-

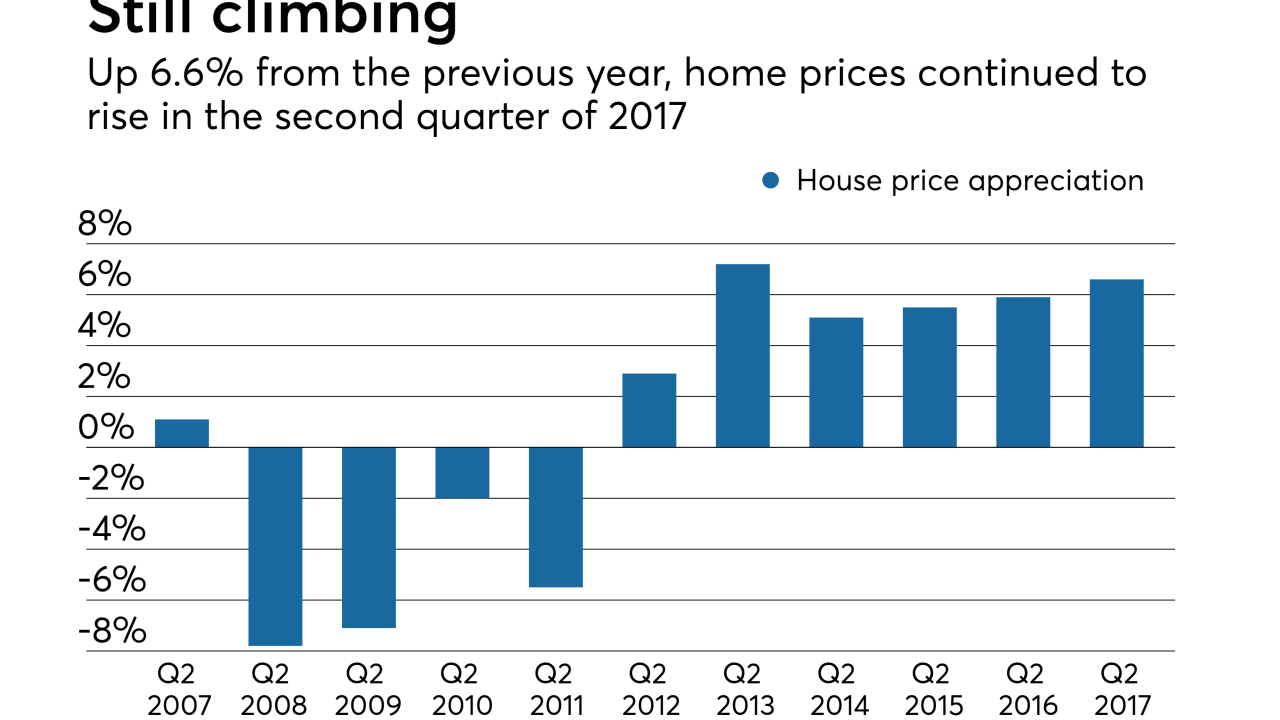

With inventory still low, home prices continued to rise in the second quarter of 2017.

August 23 -

Housing starts faltered in July on an abrupt slowdown in apartment construction and a modest decline in single-family homebuilding that shows the industry will do little to spur the economy.

August 16 -

Sentiment among American homebuilders unexpectedly increased to a three-month high as builders saw greater prospects for industry demand despite elevated material costs and shortages of labor and lots.

August 15 -

Housing affordability dipped as rising home prices offset a quarter-point drop in mortgage interest rates.

August 14 -

Newly constructed home purchase mortgage applications were down by 12% compared with June, but the data indicates housing starts won't drop as much as expected.

August 11 -

Canadian home construction is on pace for its best year since the 2008-2009 recession, with builders showing no sign of being slowed by rising interest rates or fears of a housing correction.

August 9 -

Resolute Forest Products is confident that U.S. import duties on softwood lumber won’t impact its future earnings because the Canadian company expects to be reimbursed for the levies paid.

August 8 -

Old pastures, tired citrus groves and vacant land are quickly transforming into metro Orlando neighborhoods, with about 4,000 new houses underway during the most recent quarter, a new study shows.

August 4 -

After launching construction lending support via Encompass in February, Ellie Mae sees shrinking construction loan closing times and increased volume.

August 3 -

Housing construction in the Twin Cities metro rose nearly 17 percent in July, but most of that gain was apartments.

August 3 -

Home sales — and prices — reached a new high in the Twin Cities area last month, but the dearth of listings continued and may soon put a brake on deals.

July 19 -

Residential construction ended the second quarter on a stronger note as groundbreaking on new homes rebounded in June to the fastest annualized pace in four months.

July 19 -

Sentiment among homebuilders deteriorated to an eight-month low in July on concerns about higher material costs, according to data from the National Association of Home Builders/Wells Fargo.

July 18 -

Loan application activity for the purchase of newly constructed homes decreased 4% in June from the previous month, according to the Mortgage Bankers Association.

July 17 -

A builder promises to offer that rarest of products in Palm Beach County's real estate market — new single-family homes priced at less than $300,000.

July 13 -

As demand for new homes outpaces supply, it is essential for mortgage lenders to pursue strategies that stimulate inventory levels, such as supporting builders with construction financing and offering homebuyers single-close construction-to-permanent loans. (The first in a four-part series on the mortgage industry's response to the housing inventory shortage.)

July 11 -

No one needs to tell Mike and Suzy Johnson that the Columbus, Ohio, housing market is hot.

July 6 -

Want to buy an affordable house in the Sacramento area? Better get in line.

July 3 -

Homebuilders in the Twin Cities on Friday finished their best month in more than a decade.

July 3 -

A proposed ordinance in one California city would require developers planning residential projects costing $100,000 or more to pay an affordable housing impact fee.

June 29