The year 2016 has brought a strong degree of uncertainty and turmoil to the mortgage industry. Issues spurred by regulation led to

As the industry descends on Boston for its annual convention, questions bubble to the surface regarding the challenges of the past year, and those that lie ahead. In asking these questions, trends begin to emerge that shape the hurdles the industry has yet to overcome.

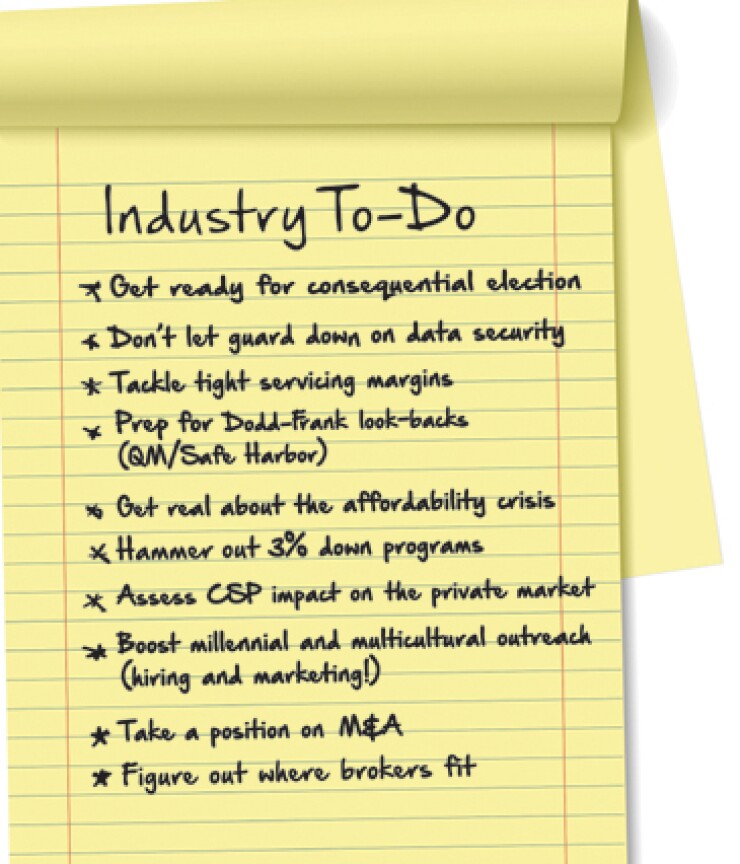

There are questions of competition, many of which are defined by the changing face of the industry and the consumers it serves. As lenders seek to attract more millennial, African-American, Hispanic and Asian-American borrowers, how do they adapt their hiring and marketing practices to underscore these efforts? And with their numbers diminished, what does the future hold for mortgage brokers?

Other concerns fall within the realm of governance.

Another big question mark facing the industry is affordability. The homeownership rate has yet to rebound from the financial crisis, and steadily increasing home prices hardly help matters. So how can lenders take housing data and use it to guide their business strategy? And do rising prices mean that low-down-payment programs are here to stay?

Still, other obstacles remain that mortgage companies need to address. Servicers face pressures as profit margins remain tight. Those in the secondary market must address the bottom-line effects that the implementation of the Common Securitization Platform will have.

And the entire industry is dealing with the burgeoning issue of data security, particularly as regulators require lenders to intake more and more of their customers' personal information.

With 2017 nearing, the answers to these and other questions could provide an outline for the mortgage industry's response to the biggest issues facing it today.

Explore the National Mortgage News MBA Annual Special: