

August 19 -

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

As mortgage rates stayed below 3% in the third quarter, originations spiked to the highest quarterly total since 2007 and highest dollar volume since 2005, according to Attom Data Solutions.

November 20