-

There was another surprise Tuesday as Republicans managed to keep a Senate majority following the elections, likely giving the gavel of the Banking Committee to Sen. Mike Crapo, a right-of-center Idaho lawmaker who has proven willing to reach across the political aisle in the past.

November 9 -

Many issues facing President-elect Trump and the 115th Congress will have far-reaching implications for the mortgage industry. Here's a look at five of those most pressing questions awaiting elected officials when they take office in January.

November 9 -

An index to SourceMedia's comprehensive election analysis for professionals in financial services, healthcare and technology, with coverage of more than 50 contests and ballot initiatives

November 9 -

Lenders have the most consumer-facing role in the mortgage industry. By adopting three cultural adjustments, they can introduce more diversity into the workforce and create sustainable businesses and stronger communities.

November 8 New American Funding

New American Funding -

The Justice Department has widened its investigation of Fulton Financials mortgage lending practices to include four new units.

November 7 -

San Francisco has completed the transfer of ownership of its public housing sites from the San Francisco Housing Authority to community-based affordable housing teams, part of a long-term bond-financed initiative begun in 2013.

November 7 -

The Mortgage Bankers Association's Opens Doors Foundation has raised more than $59,000 as a charity partner of the New York City Marathon.

November 4 -

Fannie Mae's new representation and warranty relief offers lenders a long-awaited incentive to use its automated loan validation technology. But is it enough for lenders to make the necessary technology updates and process changes to implement the tools?

November 3 -

If Democrats succeed in winning control of the Senate after next week's election, the gavel of the Senate Banking Committee is likely to fall to Sen. Sherrod Brown, a progressive from Ohio who has called on the biggest banks to hold significantly more capital.

November 2 -

Pennsylvania Treasurer Timothy Reese launched a $100 million initiative that he said would provide a competitive rate of return while supporting affordable housing.

November 1 -

The Federal Reserve has maintained historically low interest rates for too long, causing superficially high prices in housing and other assets. The outcome of the presidential election will likely decide whether the Fed maintains the status quo or embraces risk and raises rates.

October 31 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

The mortgage industry is welcoming the Obama administration's possibly final word on housing finance reform, hoping it will serve as guidepost for the future.

October 28 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28 -

Both Fannie Mae and Freddie Mac failed to achieve their low-income and very low-income single-family home purchase goals for 2015, the Federal Housing Finance Agency annual housing report said.

October 28 -

The U.S. housing market is about 10 times larger than Canada's, but we can learn a few lessons from the country's cautious approach to its housing policy.

October 24 Steel Curtain Capital Group LLC

Steel Curtain Capital Group LLC -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

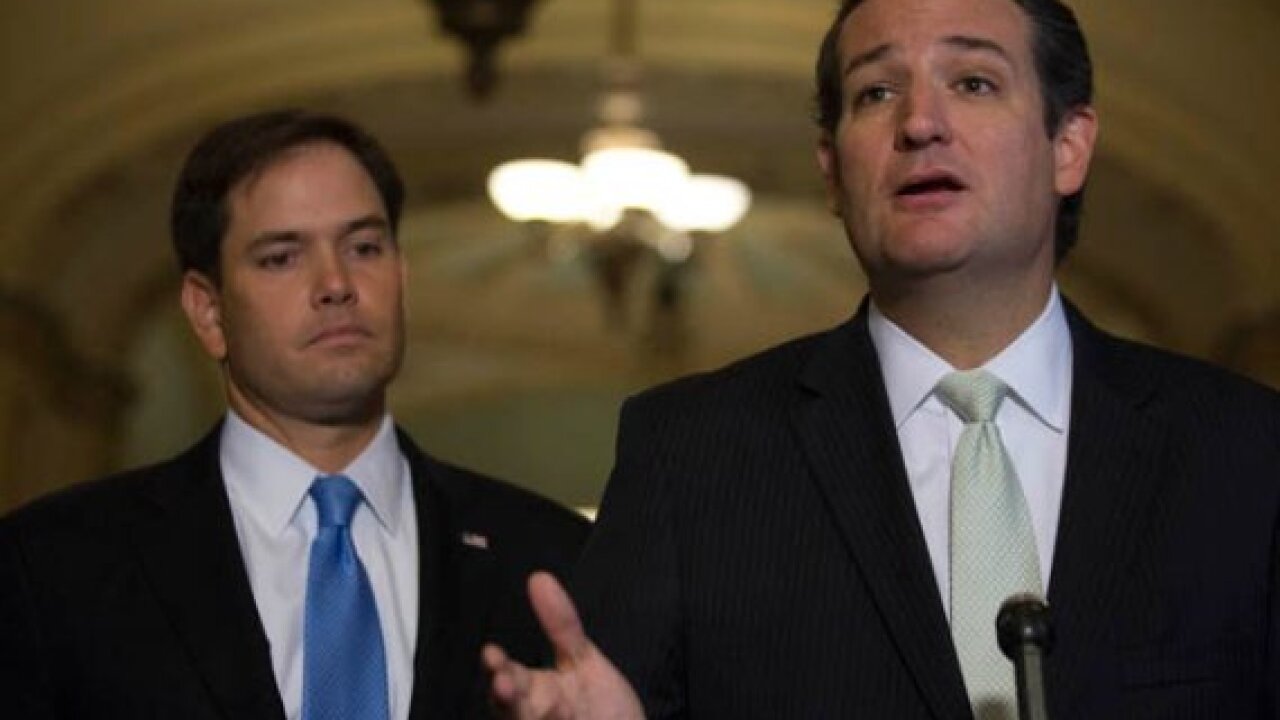

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

From House Speaker Paul Ryan to Financial Services Committee Chairman Jeb Hensarling, these 10 candidates for the House of Representatives attracted the most in campaign donations from the mortgage industry.

October 21 -

Bank of America is expanding a program that provides 3% down payment home loans through a partnership with Freddie Mac and a North Carolina credit union.

October 20 -

In a move designed to help further calm lender fears about mortgage repurchase liability, Fannie Mae is preparing to offer immediate representation and warranty relief to lenders that use its suite of automated quality assurance technology.

October 20