Industry News

Industry News

-

Fortress has been one of the most active home equity investment firms in November, investing $1 billion in Cornerstone.

December 1 -

Saul Van Beurden, Wells Fargo's consumer banking CEO and former head of technology, will lead the way on harnessing artificial intelligence.

November 25 -

Lancaster, Pennsylvania-based Fulton Financial said Monday it will pay $243 million in stock for Blue Foundry Bancorp, which has lost more than $20 million since converting to a public company in 2021.

November 24 -

Luxury home prices rose 5.5% year over year in October to a median $1.28 million, far outgaining the 1.8% increase of nonluxury homes.

November 24 -

Renters can now enroll in CreditClimb through Zillow to have their on-time rent payments reported to the three major credit bureaus.

November 21 -

A combination of factors, including the rise of retail investing and sound assets, propelled ETF formation, with at least four issuances over the past year.

November 19 -

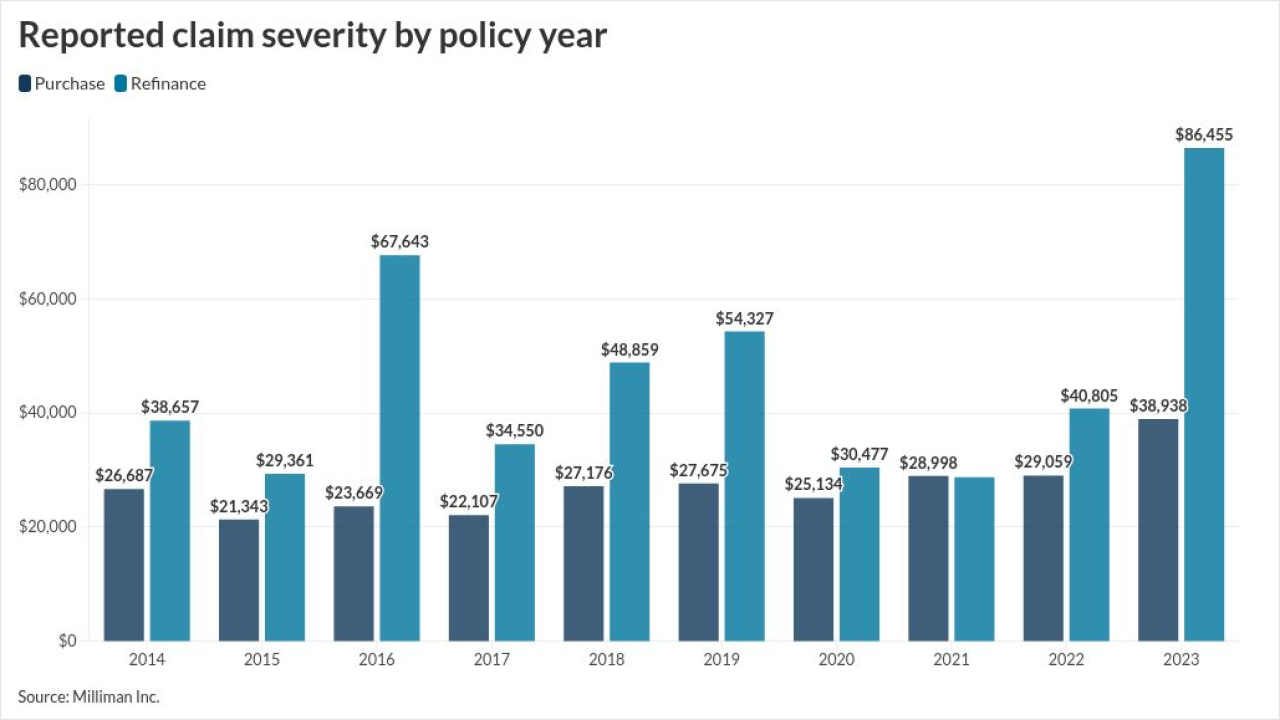

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

An activist investor is seeking more information on how, and when, the largest bank deal of 2025 came together.

November 18 -

AIME's CEO takes an additional AI leadership role, ALTA elects new president and Revolution, Tidalwave, Visio welcome chief operating officers.

November 17 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

Recent merger activity also includes the purchase of an Alabama title company by technology firm Propy, as experts see ongoing consolidation through 2026.

