-

Arch Capital Group's mortgage insurance subsidiary slipped to No. 2 in market share just five quarters after completing the acquisition of former No. 1 United Guaranty Corp.

May 2 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

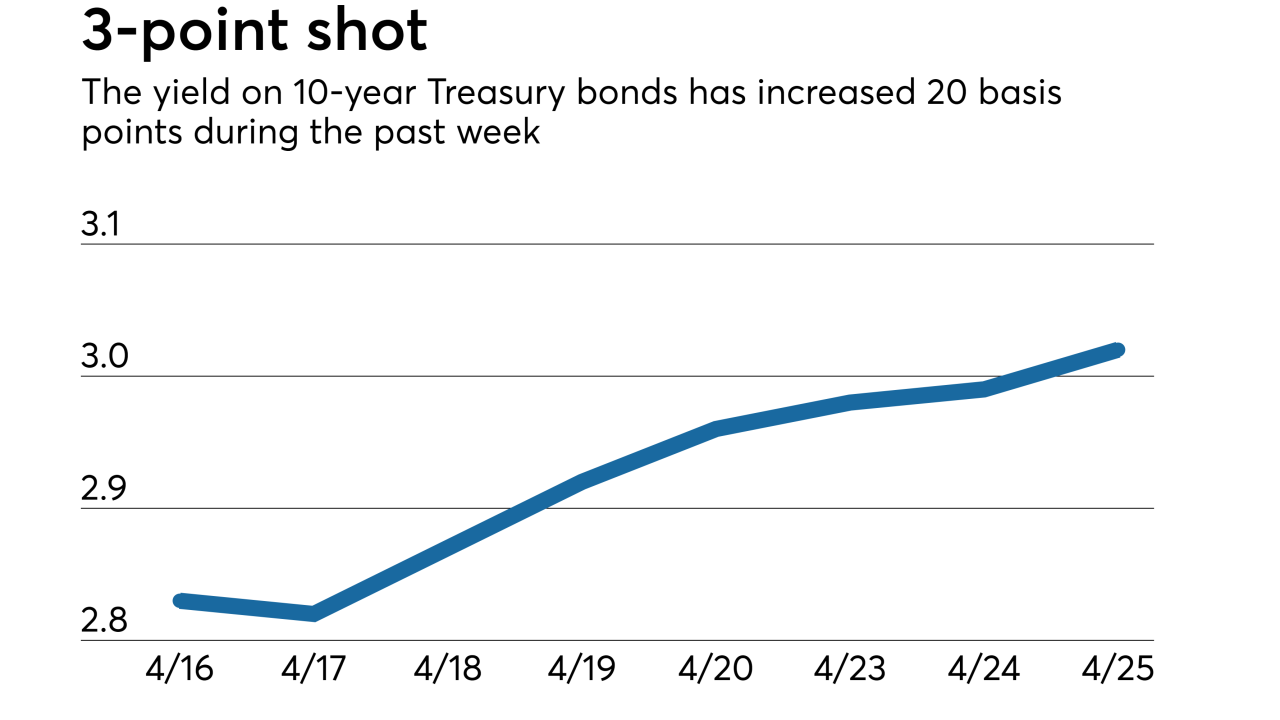

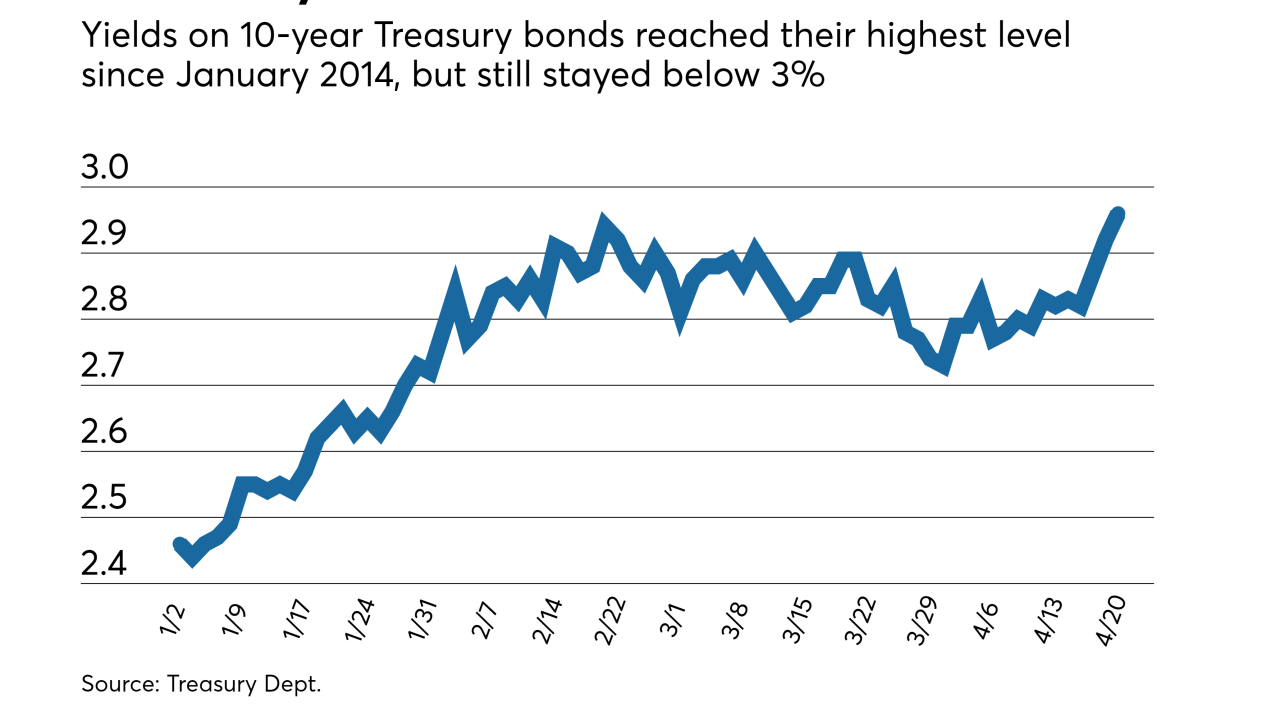

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

Yields on the 10-year Treasury hit their highest level since the start of 2014 and got very close to cracking the 3% mark, signaling a potential spike in mortgage rates.

April 20 -

MGIC Investment Corp.'s first-quarter net income beat analysts' estimates due to favorable loss development and that should be seen with the other private mortgage insurers.

April 18 -

Ditech Holding Corp. lost $426.9 million in 2017, with almost half of that recorded during the fourth quarter, when the company filed for bankruptcy.

April 17 -

One measure of how much things have changed in the last decade at Bank of America: The firm has stopped reporting fees from its mortgage business.

April 16 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase were weaker than Keefe, Bruyette & Woods forecast due to lower-than-expected gain-on-sale margins.

April 13 -

Zillow Group Inc. plans to start buying houses directly from sellers to test its ability to make money by flipping real estate.

April 13 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10 -

A bill to allow captive insurance companies to be reinstated as members of the Federal Home Loan Bank System appears to be dividing the FHLB community.

March 21 -

Issuance of Ginnie Mae securities backed by reverse mortgages rose above $1 billion for the second time in two years, according to the government agency's latest monthly report.

March 20 -

Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

March 19 -

Nonbanks are originating more commercial mortgages on fixer-uppers in response to a sharp drop in the cost of funding in the securitization market. These deals are said to be "vastly different" than other CRE instruments that sustained big losses in the crisis — so far.

March 16 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

Crossroads Systems Inc. has relaunched with the acquisition of a community development financial institution focused on the Hispanic mortgage market.

March 9