Industry News

Industry News

-

Recent merger activity also includes the purchase of an Alabama title company by technology firm Propy, as experts see ongoing consolidation through 2026.

November 11 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

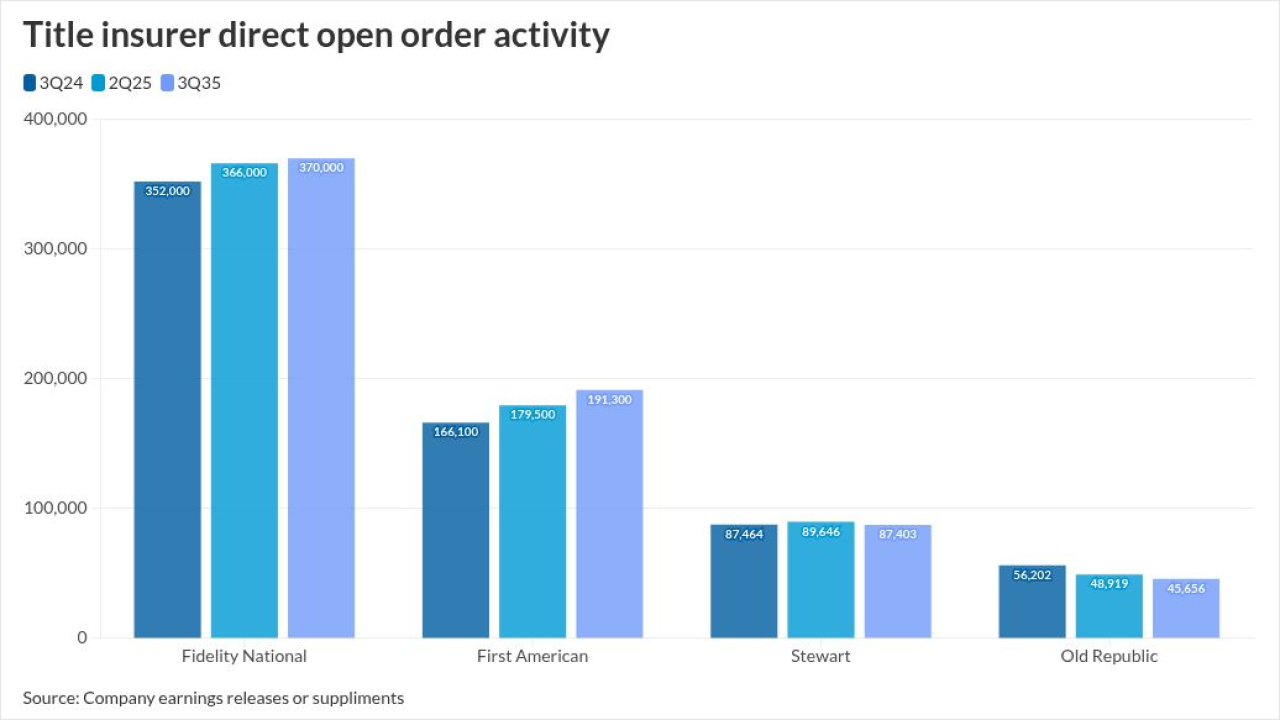

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

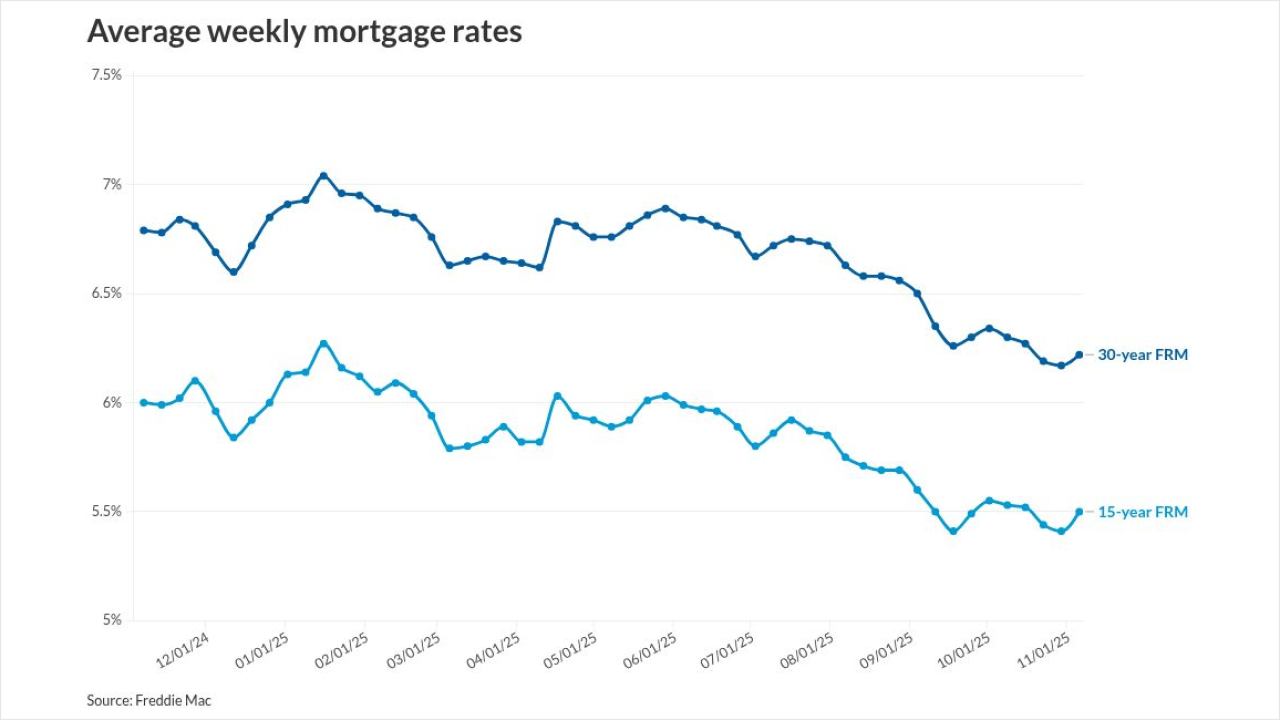

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

The latest sale consists of close to 1,200 HECMs secured by vacant residential units found in 46 states, according to data provided by the government agency.

November 5 -

The latest case comes after at least three other zombie lawsuits in the past year, with the owner of the loan in question claiming $173,000 in past-due interest.

November 4 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3 -

The acquisition complements existing lending channels at Carrington and also adds Reliance's full servicing portfolio to its platform, the company said.

October 31 -

Instances of miscommunication between servicers and borrowers have declined, but some warn that CFPB stepping back from enforcement could create oversight gaps.

October 30 -

Until August, Bell was the executive director for loan guaranty service at the Department of Veterans Affairs, where he was credited with growing the program.

October 30 -

Company officials credited recent mortgage rate pullbacks, a nonagency servicing partnership and Improvements in technology behind recent momentum.

October 30 -

The 30-year rate dropped just 0.2 percentage points, as Federal Reserve Chair Jerome Powell's recent comments caused Treasury yields to rise.

October 30 -

The former AIME boss and current Rocket Pro leader claims the megalender has threatened to pull the trade group's funding should it pay her a $240,000 bonus.

October 30 -

The deal will help drive development at Mortgage Cadence, which had been a unit of Accenture, and enable new integrations and automation, according to leaders.

October 29 -

A regulation requiring nonbanks to report violations of local and state orders to federal offices was redundant and offered no benefit, mortgage leaders said.

October 29