-

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

A reduction in Ditech Holdings' quarterly net loss fell short of what the company needed to avoid the possibility of another Chapter 11 filing.

November 15 -

D.R. Horton Inc. fell the most in more than three years after executives at the builder said the market for homes is getting "choppy" and that the pace of order growth may slow next quarter.

November 8 -

Mr. Cooper Group — the new name following the combination of Nationstar Mortgage and WMIH Corp. — posted a $54 million third-quarter profit and announced plans to buy Pacific Union Financial, as well as make other strategic acquisitions.

November 8 -

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

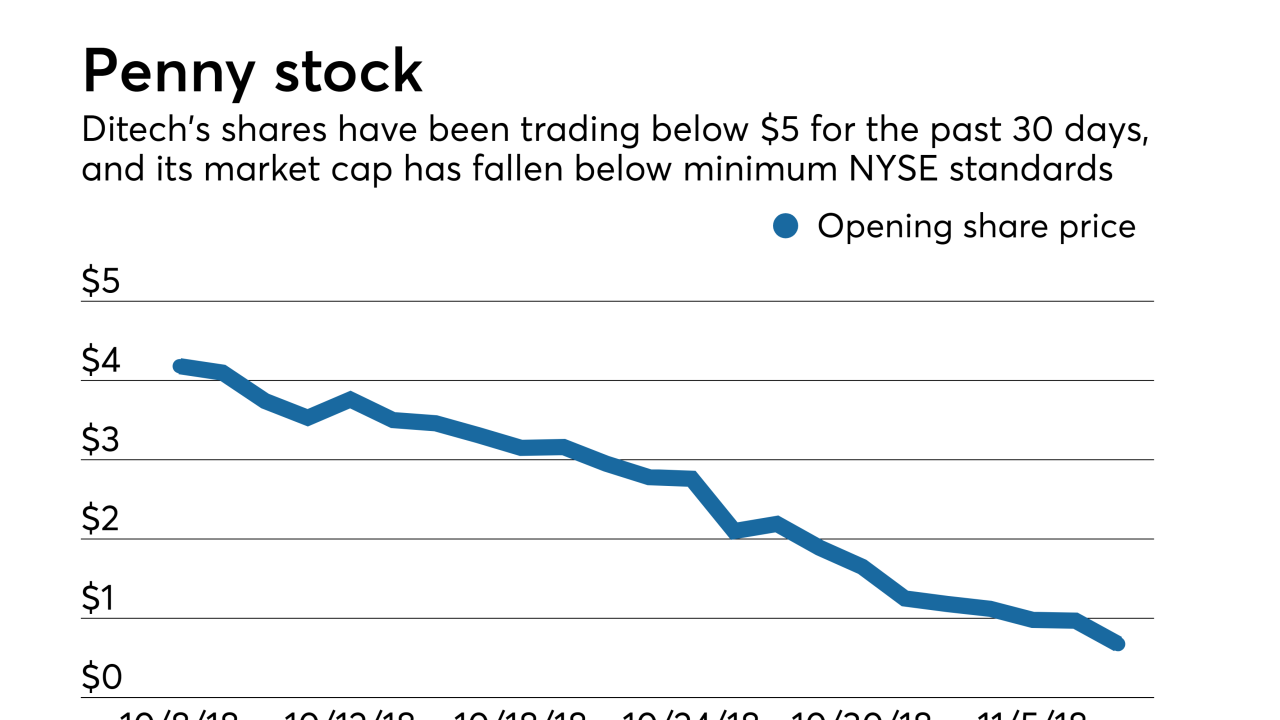

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Austin's record-breaking $250 million affordable housing bond appeared to be on its way to approval late Tuesday.

November 7 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Laurel Davis, VP, credit risk transfer at Fannie Mae, explains why the switch to a REMIC structure for CAS is important, and why it took so long.

November 2 -

The company’s first transaction, Eagle Re 2018-1, transfers a portion of the credit risk on approximately $36.3 billion of mortgages, according to Morningstar Credit Ratings.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

New Residential Investment Corp. expects to raise $433 million from a follow-on offering of 25 million shares of its common stock it priced on Nov 1.

November 1 -

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

Earnings at four of the private mortgage insurers increased significantly over last year's third quarter even as total mortgage origination volume shrunk during the same time frame.

October 31 -

Lennar Corp. is selling a portion of its Rialto business to Stone Point Capital for $340 million, adding to Stone Point's holdings in the real estate and financial industries.

October 30 -

Black Knight's third-quarter net earnings were slightly below the same period last year, although total revenue increased by 7% compared with one year prior.

October 30 -

The structure reduces counterparty risk in the GSE's benchmark Connecticut Avenue Securities program; it also expands the investor base.

October 30 -

Under the Federal Housing Finance Agency's plan, small Home Loan banks would face a new housing benchmark and a volume threshold for meeting the goals would be eliminated.

October 29 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25 -

All four national title insurance underwriters saw an increase in third-quarter net earnings compared with one year prior even as new orders declined because mortgage origination volume fell this year.

October 25