-

From Big Sky Country to the peaks of Colorado, here's a look at the metro areas offering owners the most stability and appreciation in home prices over the past 25 years.

July 25 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

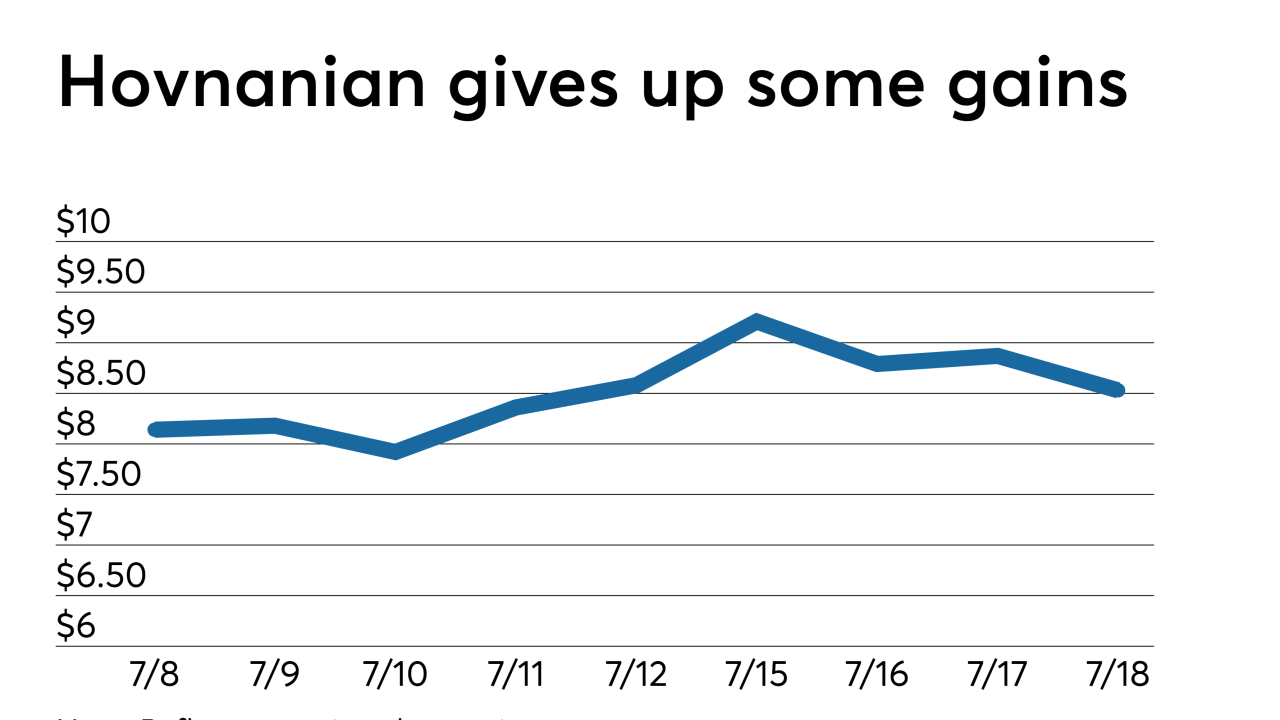

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11 -

Builder MDC Holdings' preliminary numbers for net new home orders registered their highest quarterly increase in years, adding to signs of growing demand for housing.

July 8 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Mortgage rates ticked up slightly this week with opposing trends in the stock and bond markets fighting for dominance, according to Freddie Mac.

July 3 -

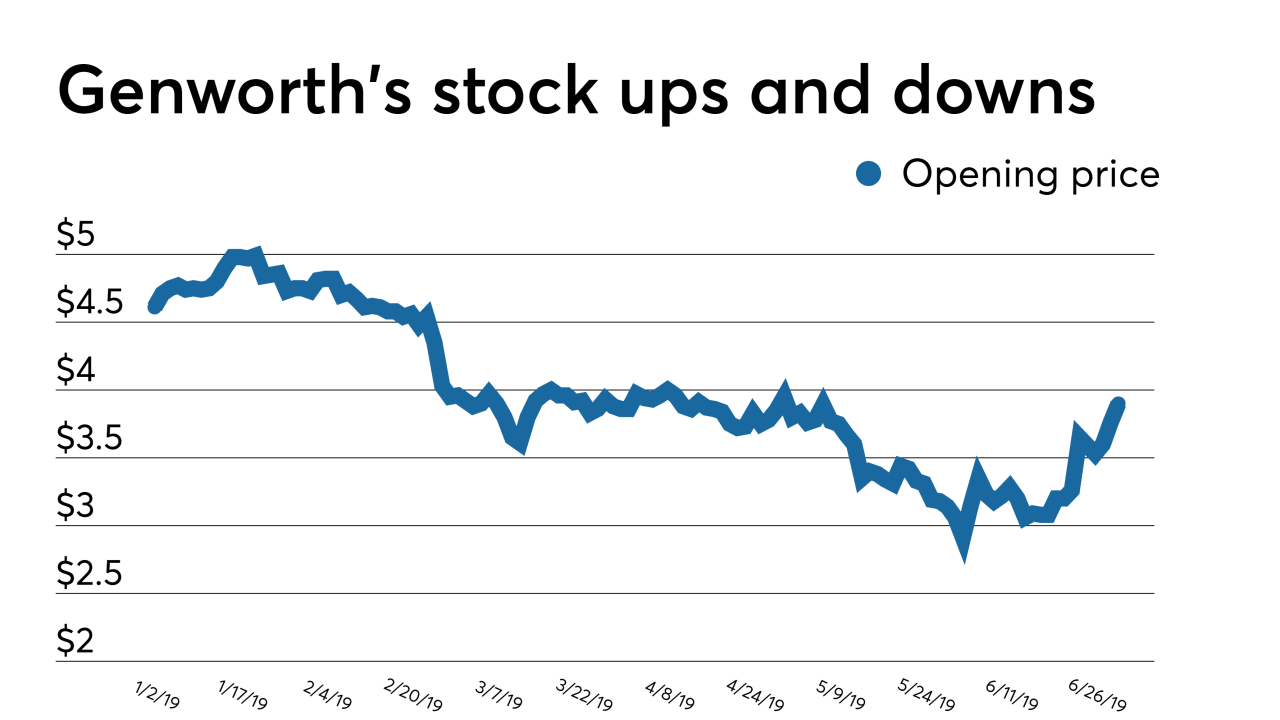

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

On sunny days, the Grand Venezia at Baywatch condominiums in Clearwater, Fla., offer a view of Old Tampa Bay that calms the mind.

June 28 -

Nearly $300 million of municipal debt sold 12 years ago to expand Central New York's Destiny USA shopping mall were dropped to junk-level Ba2 by Moody's Investors Service.

June 17 -

OBX 2019-INV2 is a private-label RMBS pool of 1,087 of agency-eligible investor-property loans.

June 12 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

The $10 million home that just went on the market in Bennett Valley was built with tech money and there's a good chance tech money will buy it.

June 10 -

A long list of "preparatory steps" means that any potential Fannie Mae and Freddie Mac initial public offerings are at least three to four years away, according to Raymond James.

June 6 -

About half of the multifamily housing units built nationally that use the federal 4% Low Income Housing Tax Credit are financed with tax-exempt PABs.

June 5 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

First American Financial Corp. tumbled the most in nearly eight years amid concerns that a security flaw at the title insurer may have allowed unauthorized access to more than 885 million records related to mortgage deals going back to 2003.

May 28