-

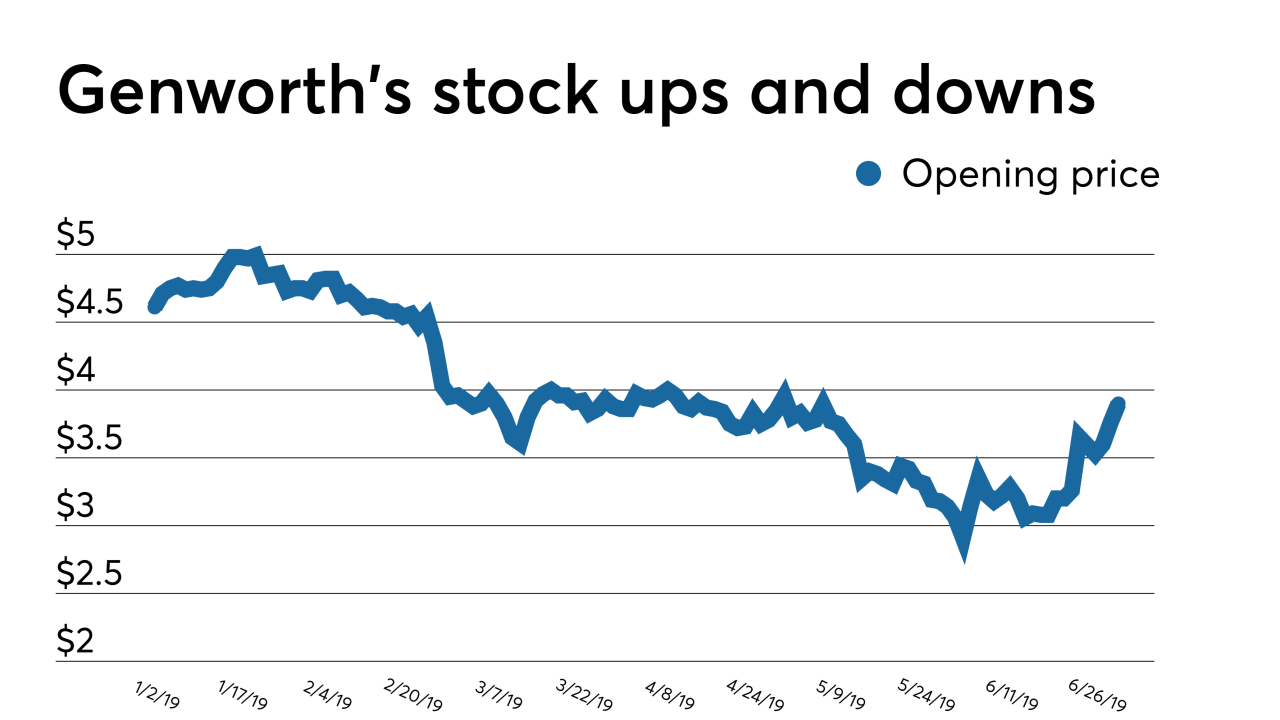

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

On sunny days, the Grand Venezia at Baywatch condominiums in Clearwater, Fla., offer a view of Old Tampa Bay that calms the mind.

June 28 -

Nearly $300 million of municipal debt sold 12 years ago to expand Central New York's Destiny USA shopping mall were dropped to junk-level Ba2 by Moody's Investors Service.

June 17 -

OBX 2019-INV2 is a private-label RMBS pool of 1,087 of agency-eligible investor-property loans.

June 12 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

The $10 million home that just went on the market in Bennett Valley was built with tech money and there's a good chance tech money will buy it.

June 10 -

A long list of "preparatory steps" means that any potential Fannie Mae and Freddie Mac initial public offerings are at least three to four years away, according to Raymond James.

June 6 -

About half of the multifamily housing units built nationally that use the federal 4% Low Income Housing Tax Credit are financed with tax-exempt PABs.

June 5 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

First American Financial Corp. tumbled the most in nearly eight years amid concerns that a security flaw at the title insurer may have allowed unauthorized access to more than 885 million records related to mortgage deals going back to 2003.

May 28 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22 -

PIMCO Mortgage Income Trust tabled plans to launch an initial public offering this week following a steep stock market decline Monday.

May 15 -

Zillow's mortgage division experienced better customer demand in the first quarter than it expected, but its revenue was outweighed by expenses that led to a pretax loss of $9.6 million.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Moody's Investors Service downgraded tax-exempt bonds issued for a Syracuse, New York, shopping mall expansion to the last rung above junk.

May 10 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Intercontinental Exchange's proposed acquisition of Simplifile will enhance its MERS unit's growing presence in handling electronic notes.

May 2 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

Fannie Mae is considering sharing more risk with the private sector to reduce future strain on its earnings from the implementation of the Current Expected Credit Loss accounting standard next year.

May 1