Industry News

Industry News

-

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Walker & Dunlop Affordable Bridge Capital will originate flexible, short-term first-mortgage bridge loans for properties designated for government programs.

January 7 -

A shared client base helped lead to introduction of the new integration, with implementation scheduled to come later this year, the companies said.

January 7 -

The deal still faces a lawsuit from activist investor HoldCo Asset Management, which contends that Comerica didn't properly shop itself before agreeing to sell to Fifth Third.

January 6 -

First Federal Bank stretched its retail mortgage operations into Louisiana and Mississippi, following its expansion into the Midwest and Arizona in 2023.

January 5 -

Brinton joins the mortgage industry trade group after previously holding accounting leadership positions at a range of business organizations and nonprofits.

January 2 -

The merger of equals, which received a chilly reception from investors when it was announced in July, closed faster than analysts had expected.

January 2 -

Kind Lending, Class Valuation, also add CFOs, Mortgage Capital Trading boosts artificial intelligence efforts and Acra welcomes an industry veteran.

January 2 -

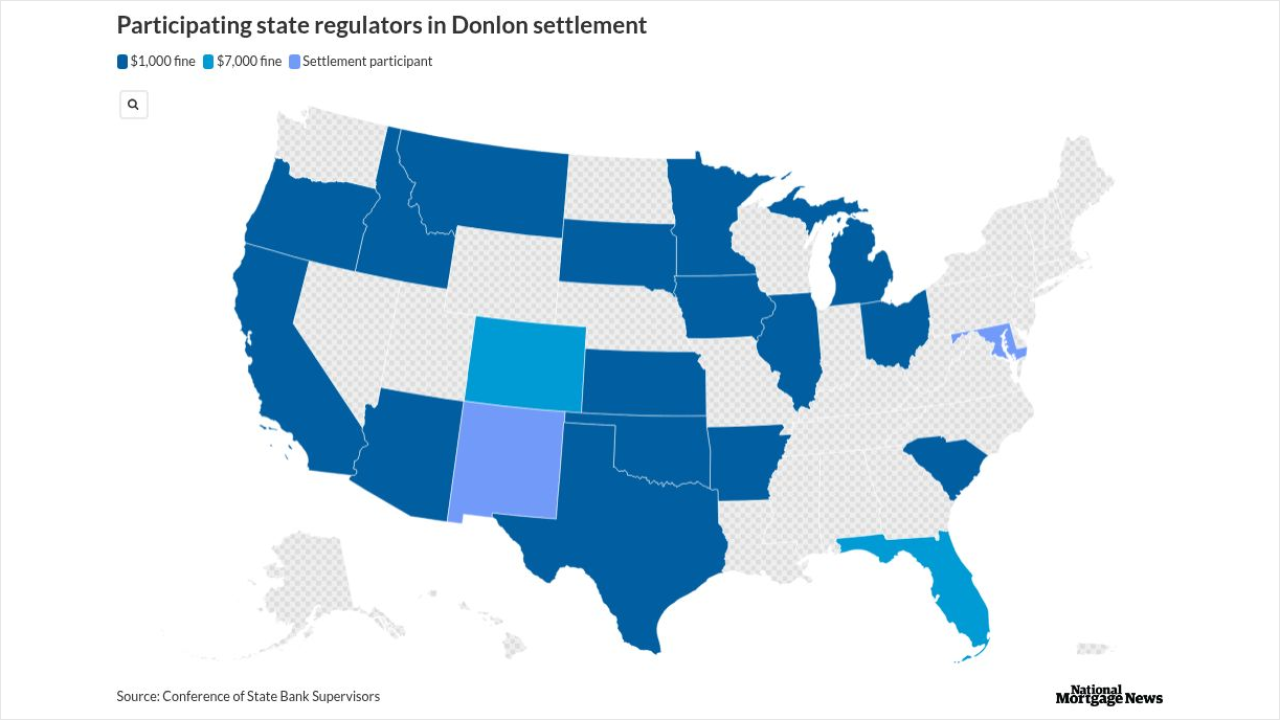

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

AI's capabilities far exceed how the technology is being used in mortgage, but an all-in strategy will quickly put companies ahead of the pack, leaders say.

December 31 -

National home prices grew monthly and annually in October, but considerably less than last year, according to S&P Dow Jones Indices.

December 30 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

The latest announcement comes two months after an initial round of staff reductions following approval of Rocket's acquisition of the company.

December 29 -

Here are the most-read stories from National Mortgage News over the past year.

December 29 -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Home prices rose 0.2% nationally month-over-month in November, but there were an estimated 37.2% more sellers than buyers in the market, Redfin said.

December 26 -

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

December 24 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

The national mortgage delinquency rate jumped to 3.85% in November, up 15% month over month and 2.79% year over year, according to ICE Mortgage Technology.

December 23