-

The company, on the cusp of going public via a merger, recently added Wells Fargo to its client roster.

May 26 -

Garg discusses how Better plans to maintain growth in a volatile market in an exclusive interview.

May 25 -

The transaction goes a long way toward the company’s goal to amass MSRs with a total unpaid principal balance of up to $150 billion.

May 25 -

The company provides a secondary market outlet for its retail and wholesale lending corporate sibling as well as for small balance commercial loans.

May 21 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

The deal was constructed under Angel Oak’s social-bond framework, in which the firm intends to use the proceeds to help finance residential loans for underserved borrowers.

May 17 -

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Stock prices for the four stand-alone MI companies have declined significantly since the start of May.

May 13 -

After massive fundraises and IPO rumors swirled, the originator and servicer announced it will merge with Aurora Acquisition Corp. and go public in the fourth quarter of 2021.

May 11 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10 -

The real estate investment trust has been buying residential business-purpose loans from the company since 2017.

May 6 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

United Wholesale Mortgage set off a brawl in the press when it forbade brokers from doing business with Rocket and Fairway. As a small group of brokers pursue legal action over the ultimatum, experts weigh in on whether the spat is benefiting the wholesale channel.

May 5 -

After the spinoff and a concurrent private sale to Bayview Asset Management, Genworth Financial will still own 80% of the rebranded Enact.

May 4 -

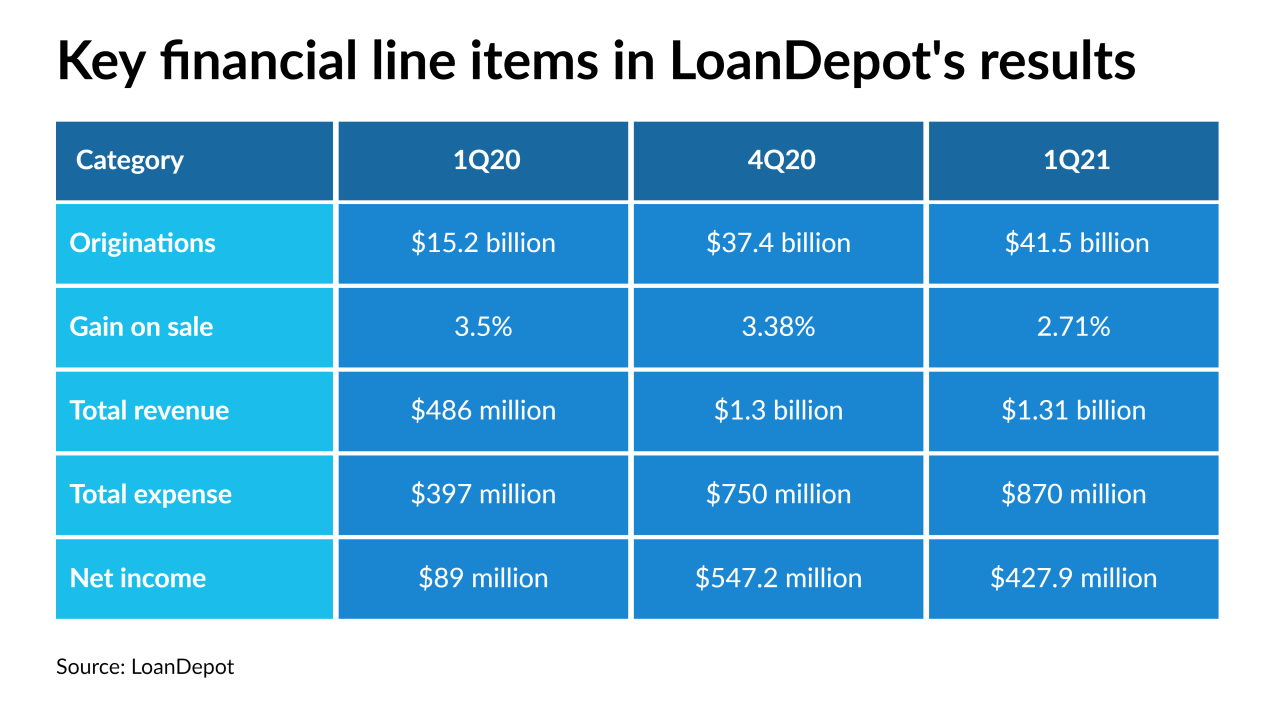

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

The company says its first quarter net income nearly doubled from its showing in Q4 2020, due in part to cost-cutting and servicing income. It also revealed more information about unauthorized payment drafts by its vendor.

April 29 -

Depressed Treasury yields have kept mortgage rates under 3% recently, but positive economic news could indicate larger increases will follow this week’s uptick.

April 29 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28