-

The Federal Reserve has maintained historically low interest rates for too long, causing superficially high prices in housing and other assets. The outcome of the presidential election will likely decide whether the Fed maintains the status quo or embraces risk and raises rates.

October 31 Mitsubishi UFJ Securities International

Mitsubishi UFJ Securities International -

The mortgage industry is welcoming the Obama administration's possibly final word on housing finance reform, hoping it will serve as guidepost for the future.

October 28 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28 -

Both Fannie Mae and Freddie Mac failed to achieve their low-income and very low-income single-family home purchase goals for 2015, the Federal Housing Finance Agency annual housing report said.

October 28 -

The U.S. housing market is about 10 times larger than Canada's, but we can learn a few lessons from the country's cautious approach to its housing policy.

October 24 Steel Curtain Capital Group LLC

Steel Curtain Capital Group LLC -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

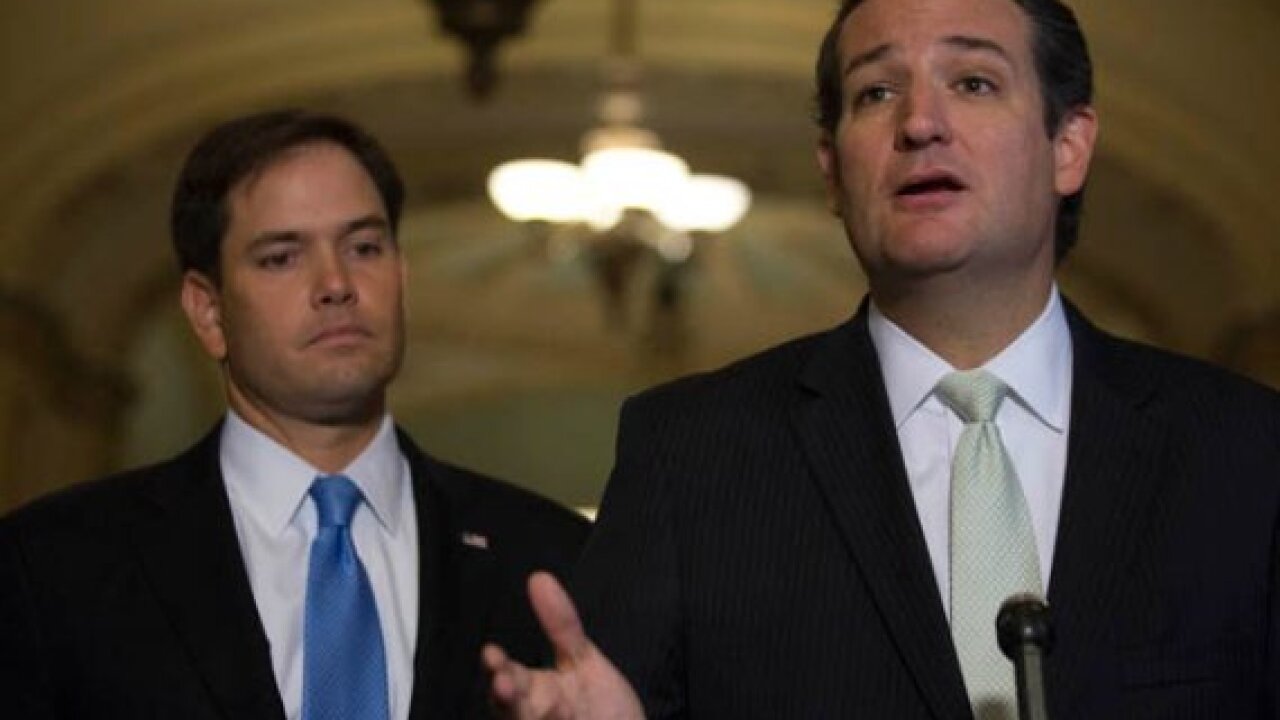

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

From House Speaker Paul Ryan to Financial Services Committee Chairman Jeb Hensarling, these 10 candidates for the House of Representatives attracted the most in campaign donations from the mortgage industry.

October 21 -

Bank of America is expanding a program that provides 3% down payment home loans through a partnership with Freddie Mac and a North Carolina credit union.

October 20 -

In a move designed to help further calm lender fears about mortgage repurchase liability, Fannie Mae is preparing to offer immediate representation and warranty relief to lenders that use its suite of automated quality assurance technology.

October 20 -

To successfully respond to the most pressing challenges facing the mortgage industry right now, lenders and servicers must navigate issues of competition, governance, affordability and margins.

October 18 -

Independent mortgage bankers are concerned that if Congress votes to privatize the Common Securitization Platform, it could give large banks too much control over the real estate finance market.

October 18 -

Mortgage industry groups are frustrated by the lack of progress on real estate finance reform, and that spurred one group the National Association of Home Builders to endorse Congressional candidates for the first time.

October 18 -

New American Funding and Alterra Home Loans have selected Radian Group as the preferred private mortgage insurance providers for their Your Path loan program.

October 17 -

Regions Financial in Birmingham, Ala., has bought a business that manages low-income housing tax credits.

October 17 -

The housing industry has staunchly defended the mortgage interest tax deduction as an essential tool for promoting homeownership. But attitudes are softening, as data show the low- and moderate-income homebuyers who need the subsidy the most are getting the least benefit.

October 7 -

M&T Bank is offering mortgage subsidies through a new program to qualified consumers in New Jersey and nearby states.

October 5 -

The Federal Reserve's mishandling of monetary policy in the 1970s opened the door to questionable products for unqualified borrowers, setting the stage for the housing crisis 30 years later.

October 3

-

Hillary Clinton and Donald Trump should face more questions about housing policy, especially the lack of affordable housing to own or to rent nationwide, said Fannie Mae Chief Tim Mayopoulos.

September 30 -

An FHA lender was cited for violating Department of Housing and Urban Development rules by allowing repayment provisions in second mortgages.

September 30