-

The credit watch involves single-borrower securitizations of commercial mortgages for high-priced resorts in Florida and Hawaii.

March 19 -

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

March 17 -

The Federal Reserve's most recent economic-stimulus effort could reduce disparities between a rally in Treasurys and a relative slump in mortgage-backed securities that contributed to higher average home-lending rates last week.

March 16 -

The Affordable Housing Credit Improvement Act last week achieved a milestone by garnering bipartisan cosponsorship by more than half of the 435 members of the House.

March 16 -

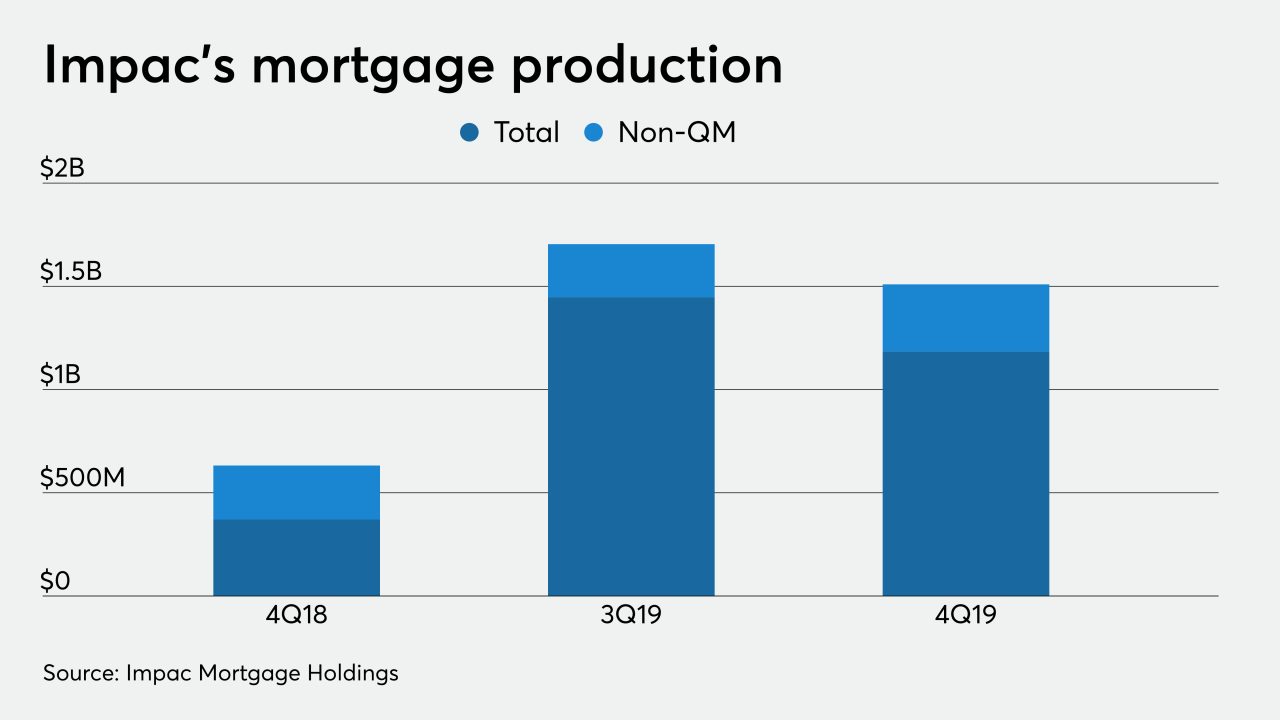

Impac Mortgage Holdings decided a year ago to emphasize its non-qualified mortgage lending operations and placed the company in position to succeed when the housing market returns to normal.

March 13 -

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

March 12 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

The 10-year Treasury yield fell below 0.5% and the 30-year yield dropped under 0.9%, taking the whole U.S. yield curve below 1% for the first time in history.

March 9 -

Altisource Portfolio Solutions lost nearly the same amount of money as it did for the whole year while it continued the business transition started in 2018.