November 11 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

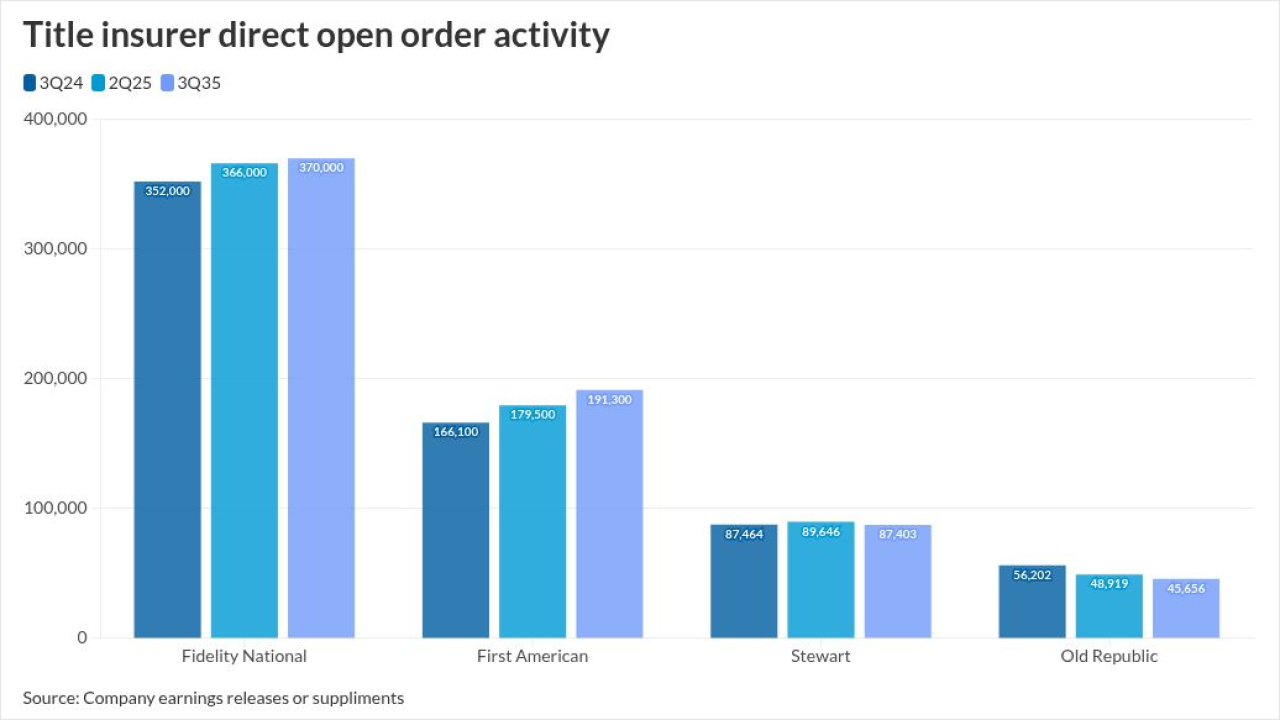

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

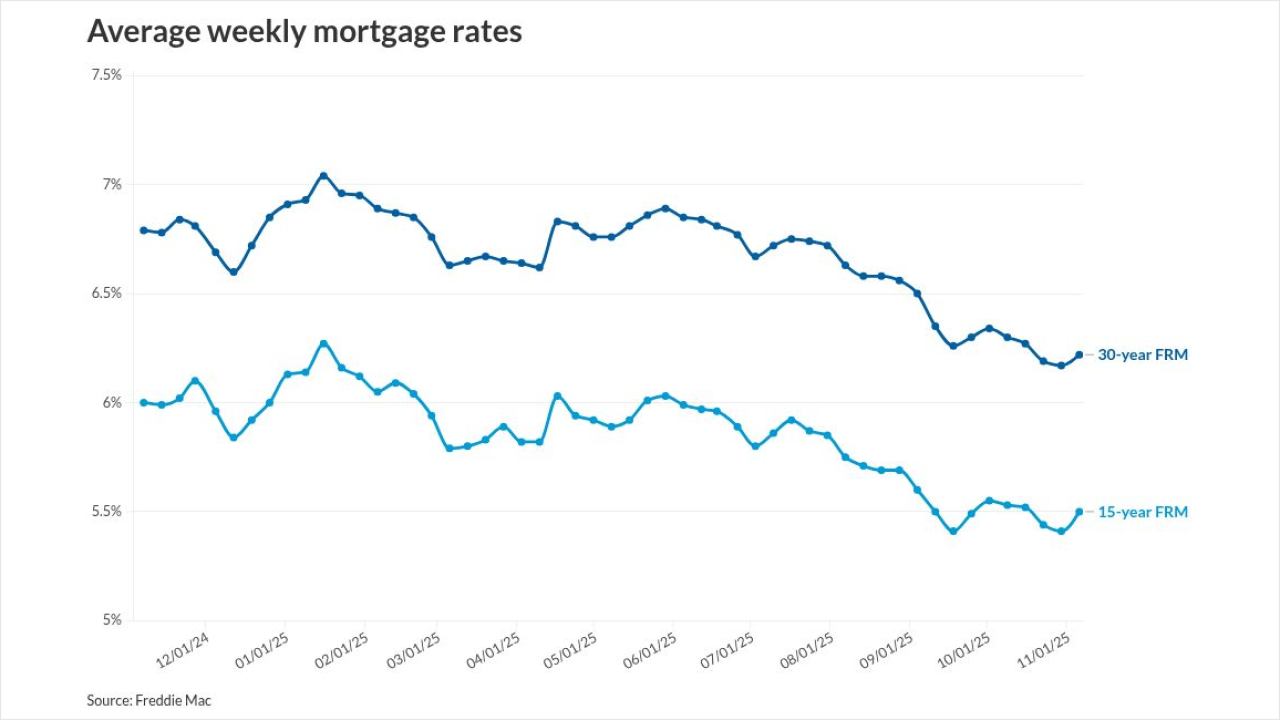

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

The latest sale consists of close to 1,200 HECMs secured by vacant residential units found in 46 states, according to data provided by the government agency.

November 5