-

First-quarter year-over-year results declined at a pair of mortgage bankers active in the acquisitions market as well as at the provider of the most used servicing technology.

May 1 -

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

Title underwriters and other vendors reported year-over-year declines in business activity (although some reported improved profitability), but lower interest rates made them optimistic about their prospects going forward.

April 26 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

April 23 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

Historically, rising interest rates have enabled banks to earn more, but this time around in the banking industry, like much else, things are a little different.

April 23 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Homebuilder stocks are slipping after sales of previously owned homes fell more than forecast in March and KBW cut its rating on D.R. Horton shares.

April 23 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

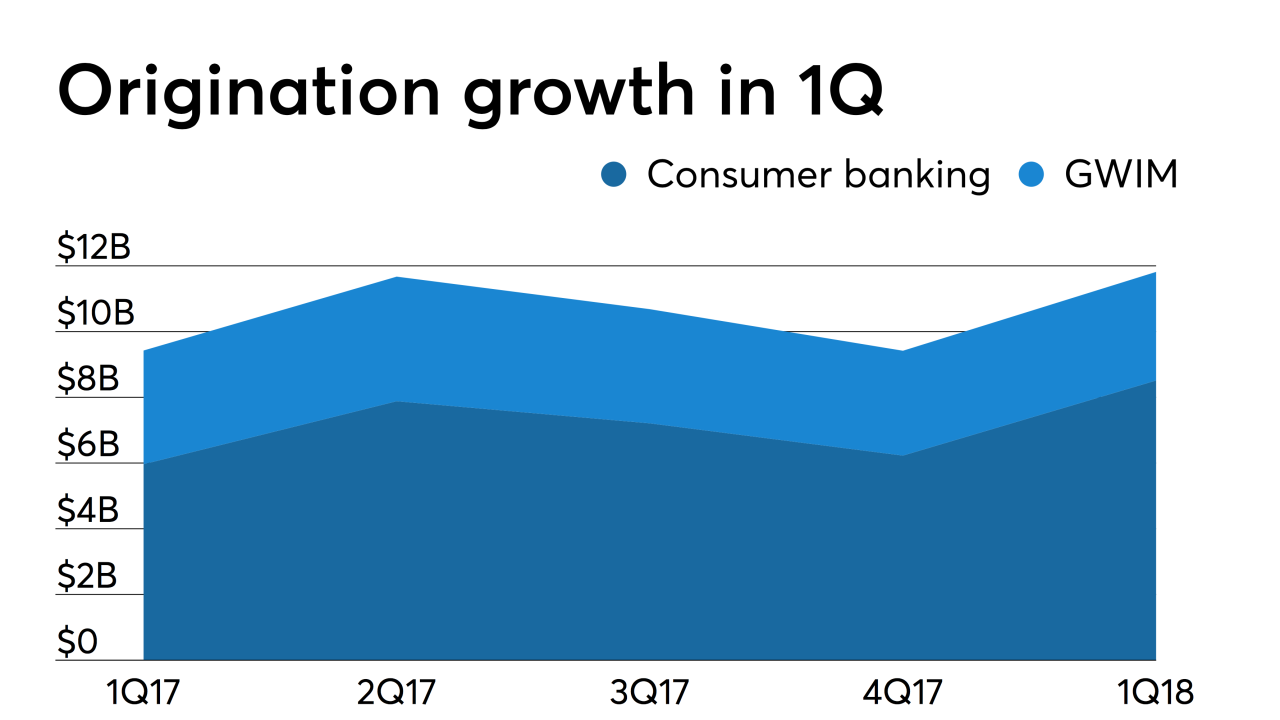

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

A trio of Los Angeles-area real estate developers were accused by the federal government of taking $1.3 billion of investor funds that was supposed to be used for hard money loans for their own use.

April 15 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase could be an early sign of an improving industry.

April 12 -

The residential mortgages being reinsured are less risky, by several measures, than its previous deal; none of the borrowers have ever missed a payment.

April 11 -

B. Riley FBR initiated equity coverage on Fannie Mae as the chances for privatization of the government-sponsored enterprises improved in a housing finance reform package.

April 5 -

The stream of newly minted, IPO payouts from Lyft — and soon, other tech unicorns — may have Bay Area home sellers dreaming of bigger payouts and buyers wary of even heftier mortgages.

April 5 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

The fate of U.S. office markets is intertwined with that of the biggest technology companies, Starwood Capital Group Chairman Barry Sternlicht said.

April 3 -

The Structured Finance Industry Group wants Treasury and the IRS to issue a notice that a change from Libor to an alternative index would not be treated as a taxable exchange.

March 31 -

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27