March 6 -

An effort by the Federal Housing Finance Agency to examine membership rules for the Federal Home Loan Bank System is reigniting an argument over whether to allow more nonbanks in or impose tougher barriers.

March 1 -

Ginnie Mae in 2020 is going to seriously examine what it would take to respond to a longstanding, priority request of its issuers.

February 27 -

CoreLogic's fourth-quarter earnings reflect the success of the transformation to an appraisal management company business model accelerated in the prior-year period.

February 27 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.

February 25 -

The agency plans to conduct a review of how it regulates the 11 Federal Home Loan banks amid concerns that some companies are inappropriately seeking a back door into the Home Loan Bank System.

February 24 -

The Trump administration proposes cutting personnel and other budgetary items at the bureau, while the agency’s director — who controls the purse strings and was hand-picked by the administration — aims to boost spending and hire more employees.

February 20 -

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

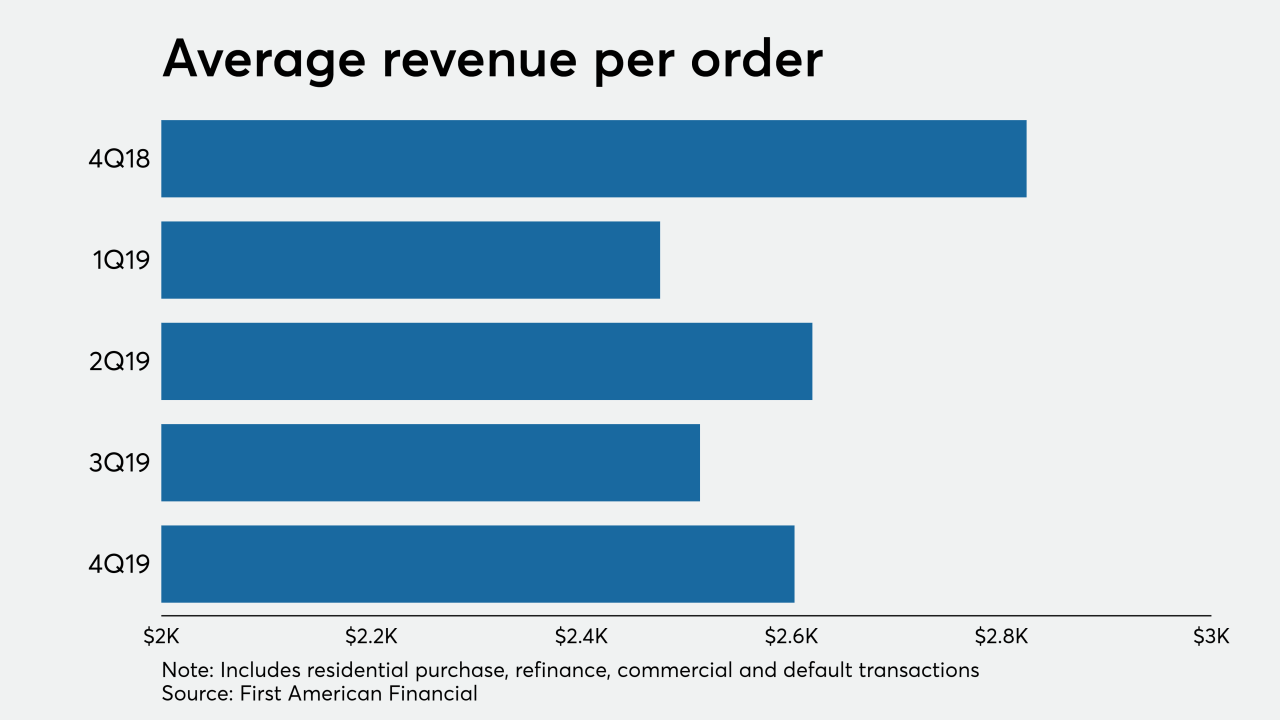

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12